Motive to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The top requirements in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Advert discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is at the second trading at a significant resistance stage as bulls try to procure momentum and push for a new excessive. The broader market stays under strain as global uncertainty escalates, largely fueled by ongoing substitute tensions between the US and China. Closing week, US President Donald Trump announced a 90-day tariff halt on all countries excluding China, intensifying concerns about an prolonged substitute war that can perhaps destabilize global monetary markets.

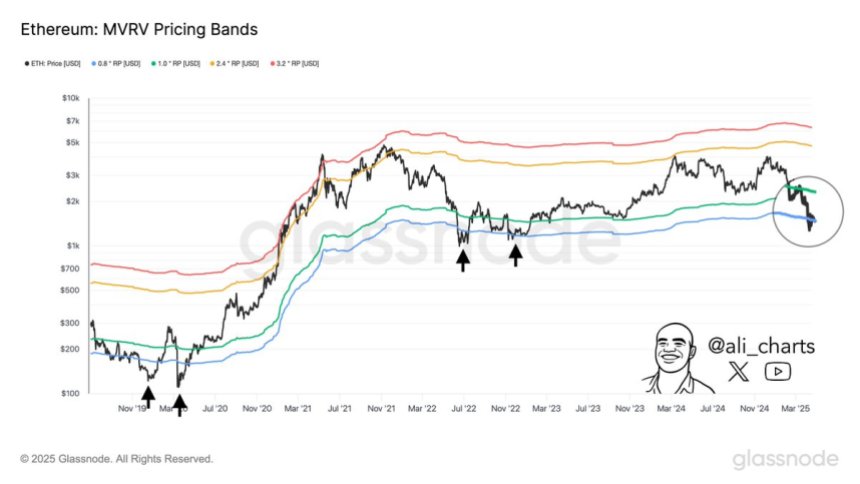

On this excessive-stakes atmosphere, Ethereum’s rate action is impending consideration from investors and analysts. Prime crypto analyst Ali Martinez shared that historically, the supreme Ethereum making an try to safe alternatives enjoy emerged when the cost drops below the decrease MVRV (Market Rate to Realized Rate) Tag Band—a stage that indicators skill undervaluation. Severely, ETH is now trading exactly in that zone.

This alignment between technical stipulations and macroeconomic instability suggests that Ethereum shall be entering a phase of accumulation, with long-duration of time investors having a survey to capitalize on discounted prices. Nonetheless, sustained upward momentum will rely on whether or now not bulls can overcome on the spot resistance and whether or now not macro stipulations fortify. The arrival days would possibly perchance perhaps show camouflage pivotal for ETH because it assessments both technical and psychological thresholds.

Ethereum Dips Into Historical Opportunity Zone

Ethereum is at the second trading below key resistance stages after enduring several weeks of marketing strain and rancid market performance. Since losing the most significant $2,000 enhance stage, ETH has fallen roughly 21%, a clear indication that bulls enjoy yet to procure regulate. Broader macroeconomic pressures, especially rising global tensions and uncertain substitute stipulations between the US and China, enjoy additional dampened market sentiment. These stipulations enjoy pushed many investors to exit riskier resources fancy cryptocurrencies, leading to elevated volatility and lowered market participation.

Without reference to this downtrend, some analysts maintain Ethereum shall be nearing a pivotal turnaround zone. In accordance with Martinez, regarded as one of the supreme historic indicators for Ethereum accumulation has been rate action dipping below the decrease dash of the MVRV Tag Band—a metric that compares market rate to realized rate to evaluate whether or now not an asset is over- or undervalued. At the moment, Ethereum is trading under that decrease band.

Martinez emphasizes that this positioning has typically preceded sturdy upside reversals, especially in some unspecified time in the future of classes of unsuitable market pessimism. Whereas momentary volatility would possibly perchance additionally simply persist, ETH’s entry into this zone would possibly perchance perhaps most authorized a uncommon replacement for long-duration of time investors to fetch at historically discounted stages—if market stipulations stabilize and sentiment shifts.

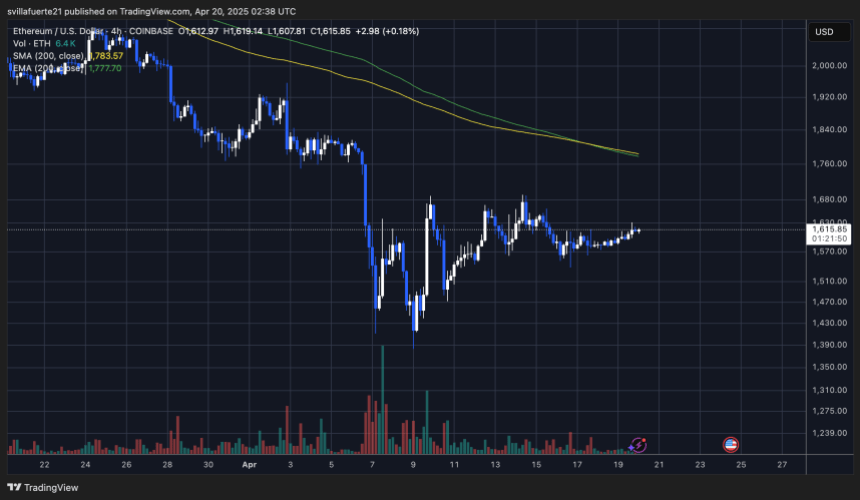

ETH Stalls In Tight Vary

Ethereum is at the second trading at $1,610 after simply about a week of low volatility and sideways action. Since closing Tuesday, ETH has remained locked in an proper differ between $1,550 and $1,630, reflecting the market’s uncertainty and hesitation to take a clear directional stance. This slim trading zone highlights a duration of rate compression, typically a precursor to the next switch in both direction.

For bulls to procure momentum and shift sentiment, Ethereum must reclaim the $1,700 stage and push decisively above the $2,000 designate. These stages now not fully aid as key psychological barriers but in addition enlighten significant zones of old enhance which enjoy now became into resistance. A breakout above $2,000 would likely residing off renewed making an try to safe hobby and residing the stage for a likely restoration rally.

Nonetheless, if bearish strain builds and the $1,550 ground is breached, Ethereum would possibly perchance perhaps snappy check the $1,500 enhance zone. A breakdown below that stage would converse additional downside effort, potentially accelerating promote-offs and deepening the most popular correction. Till a breakout or breakdown occurs, traders would possibly perchance additionally simply serene prepare for extra consolidation and volatility as the market awaits a macro or technical catalyst.

Featured image from Dall-E, chart from TradingView

Disclaimer: The suggestions found on NewsBTC is for academic purposes

fully. It would now not enlighten the opinions of NewsBTC on whether or now not to buy, promote or withhold any

investments and naturally investing carries dangers. You’re informed to conduct your enjoy

research before making any investment choices. Utilize recordsdata provided on this internet design

fully at your enjoy effort.