Ethereum is down nearly 35% from July highs and roughly 40% from 2024 peaks. Whereas there is hope amongst holders that the coin will safe better, breaking local resistance, the momentary fashion favors sellers.

From the day after day chart, no longer fully is ETH struggling to attain momentum and push above $2,800, nonetheless sellers had been relentless, diffusing any strive greater. As the coin is capped below $2,500 at press time and actively aligning with the promoting strain of gradual August, Santiment analysts glean picked out a spell binding construction.

Ethereum Register Extra Customers Than Bitcoin

In a put up on X, the sentiment evaluation platform notes that though costs are down at predicament rates, the network is interestingly resilient, especially looking out at person development metrics.

Connected Reading: Analyst Says Litecoin Will Outperform Bitcoin And Big Cap Cryptos With 11,000% Breakout

In the final three months, the sequence of abnormal Ethereum addresses has been rising gradually, outpacing these of Bitcoin. On the other hand, it gentle lags the sequence of USDT addresses over the identical length.

To put in the number, as of September 3, Santiment analysts properly-known that Bitcoin had 54.18 million abnormal wallets, down 0.1% in three months. On the identical length, Ethereum boasted of more than 126.96 million addresses, up 3.3%.

The upward push in the sequence of present customers in Ethereum signals self perception in the network and even seemingly rising adoption despite tough market circumstances. In the period in-between, USDT, the fiat-pegged stablecoin, had 5.ninety 9 million addresses, up 4% in three months.

Of the three, the rapidly development of USDT addresses in the final three months might well also signal total apprehensiveness amongst traders. As crypto costs contract, holders resolve to convert their holdings to USDT, explaining the amplify.

But another interpretation of this construction is that more novel customers are alive to to explore crypto. By holding USDT through custodial wallets or through exchanges love Binance, they’ll readily splash on Bitcoin or any different prime altcoin every time the time is prepared.

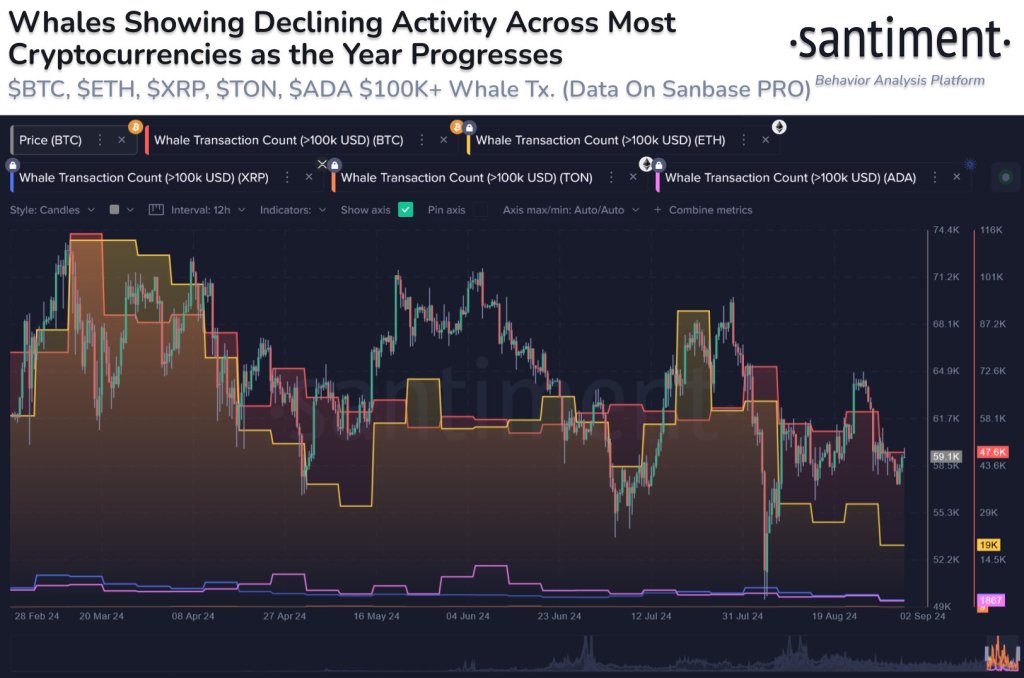

Bitcoin And Ethereum Whale Boom Declining

Even so, whereas there is development in the sequence of customers, whale process, Santiment analysts search, has been declining. Of bid, the sequence of whale transactions has been down since Q1 2024 after costs peaked.

Surging costs, coupled with the approval of predicament Bitcoin ETFs, especially in the United States, revived passion, explaining growth in whale process.

Bright about the regular contraction of costs, Santiment analysts predict whale process to drop. This outlook will fully commerce once there is volatility spurred by Ethereum or Bitcoin costs ripping above key liquidation ranges in the quick to medium term.

Feature image from DALLE, chart from TradingView

Disclaimer: The certainty discovered on NewsBTC is for tutorial capabilities

fully. It would not signify the opinions of NewsBTC on whether or no longer to safe, sell or shield any

investments and naturally investing carries dangers. You might well perchance even be educated to habits your contain

study earlier than making any funding choices. Use files supplied on this web put

fully at your contain likelihood.