Disclaimer: That is a Press Liberate offered by a third earn together who’s to blame for the whisper material. Please habits your have research before taking any amble in step with the whisper material.

Study our Promoting Pointers Right here

Senate Democrats submitted a counterproposal to the Accountable Financial Innovation Act final week that replace advocates teach may perchance well successfully ban decentralized finance in the united states.

This standstill is yet every other blow to the blockchain replace’s hopes for a lawful framework that would unlock institutional capital. Senate Banking Committee Chair Tim Scott in the starting attach anticipated passage by unhurried September, nonetheless partisan divisions have descended into accusations of contaminated-faith negotiating.

For crypto markets, regulatory uncertainty extends the data vacuum, and when frameworks shift and solutions remain unclear, traders who can video display sentiment and capital flows in real time preserve decisive advantages over those expecting headlines. That’s why DeepSnitch AI has huge aquire steady away, providing AI-driven intelligence that functions irrespective of regulatory outcomes.

ETH ETFs diverge from Bitcoin as institutional amble for meals shifts

Ethereum ETFs recorded $5.32 million in earn inflows on October 15, pushing cumulative inflows to $14.72 billion at the same time as Bitcoin ETFs bled $94 million in outflows. The divergence suggests institutions notice ETH in a different way than BTC, severely with the SEC’s October 23 cut-off date looming for decisions on 16 crypto ETF functions, in conjunction with merchandise that may perchance well enable staking efficiency.

If regulators approve ETH staking rewards inner ETF constructions, institutional traders may perchance well make yield while holding exposure to the second-biggest cryptocurrency, a feature Bitcoin merchandise can no longer replicate. That capability differentiation may perchance well amble up adoption amongst pension funds and endowments in search of earnings generation alongside capital appreciation.

The contrasting flows between BTC and ETH ETFs signal that institutional tales are getting tangled. Bitcoin stays digital gold, nonetheless Ethereum’s programmability and staking yield offer further build propositions that attraction to fully different allocators.

For retail traders, the build a query to becomes whether or no longer Ethereum network upgrades can drive build appreciation mercurial enough to compete with early-stage AI initiatives providing 100x capability from sub-$0.02 entry costs.

Handiest crypto to aquire now

DeepSnitch AI: AI surveillance that stages info asymmetry

October’s momentum is lifting AI sector tokens at the same time as regulatory uncertainty weighs on majors. DeepSnitch AI sits at the convergence of two explosive trends, blockchain adoption and man made intelligence growth. Audited by every Coinsult and SolidProof, the platform offers security transparency that separates reliable initiatives from cash grabs, prolonging fundraising with out turning in merchandise.

DeepSnitch AI will deploy 5 brokers trained on blockchain info and token mechanics to provide an explanation for on-chain confusion and bring sure answers straight by Telegram. Instead of spending hours researching contract addresses, liquidity locks, and developer histories, customers will predict questions in undeniable language and receive instantaneous evaluation backed by real-time info.

Collectively, the AI brokers are inclined to become an increasing number of treasured as markets earn more complicated, creating utility that compounds barely than dilutes over time. The presale crossed $429K at $0.01915, and the staking program permits early contributors to make rewards, with free withdrawals and zero lock-up intervals as soon as claiming opens post-presale.

While Ethereum build prediction devices target $4,800 to $5,000 shut to term, those features signify 20% to 25% from recent stages. DeepSnitch AI, priced for uneven returns, offers capability for 100x if the AI brokers level to critical when markets flip volatile over again.

