ETH tag reached a 3-week excessive, trading as excessive as $2,400 on most most necessary alternate Coinbase.

The London onerous fork comes with changes that arrangement to compose ETH a deflationary coin

Ethereum’s tag has tested the $2,400 resistance stage for the foremost time since 17 June. Ether traded as excessive as $2,406 on the Bitstamp alternate and $2,400 on Coinbase all over early morning offers on Wednesday, with tag aggregating establish CoinGecko placing the cryptocurrency’s 24-hour gains at 3.4% as of Wednesday, 7 July at 07: 00 UTC.

Someplace else, the crypto market has viewed some uptick this week, with Bitcoin tag edging above $34,700. Various than ETH, altcoins such as Binance Coin (BNB), Cardano (ADA) and Polkadot (DOT) private also all shown impressive strikes to ruin above most widespread bogey tag ranges.

ETH tag outlook

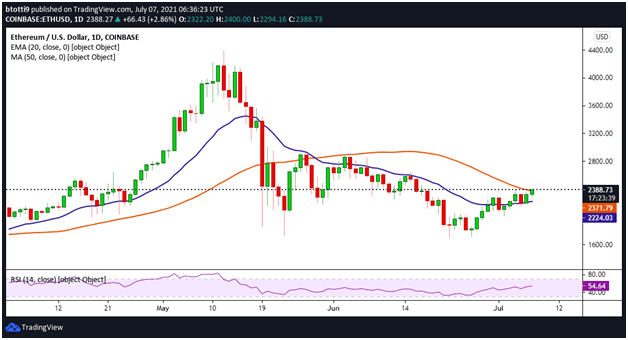

ETH tag has been on the uptrend for the past few days, charting alongside a bullish trendline since touching lows of $1,750 on 26 June. The digital asset’s tag in opposition to the US dollar is up 10.5% this past week and might presumably ruin elevated given the positive sentiment for the time being nudging it north.

This can furthermore happen if bulls preserve the resilience that noticed them battle promote-off stress to ruin above the $2.000 stage after closing month’s downturn.

The rebound to highs of $2,400 might presumably invigorate merchants and gaze them try and breach the supply wall at spherical $2,500. The trouble might presumably gaze bulls target $3,000 or more over the next few days, even supposing that can presumably rely on whether bulls can encourage ETH/USD above the 20-day exponential transferring common ($2,224) and the 50-day transferring common ($2,371), as shown in the chart under.

Having a explore on the community, packed with life addresses private been rising while on-alternate supply drops to ranges viewed in 2018.

Meanwhile, the countdown to the 4 August, 2021 activation of the highly anticipated London upgrade is on. Per unquestionably seemingly the most lead builders on the community, London will scramble live roughly at block 12,965,000.

The EIP-1559 update might presumably gaze ETH turn accurate into a deflationary asset as fee burns and diminished supply cuts entire issuance. If promote stress falls as the onerous fork approaches, ETH prices might presumably manufacture one other rally.