The value of Ethereum (ETH) has shown some predominant change in yesterday rising by 1.86%. On the opposite hand, in step with buying and selling files from CoinMarketCap, the in type altcoin has recorded negative suppose since December 2024 no matter some predominant beneficial properties in the previous month. Interestingly, underlying market exercise aspects to a doubtless fee breakout.

Ethereum Sees Tough Accumulation Exercise Amid Designate Dip

Ever since touching the $4,000 fee label, Ethereum has slipped into a downtrend falling as low as $3,000. Amidst necessary beneficial properties by Bitcoin in January, Ethereum continues to strive against hitting fixed lower lows correct via this era.

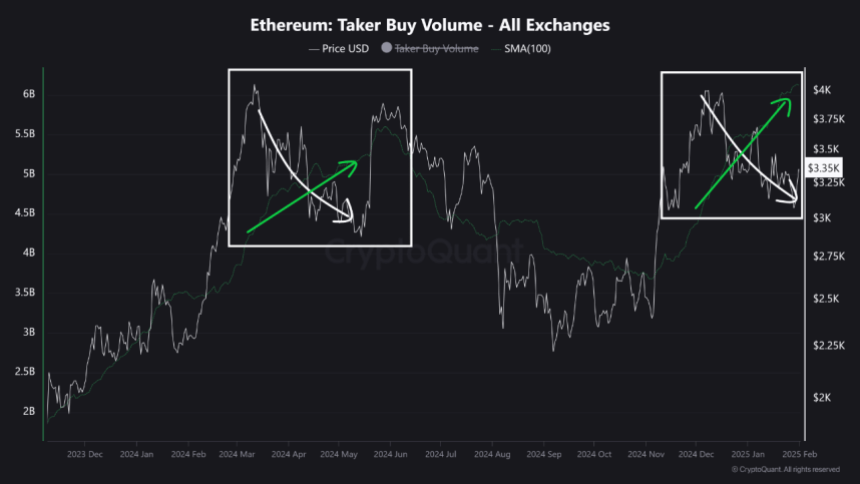

On the opposite hand, a CryptoQuant market professional with the username Crypto Sunmoon has eminent an amplify in market buying volume amidst the present fee dip indicating a bullish divergence in the ETH market. For context, a bullish divergence occurs when an asset’s fee is making lower lows while a momentum indicator is making increased lows, thereby hinting at a doubtless reversal or upward circulate.

As for Ethereum, the amplify in buying volume amid falling costs signifies a stable predict from customers significantly on the present fee ranges. This pattern extra suggests a stable self belief in the asset’s profitability as merchants predict buying stress to surpass promoting exercise in the upcoming days.

Constant with historical files, Crypto Sunmoon predicts Ethereum could ride a value surge such because the one in Could more than likely more than likely also simply 2024 when an analogous bullish divergence final occurred. For the length of that month, ETH rose by over 21% suggesting the altcoin will likely return to $4,000 if the projected fee breakout occurs, in step with present market costs.

ETH Long-Term Holders Imprint Tough Market Self belief

In diversified files, IntoTheBlock reports that long-time period holders of Ethereum for the time being boast a median conserving time of 2.4 years exhibiting massive self belief in Ethereum’s future cost doable.

On the opposite hand, Ethereum faces diversified elements at the side of an absence of short-time period contributors which prevents ETH from experiencing predominant ranges of speculative buying and selling that can drive up fee appreciation. Moreover, the rapid suppose of layer 2 solutions equivalent to Optimism, and layer 1 blockchains equivalent to Solana are moreover tampering with the capability market predict and attention for Ethereum.

At press time, ETH trades at $3,306 after a earn of 1.86% at some point soon of the last day as earlier acknowledged. Within the intervening time, the asset’s every day buying and selling volume has increased by 55.69% ensuing in a value of $30.3 billion. On higher time frames, Ethereum is moreover up by 0.22% on its weekly chart but down by 2.27% on its month-to-month chart leaving much to desire for heaps of short-time period merchants.

Featured image from iStock, chart from Tradingview

Disclaimer: The guidelines stumbled on on NewsBTC is for tutorial capabilities

easiest. It doesn’t signify the opinions of NewsBTC on whether to aquire, sell or back any

investments and naturally investing carries dangers. You are told to conduct your dangle

analysis earlier than making any investment choices. Exercise files supplied on this internet internet page

fully at your dangle effort.