Ethereum: Community upgrades beef up lengthy-term bull case

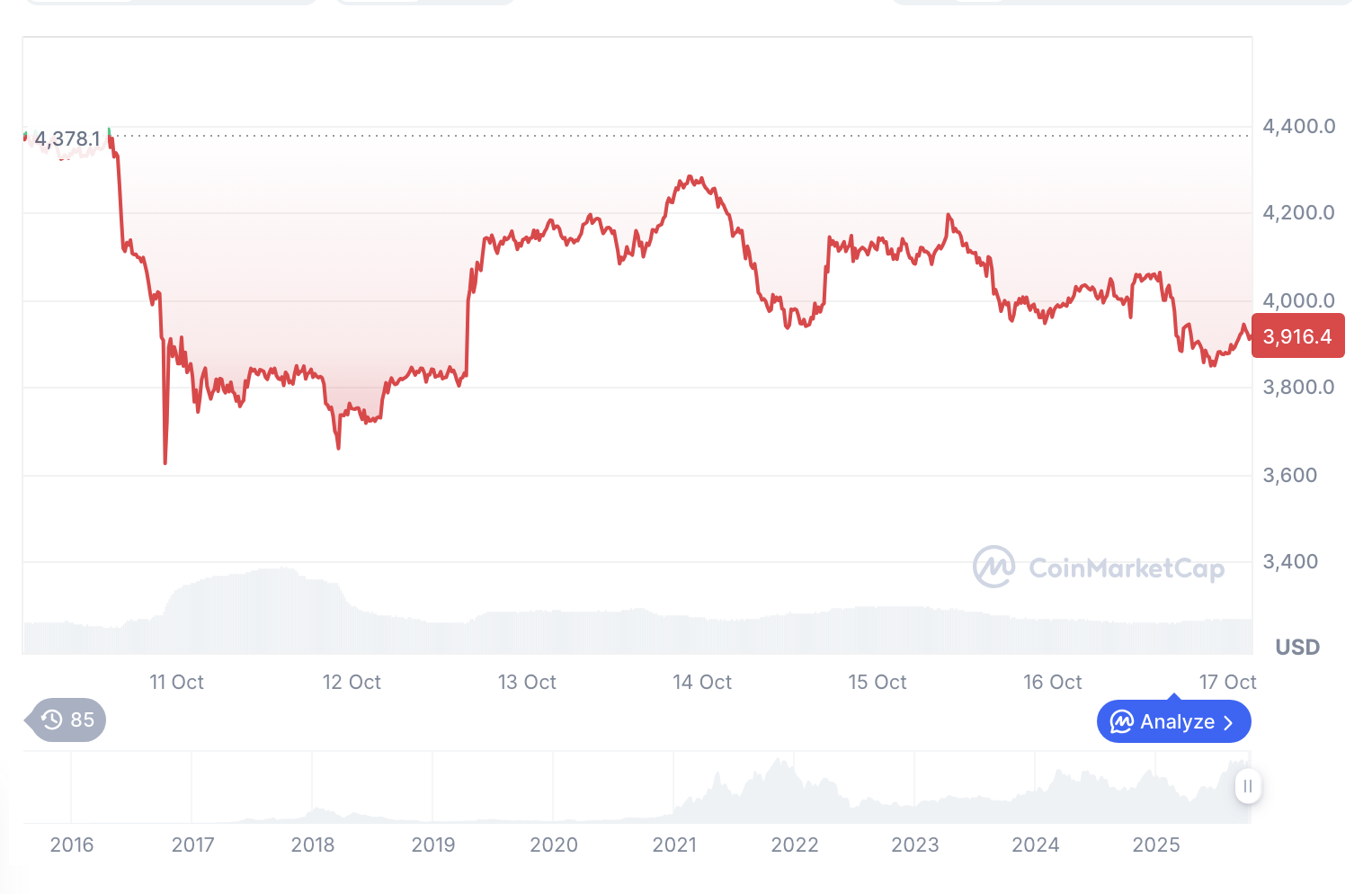

Ethereum build prediction analysts level in direction of $4,500 to $4,650 by mid-October if ETH sustains above $4,000 beef up, with capability extension in direction of $4,800 later this month if quantity helps breakout makes an try. The Fusaka strengthen scheduled for December 3 will introduce PeerDAS sampling to augment network scalability, persevering with Ethereum’s technical evolution in direction of handling mainstream adoption.

Citigroup forecasts ETH closing 2025 at $4,300, noting recent energy appears driven more by sentiment than fundamentals. Fashioned Chartered raised its target to $7,500, citing elevated replace engagement and an anticipated eightfold upward thrust in stablecoin issuance by 2026.

The ETH lengthy-term build outlook consensus hovers around $5,000 to $7,000 for 2026 if adoption continues, doubtlessly reaching $10,000 by 2030 below optimistic eventualities where Ethereum network upgrades may perchance well bring promised scalability enhancements.

