Key Takeaways

- The quantity of Ethereum wanted to task transactions has dropped 94% since January.

- The low gas costs on Ethereum consequence from less search files from for block set up.

- Historic patterns demonstrate that after the median value of using the Ethereum network reaches fable lows, the value of Ethereum frequently will enhance.

Gas costs on Ethereum possess reached lows no longer seen in over 9 months. Whereas reducing network task is the predominant reason of the decline, the more than a number of of exclusive energetic users on Ethereum remains actual.

Ethereum Exclaim Decreases

The value of using Ethereum is reaching fable lows.

In conserving with the records analytics self-discipline Nansen, gas costs hit a low of 10 gwei on the present time. Reasonable transaction costs possess near in at 12 gwei over the old couple of days, which equates to roughly $0.67 for gape-to-gape ETH transfers. To position that pick into perspective, in January, common gas costs on Ethereum were as high as 218 gwei, revealing a 94% drop within the amount of Ethereum wanted to task transactions.

The decline in gas costs on the network is because of reducing search files from for Ethereum block set up. Because blocks supreme possess a finite quantity of set up for transactions, all the intention thru sessions of high congestion, users state up the value they are engaging to pay to possess their transactions processed within the following block. Alternatively, when task decreases, the network lowers the amount of gas wanted to replicate search files from.

The NFT marketplace OpenSea, which has consistently been one in every of the greatest gas users on the Ethereum network over contemporary months, has seen task decline in contemporary weeks. In conserving with records from token terminal, OpenSea handled $67.5 million worth of transactions on Mar. 13, a 70% decline from peak February phases.

OpenSea is no longer the supreme Ethereum application to search a lower in task. Uniswap, essentially the most traditional decentralized alternate on Ethereum, has seen an everyday decline in transactions since last November. On Mar. 12, the alternate hit a new multi-month low in trading quantity of $799 million. In comparability, the alternate handled a colossal $8.8 billion worth of transactions over a 24-hour interval at its peak on Nov. 10.

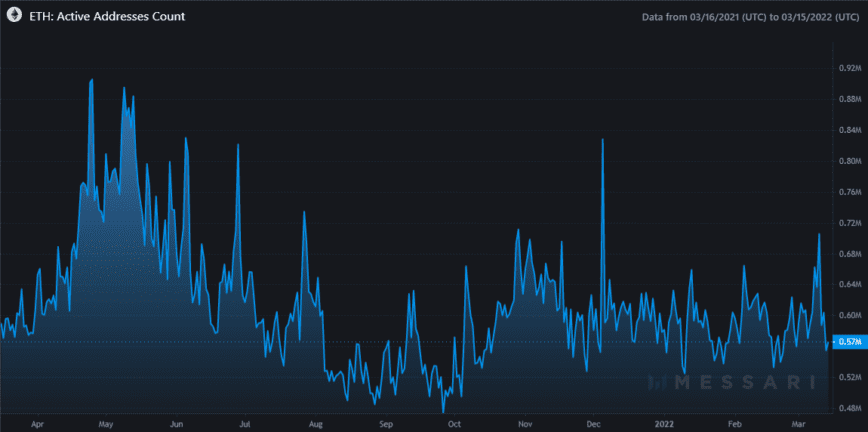

Despite the nervous search files from for Ethereum block set up, the more than a number of of wallets actively using the network doesn’t appear to be reducing. In conserving with records from Messari, the amount of exclusive energetic Ethereum addresses has stayed consistently above 500,000 and has no longer capitulated to the lows noticed all the intention thru the summer time of 2021.

Because the more than a number of of exclusive energetic users on Ethereum remains fixed, it implies that users are quiet transacting on the network, supreme less continuously than before.

For many Ethereum vitality users, the low gas costs seemingly near as a blessing. As network transactions are now more cost-effective, merchants are ready to catch profit of smaller arbitrage alternatives, thus bettering capital effectivity. The low gas costs could maybe also be seen as a welcome relief for additional casual users. The value of buying and itemizing NFTs on platforms cherish OpenSea has also become critically more cost-effective. Customers who had pending airdrops or staking rewards to have will seemingly be ready to attain so with out eating into their profits as phenomenal as they’d possess carried out when costs were at fable highs.

Whereas gas costs are low, they won’t necessarily preserve that intention for long. Attempting at historical patterns, every time the median value of using Ethereum reaches fable lows, it frequently jumps serve up as a result of value of Ethereum increasing. Whether a an identical occasion will play out rapidly remains to be seen.

Disclosure: At the time of scripting this piece, the creator owned ETH and diverse alternative other cryptocurrencies.

The records on or accessed thru this web self-discipline is received from self sustaining sources we predict to be accurate and legit, however Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any records on or accessed thru this web self-discipline. Decentral Media, Inc. is no longer an investment consultant. We attain no longer give personalized investment advice or other financial advice. The records on this web self-discipline is field to swap with out search. Some or all of the records on this web self-discipline can also become outdated-usual, or it will seemingly be or become incomplete or unsuitable. We can also, however are no longer obligated to, change any outdated-usual, incomplete, or unsuitable records.

You can too quiet never construct an investment likelihood on an ICO, IEO, or other investment essentially based on the records on this web self-discipline, and moreover that you must even quiet never account for or in another case depend upon any of the records on this web self-discipline as investment advice. We strongly counsel that you consult a certified investment consultant or other certified financial authentic whereas you are making an try to obtain investment advice on an ICO, IEO, or other investment. We attain no longer derive compensation in any invent for examining or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized gross sales, securities, or commodities.

Glimpse bulky phrases and prerequisites.

Ethereum Hints at Recovery From Market Slip

The Ethereum network appears to be gaining the task it wants for a value restoration. Quiet, Ethereum is yet to search an everyday delay in new addresses to red meat up the…

10M ETH Staked in Ethereum Consensus Layer Contract

The Ethereum consensus layer deposit contract has surpassed 10 million in ETH staked. This represents roughly 8% of all of the Ethereum provide. Ethereum’s Roadmap Momentum surrounding Ethereum’s swap from Proof-of-Work…

OpenSea Saw a 646x Lengthen in Shopping and selling Volume in 2021

The NFT marketplace OpenSea has registered a colossal $14 billion in trading quantity all the intention thru 2021, a long way outpacing its 2020 efficiency of $21.7 million. OpenSea’s Breakout Year 2021 will waddle down…