Curve Finance’s growth to Polygon kickstarted a enormous migration of yield farmers onto the network. Now, the protocol has launched on Fantom and xDai.

Curve’s Multi-Chain Future

Curve Finance has launched the same version of its decentralized trade on Fantom and xDai.

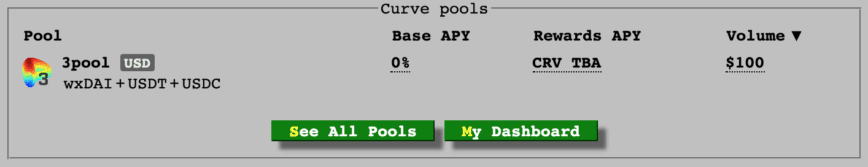

On Fantom, three pools are accessible, while xDai has most difficult one: the protocol’s DAI, USDC, and USDT pool. With the correct incentivization mechanisms, the protocol could well serene force fundamental liquidity to the two chains.

When Curve ported its protocol to Polygon, the lag contributed to the Ethereum scaling solution’s exponential dispute. The decentralized trade affords deep pools of liquidity with minimal tag slippage even on mammoth transactions. A month after it had launched on Polygon, many yield farmers migrated from Ethereum and Binance Tremendous Chain.

As both Fantom and xDai are Ethereum Virtual Machine neatly suited, porting an Ethereum-native protocol relish Curve doesn’t require rewriting a variety of the code. Minimal changes are ample to unlock a working product.

Slightly of CRV arrives to https://t.co/oCPLGumIRA pic.twitter.com/jgibhOtW0r

— Curve Finance (@CurveFinance) July 1, 2021

Curve has been the controversy of DeFi recently, particularly after it launched its extremely anticipated V2 update. The protocol added concentrated liquidity function pioneered by Uniswap V3 and gave the chance to trade volatile assets. The venture has furthermore been central to ongoing DeFi rivalries sharp Yearn.Finance, Alchemix, and Convex Finance because it distributes CRV rewards to the respective protocols.

Curve became one amongst Ethereum’s first DeFi protocols and has greatly grown recently. It accommodates about $7.95 billion in total tag locked in accordance with DeFi Pulse, which locations it second in the relieve of most difficult Aave.

You more than seemingly can serene by no technique receive an funding decision on an ICO, IEO, or other funding in line with the info on this internet function, and you can serene by no technique clarify or otherwise rely on any of the info on this internet function as funding advice. We strongly recommend that you just consult an authorized funding advisor or other licensed monetary legit whilst you are in search of funding advice on an ICO, IEO, or other funding. We enact no longer settle for compensation in any build for analyzing or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

Yield Farmers Are Migrating to Polygon

Polygon presents a identical yield farming trip to Ethereum mainnet at a fraction of the value. Key metrics display that DeFi vitality users are starting up emigrate to the network….

Fantom Token Soars 40% After Vital Community Upgrade

Fantom has rounded off its “foremost network upgrade to this point” earlier this morning. “Enormous Milestone” Pumps Fantom Fantom, one amongst the crypto build’s fastest-rising Proof-of-Stake (PoS) networks, has efficiently…

Yearn Finance, Alchemix, Curve Finance in DeFi Clash

Some of DeFi’s most difficult-known protocols are debating the affect of their yield farming solutions. The discussions heart on Alchemix, Yearn Finance, and Curve Finance. DeFi Projects in Conflict A neighborhood…

How one can Change Using the Inverse Head and Shoulders Pattern

In stock or cryptocurrency shopping and selling, you can need heard of the duration of time “inverse head and shoulders.” Additionally is named the “head and shoulders backside” formation, the inverse head and shoulders chart pattern can…