Ethereum liquid staking platforms are making waves in the decentralized finance (DeFi) ecosystem. Latest on-chain reports admire published that liquid staking protocols admire recorded a recent milestone in the quantity of Ether (ETH) staked, reaching a staggering 12 million ETH stamp in precisely about a days.

Ethereum Liquid Staking Beneficial properties Momentum

With Ethereum 2.0 thriving, liquid staking protocols in the DeFi ecosystem admire been rising fleet despite contemporary market volatility.

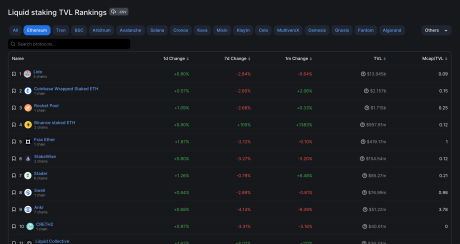

Examine files from DeFi TVL aggregator, Defillama, published on Monday, September 25, the mighty enhance of Ethereum holdings in liquid staking platforms. Per the guidelines, the ETH in liquid staking protocols has risen to roughly 12.31 million and will continue rising.

Reports uncovered that a staggering 370,000 ETH were staked in precisely 5 days, allowing liquid staking protocols to reach their contemporary 12 million stamp. Liquid staking platforms like Lido, Rocket Pool, Coinbase, and Binance are amongst the list of prominent protocols that ended in the contemporary upsurge in Ether staking.

Per Defillama TVL rankings, Lido holds the tip establish for the amount of Ethereum staked with a TVL of $13.997 billion in liquid staking. The protocol secured over 8 million Ether on September 20, and one other 30,000 after that.

Lido Finance dominates ETH liquid staking | Source: DeFiLlama

Coinbase is currently ranked 2d in Defillama’s TVL rankings, preserving roughly $2.155 billion, a fundamental gap from Lido’s TVL.

Coinbase has about 1.3 million Ether currently in its reserve. Whereas, Rocket Pool holds the third space in TVL rankings and has elevated its Ether holdings from 940,496 to 945,402.

Binance Liquid Staking Platform Takes The Lead

Binance liquid staking platform has been the driver in the motivate of the contemporary spike in ether inflow in liquid staking protocols in the DeFi ecosystem.

Per reports, Binance added a startling amount of ether to its already huge ether reserves. The liquid staking platform which beforehand recorded 445,000 ETH in its reserve, added 318,605 ETH and now holds 764,105 ETH. Examine files admire published that Binance gathered a appreciable amount of ETH tokens to enhance its staking token, Wrapped Beacon ETH (WBETH).

In the final three months, the DeFi ecosystem recorded a liquid staking valuation above $20 billion evaluating diverse protocols in the DeFi ecosystem. Following this, Defillama’s September files published liquid staking protocols now reduction $20.5 billion in resources, increasing by a staggering 293% from previous lows in June 2022.

Even supposing the significant protocols guidance the surge are Lido, Binance, and Rocket Pool. Other upcoming liquid staking protocols like Davos and InQubeta are persisting, driven by the Ethereum 2.0 make stronger and traders favor to maximise their earnings through Ethereum staking.

ETH price at $1,587 as liquid staking surges | Source: ETHUSD on Tradingview.com

Featured characterize from iStock, chart from Tradingview.com