That talked about, Ethereum’s $475 billion market cap limits explosive percentage features at this stage, so those in search of 100x returns may perchance well be radiant to look in other places. A appreciable climb to $7,000 equates to roughly 75% upside from recent costs, which is sizeable for an established asset nonetheless modest when put next to presale initiatives worship DeepSnitch AI.

Layer-2 sing retains mountain climbing and staking participation stays steady, with over 66 million ETH locked, tightening circulating supply and supporting lengthy-term bullish narratives.

BNB: Coinbase itemizing adds liquidity after replace debate

BNB regarded on Coinbase’s roadmap for listings on October 16, following public debate over replace itemizing necessities. The discussion started when Limitless Labs CEO CJ Hetherington contrasted Binance’s alleged 2 million BNB security deposit requirement with Coinbase’s approach of simply building “one thing essential on Rotten.” Binance in the starting attach threatened lawful amble before apologizing for excessive conversation, while Coinbase’s head of Rotten Jesse Pollak argued itemizing must peaceful build zero percent.

The replace speaks to increasing stress around itemizing transparency because the amount of tokens explodes. Fashioned Binance CEO CZ, who controls roughly 64% of BNB’s circulating supply, praised the Coinbase itemizing nonetheless urged the replace to checklist more BNB Chain initiatives. BNB trades around $1,149 with a $160 billion market cap, making it the third-biggest cryptocurrency and a gradual bet for stability.

For traders in search of blue-chip exposure with institutional backing, BNB is a stable option. For those hunting uneven returns, DeepSnitch AI is the larger avenue, requiring exclusively modest market penetration to bring exponential features, while BNB would require surpassing Ethereum completely to form 10x from recent stages.

Conclusion

Democrats’ counterproposal stalled the crypto framework invoice indefinitely, extending regulatory uncertainty that makes whale surveillance tools more treasured. Ethereum build prediction targets $4,800 to $5,000 if Ethereum network upgrades and ETF momentum originate, with ETH staking rewards adding yield diagram that Bitcoin can no longer match. The ETH lengthy-term build outlook stays constructive by 2026, although at $475 billion market cap, upside is capped when put next to earlier cycles.

DeepSnitch AI, on the opposite hand, is mercurial-forthcoming sell-out, and its mixed AI-driven surveillance and presale timing are magic in the making. SnitchGPT and AuditSnitch will bring instantaneous evaluation and contract verification, tools that become principal when regulatory frameworks shift and market complexity increases.

For those in search of uneven bets, the necessity between 25% features in ETH and capability 100x in DeepSnitch AI successfully boils the entire formula down to effort tolerance and time horizon.

Check out DeepSnitch AI’s presale before the subsequent jump.

FAQs

What’s the Ethereum build prediction for unhurried October 2025?

Analysts forecast ETH may perchance well take a look at $4,500 to $4,800 by month-cessation if it holds above $4,000 beef up. The Ethereum build prediction relies on ETF flows, network upgrades, and broader effort amble for meals.

How form ETH staking rewards compare to feeble investments?

Staking rewards vary between 3% and 5% APY, aggressive with bonds nonetheless providing exposure to price appreciation. With over 66 million ETH staked, the network combines yield and security.

Why bear DeepSnitch AI alongside Ethereum?

Ethereum offers stability with 20% to 30% capability features shut to term. DeepSnitch AI, priced at $0.01915 with audited security and AI utility, offers 100x capability that nicely-kept caps can no longer match at recent valuations.

Disclaimer: This media platform provides the whisper material of this article on an “as-is” basis, with out any warranties or representations of any kind, train or implied. We mediate no responsibility for any inaccuracies, errors, or omissions. We form no longer mediate any responsibility or approved responsibility for the accuracy, whisper material, images, movies, licenses, completeness, legality, or reliability of the data presented herein. Any concerns, complaints, or copyright disorders linked to this article must be directed to the whisper material supplier talked about above. Study our Promoting Pointers Right here.

Editor-in-Chief of CoinCentral and founding father of Kooc Media, A UK-Based completely mostly On-line Media Company. Believer in Initiate-Provide Tool, Blockchain Know-how & a Free and Stunning Web for all. His writing has been quoted by Nasdaq, Dow Jones, Investopedia, The Unusual Yorker, Forbes, Techcrunch & Extra. Contact Oliver@coincentral.com