Over time, the crypto market has maintained a shut relationship with the stock market. Ethereum, the second-largest cryptocurrency, rose in lockstep with U.S. shares for the foremost time in February. As a consequence, the token’s 40-day correlation coefficient with the S&P 500 reached 0.65.

Despite the brake anxious investors comprise put on tag converse prior to now week, the Ethereum (ETH) tag is poised to rise over the weekend. Although procuring and selling volume has elevated over the final week, and thus will have to comprise resulted in extra consistent fluctuations, tag responsiveness has been tormented by geopolitical details, earnings, and stock market whipsaws.

Ethereum Assign Witnesses Turbulence

The fee of Ethereum has had a grueling week for investors and merchants, with mountainous swings in step with earnings, geopolitical events, and investors turning from risk-on to risk-off look after a mild switch. But with volatility comes opportunity, and as all of these events wind down in the direction of the weekend, bulls will comprise the playground to themselves and can power the associated fee up to $3,500 in the occasion that they resolve the licensed entry phases. Put a question to of the RSI to rise over 50 again, with hundreds room sooner than procuring and selling into overbought territory.

Primarily based totally on statistics from Santiment, a crypto market habits diagnosis tool, Ethereum has a stable (+ve) correlation with the S&P 500 index. Following a 1.8 p.c fall in the S&P 500 index’s figures, the associated fee of ETH elevated by 3%.

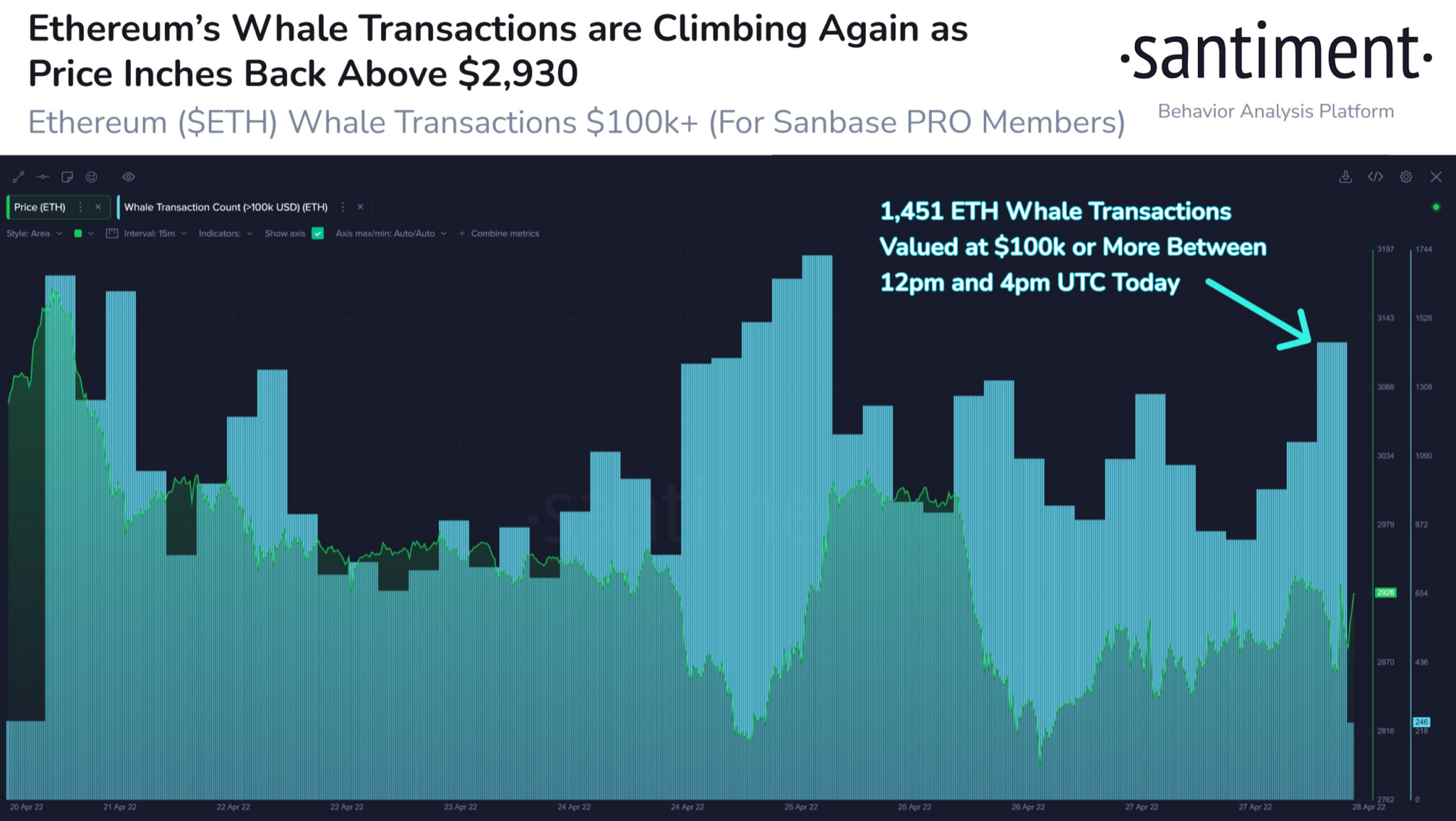

Supply: Santiment

The tweet from April 29th added,

“Aided by a +1.8% day in the SP500, Ethereum has jumped support above $2,930 with its tight correlation to equities markets.”

Now, as seen in the graph above, ETH’s most noteworthy investors, the whales, comprise retaliated by wanting for extra ETH. On that day, the series of whale transactions fee more than $100,000 surged dramatically.

In a four-hour duration, 1,451 such transactions comprise been documented. The jump, in step with Santiment, advised that key stakeholders comprise been paying consideration to the associated fee enhance.

Suggested Reading | Metaverse Tokens On Overdrive, Outpace Bitcoin And Ethereum

Is Equities Market Correlation Honest reliable For ETH?

This wasn’t the foremost time ETH had confirmed indicators of a growing relationship with the stock market. The two sank together on March 31st, as reported three weeks earlier, nonetheless started climbing again after April 1st. Ether surged in tandem with the SP500 since mid-March.

Every particular scenario in the crypto-verse is accompanied with a negative counterpart. That is, as a minimum, a truth. This scenario is just not any exception. Crypto’s stable affiliation with equities, in particular, would possibly almost definitely perhaps work wonders. Varied revered entities, on the different hand, comprise censored cautionary cases for the identical.

ETH/USD has remained below $3k. Supply: TradingView

Arthur Hayes, the used CEO of BitMex, raised warning flags about this hyperlink in this instance. Surprisingly, the stock market appears to be headed for a mammoth fall by procedure of 2022 as the Federal Reserve tightens financial coverage to war inflation.

Related Reading | Bitcoin Futures Foundation Nears One-Yr Lows, How Will This Own an impact on BTC?

Featured image from Pixabay, Santiment, chart from TradingView.com