Ethereum has constantly been a pioneer for further than one formula of the crypto deliver ranging from DeFi to NFTs, as effectively as excessive gas costs and innovations to clear up its scalability considerations. As the chain’s scope grew, so did its limitation for scalability.

The next article explores how layer-2 solutions are evolving within the present undergo market.

Optimism Brings Its Cavalry

On occasion called L2 solutions, these are in most cases chains built to cut the load on the mainnet of a blockchain by processing transactions and diversified operations off-chain and eventually linking it attend to the mainnet for finality.

In explicit, to Ethereum, these L2 are outdated in scaling the DeFi functions by processing their transactions off the Ethereum mainnet while aloof upholding the safety and decentralization requirements followed on the mainnet.

On the other hand, with time as Ethereum’s use and ask of are rising, these L2 opt to grow as effectively. They are doing so per basically the most contemporary traits in two of the topmost L2 solutions.

Optimism, an Optimistic rollup-basically based L2, lately airdropped its token OP to users, but the response became once no longer as expected. With a TVL of $908 million, Optimism’s OP became once expected to commence to frequent hype.

If it wasn’t decided by now, this is now not of course your sensible token commence.

The Optimism Collective is so considerable extra: a gargantuan experiment in decentralized governance that can evolve over time. OP and the Token Home are lawful the 1st step.

OP Drop #1 🪂 is are residing NOW. However first, a recap:

— Optimism (✨🔴_🔴✨) (@optimismPBC) Also can 31, 2022

On the other hand, as a end result of technical components in the course of the commence, some users had been ready to pronounce their tokens earlier than the respectable airdrop started.

This resulted in users dumping their OP tokens, and as a end result, the buying and selling tag of the token slipped from $4.5 at commence to $1.38 at the time of penning this disclose.

This marks an almost 70% decline in tag internal 72 hours of its commence.

Justifying the bungled commence, Optimism tweeted,

“We vastly underestimated the quantity of expected load that this would beget on our public RPC endpoint. When web inform guests chanced on the claims hyperlink, the public RPC started getting slammed.”

They further added that while they had been snappy to invent bigger the accessible resources to support their public RPC, the technique took hours of coordination as a end result of the quantity of load they noticed.

On the other hand, the value drop has declined within the meanwhile as OP is no longer being dumped excessively.

The 2d L2 to ride looking out developmental modifications became once the Boba Community, an L2 with bigger than $81 million locked on it.

The evolving L2 launched its intentions of turning true into a multi-chain by increasing past Ethereum.

Integrating with Fantom and Moonbeam, a parachain of Polkadot, Boba Community has accessed diversified EVM effectively matched chains for the first time.

This marks a predominant milestone for Layer 2 solutions. As Boba expands to diversified chains, it ensures scalability for DeFi functions on those chains by offering builders rating admission to to Hybrid Compute.

This instrument can enable Dapps to work along with cloud environments for records unavailable on the chain.

On the other hand, this also increases competition for Ethereum as the chains L2 invent bigger to are geared toward greater transaction speeds and lesser gas costs, which stands to be a huge mumble for Ethereum within the meanwhile.

