Key Takeaways

- Ethereum has dropped by more than 20% against Bitcoin steady in the course of the last three weeks.

- It comes as skepticism surrounding “the Merge” prevails, and not utilizing a launch date residing.

- Below the most contemporary market stipulations, the ETH:BTC ratio would possibly perhaps well perhaps tumble to 0.048.

Ethereum is having a laborious time convalescing from the contemporary market traipse.

Ethereum Slides In opposition to Bitcoin

Ethereum is lagging within the encourage of Bitcoin.

The 2d-largest cryptocurrency by market cap is exhibiting weak spot amid the most contemporary market downturn.

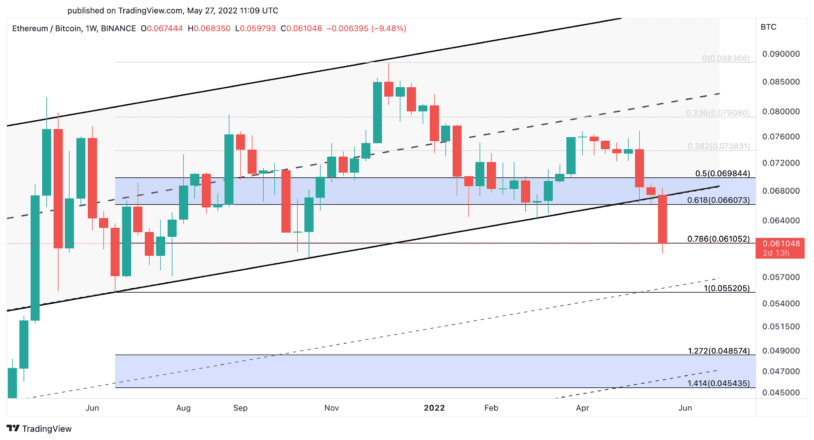

Critically, Ethereum is bleeding against every the U.S. dollar and Bitcoin. The ETH/BTC procuring and selling pair has dropped by more than 20% steady in the course of the last three weeks, breaching a necessary make stronger home. Now that Ethereum has taken a critical dip against Bitcoin, further losses would be incoming.

Moreover, skepticism is increasing within the Ethereum neighborhood over the network’s highly-anticipated “Merge” to Proof-of-Stake. On Would perchance 25, seven blocks had been reorganized on Ethereum’s Beacon Chain. Blocks 3,887,075 to 3,887,081 had been forked from the chain, elevating questions about whether the network is able to transition to Proof-of-Stake. Sigma Top co-founder Mehdi Zerouali told Crypto Briefing that the downside became “nothing systemic,” however the tournament sparked issues the total equal.

Last week, Ethereum core developer Preston Van Loon urged that the Merge would possibly perhaps well perhaps accumulate space in August. Vitalik Buterin, meanwhile, has talked about that it would possibly perhaps well perhaps occur in September or October. With a date still now not residing in stone and the broader market in decline, Ethereum’s “Merge” account has failed to study any main momentum.

Now, it appears that the opposed sentiment would be affecting the ETH:BTC ratio.

Ethereum appears to receive lost a necessary make stronger trendline that has been holding its value against Bitcoin since Would perchance 2021. The ratio dropped below 0.066, which implies 0.066 BTC dipped to a be aware of lower than 1 ETH. At a ratio of 0.066, 1 BTC is value roughly 15.15 ETH.

The ratio is considered a key indicator for crypto traders and Ethereum fans as they assuredly use it to focus on to “the Flippening,” an tournament that describes the level at which Ethereum’s market cap would overtake Bitcoin’s. In accordance with the most contemporary circulating affords for ETH and BTC, the ratio would wish to be 0.157 to gaze “the Flippening” play out.

The ETH/BTC has now dipped as shrimp as 0.06, delaying the likelihood of a “Flippening” tournament. Now that it has dipped, ETH would possibly perhaps well perhaps streak further against BTC.

The next possible home of make stronger for ETH is around 0.055 BTC. If this stage fails to defend, 0.048 BTC would possibly perhaps well perhaps develop into the presumably goal.

Whereas “the Merge” would possibly perhaps well perhaps still amplify interest in Ethereum, however as no launch date has been residing, it’s still unknown whether this will likely ship anytime soon. A profitable launch would possibly perhaps well perhaps launch some strain from the ETH/BTC procuring and selling pair, however ETH would likely wish to reclaim 0.066 BTC as make stronger to receive a chance at invalidating the pessimistic outlook.

Ethereum’s market cap is at this time around $212.6 billion, whereas Bitcoin’s is $548.6 billion. Ethereum is at this time around 38.7% the dimensions of Bitcoin in market cap phrases.

Disclosure: On the time of writing, the author of this characteristic owned BTC and ETH.

For more key market traits, subscribe to our YouTube channel and salvage weekly updates from our lead bitcoin analyst Nathan Batchelor.

The info on or accessed through this web page is obtained from unbiased sources we imagine to be correct and legit, however Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any data on or accessed through this web page. Decentral Media, Inc. is now not an funding consultant. We shatter now not give personalized funding advice or other monetary advice. The info on this web page is subject to swap without check. Some or all of the info on this web page would possibly perhaps well perhaps simply develop into outdated, or it’d be or develop into incomplete or mistaken. We would possibly perhaps well perhaps simply, however are now not obligated to, change any outdated, incomplete, or mistaken data.

It’s good to never salvage an funding determination on an ICO, IEO, or other funding in accordance with the info on this web page, and it is foremost to never elaborate or in any other case rely on any of the info on this web page as funding advice. We strongly recommend that you simply consult a certified funding consultant or other qualified monetary skilled whereas you occur to are looking out funding advice on an ICO, IEO, or other funding. We shatter now not accept compensation in any invent for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

Hit upon full phrases and prerequisites.

Bitcoin, Ethereum in Serious Situation

The crypto market sentiment went into “mistaken terror” one more time after Bitcoin and Ethereum lost be aware make stronger steady in the course of the last 24 hours. On-chain data shows increasing promoting strain, which can perhaps perhaps lead…

Avalanche Wants Otherside to Ditch Ethereum for a Subnet

Avalanche has submitted a proposal to ApeCoin DAO, suggesting it migrates the APE token and builds the Otherside Metaverse on an Avalanche Subnet. Avalanche Suggests Otherside Migration Avalanche has invited…

GameStop Has Launched an Ethereum Wallet

The arena’s largest video sport retailer, GameStop, has launched a non-custodial pockets supporting NFTs and other Ethereum-primarily based mostly sources. GameStop Launches Crypto and NFT Wallet GameStop has launched an Ethereum pockets….