ETH/USD had been showing indicators of decoupling from BTC/USD since slack April. But the loyal take a look at was as soon as to advance assist when the latter started making important strikes. The closing couple of weeks maintain decisively build paid to this form of notions.

Bullish tendencies in Bitcoin this past week looked as if it would have an effect on all altcoins adversely, as ETH/USD closed the week at $2,510 in a sad cloud duvet sample, down 7.5% from the old week.

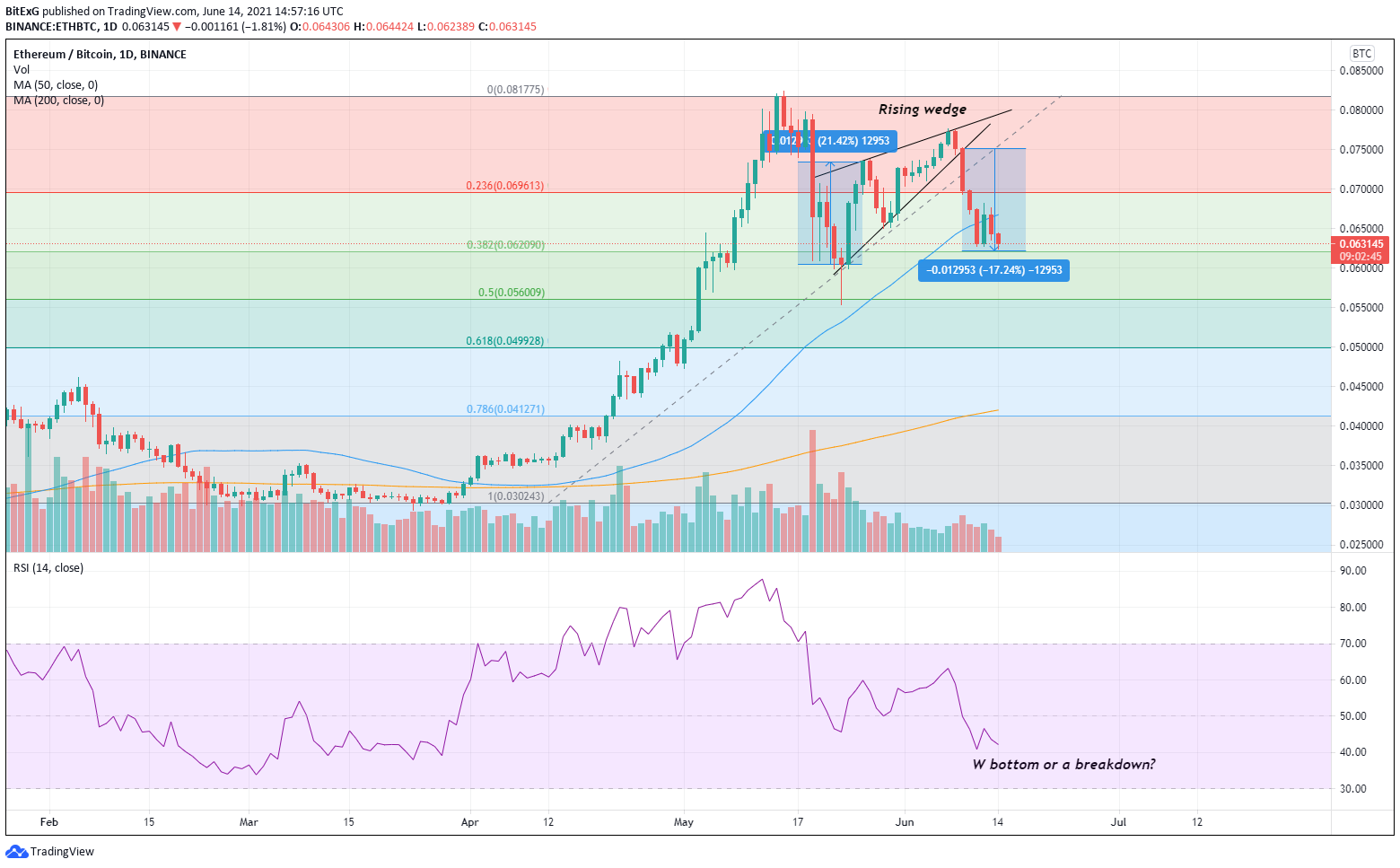

ETH/BTC broke down from a rising wedge sample on Wednesday (charted below) and has since persisted to inch down, buying the breakout aim of 0.062 BTC in some unspecified time in the future of Asian trading hours on Monday.

ETH/BTC has dropped below 50ma on the each day for the first time since breaking out from a falling wedge at the inspiration of April. Right here’s now liable to flip to resistance. An RSI double bottom recovery is one thing to protect an look on over the next couple of days. A each day end above the old swing high would ascertain the reversal sample.

the ETH/USD chart below, whereas the principle construction line dating assist to January soundless holds, the pair is currently on shakier ground than it’s ever been previously few months except an prompt recovery materializes.

Critically, Chaikin Money Circulate (CMF) has grew to alter into negative for the first time this year, indicating that promote stress is outpacing elevate stress and has to this point failed to recuperate past the 0.20 degree, which is mostly continuously known as the degree old to ascertain a decisive reversal.

The prompt aim for ETH/USD is to reclaim the 0.236 Fibonacci degree and mount but one more rally to breach 0.382, the put aside the cost has already been rejected more than one cases. A rejection at the 0.236 degree may per chance per chance per chance lead to the pair breaking down below the principle construction line, turning the market outlook bearish.

Market Summary

- Key make stronger levels – $2,250, $2,100

- Key resistance levels – $2,600, $2,900

- Market outlook – Reasonably of bearish

![]()