Ethereum and L2s

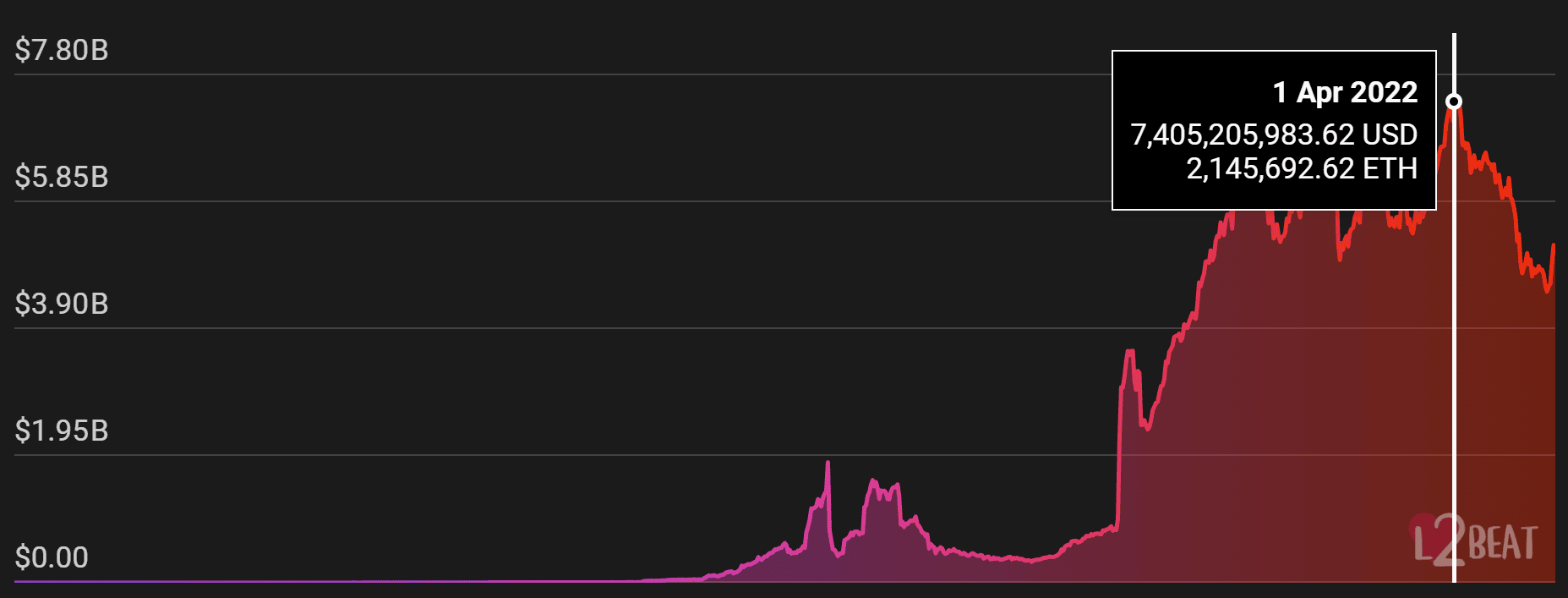

Despite being in existence since 2019, L2 greatest picked up tempo last year in February 2021 and has grown tenfolds since then.

At their height in April 2022, L2 accounted for bigger than $7.2 billion value of investments, but following the shatter of Also can 9, the entire tag locked on them diminished to $5.04 billion.

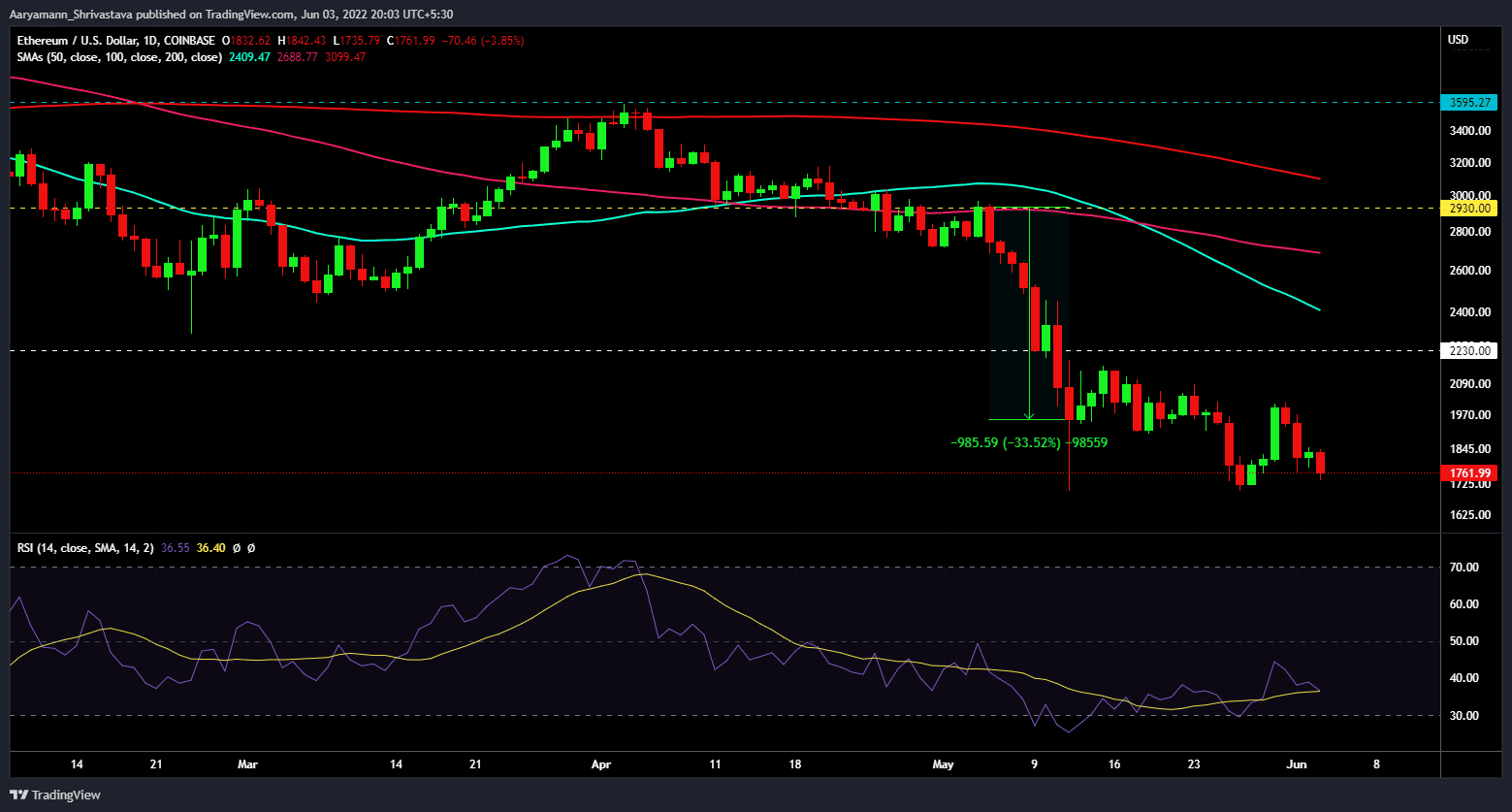

Ethereum also suffered a serious setback in its tag within the identical length, and the altcoin king plummeted by 33.52% and is within the meanwhile buying and selling at $1760.

Plus, with the broader market’s bearish strain persisting, the cryptocurrency is struggling to drag itself out of the bearish zone.

In conclusion, Layer-2 solutions’ recovery is depending on Ethereum’s recovery into the bullish zone, which would trigger a upward push within the TVL, bringing investments attend onto the chain.