The sphere of this present day’s Day by day Dive can be coin days destroyed, and inspecting the contemporary dispositions surrounding this metric. The metric “coin days” used to be first introduced up as “bitcoindays destroyed” by Bytecoin on the discussion board BitcoinTalk support in 2011.

“Coin days” refers back to the full series of days that a coin has remained dormant. If one bitcoin has no longer moved in barely one 365 days, then that coin would agree with gathered 365 coin days. Equally, if 365 bitcoin final moved in some unspecified time in the future within the past, this may well furthermore be price 365 coin days.

Thus, when taking a behold at coin days destroyed, the metric takes all of the actual particular person cash (technically: UTXOs) that moved for the length of a given day and multiplies it by how many days these cash previously remained dormant. In combination, this number offers us coin days destroyed for a given day. Taking a behold at this metric can provide one a sense of the exercise of older investors, and whether or no longer bitcoin being transacted across the network are from contemporary or mature holders.

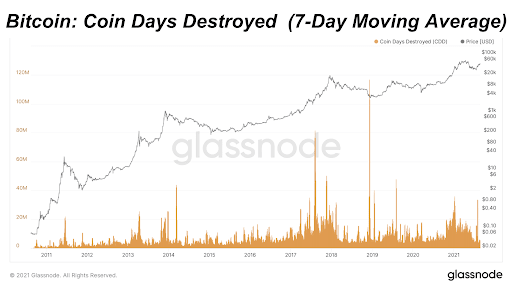

Taking a behold at coin days destroyed on my own just isn’t any longer critically functional because the day-to-day files is clouded by mammoth outliers, nonetheless for the sake of context, beneath is the each day chart of coin days destroyed during the history of bitcoin:

When making employ of a seven-day inviting average to the files, the files peaceful isn’t very functional, nonetheless dispositions became extra and extra visible. When utilizing coin days destroyed files, making employ of inviting averages with longer time frames offers investors a extra decided see into investor/HODLer dispositions.

Throughout the history of bitcoin, mammoth parabolic advances in price are met with mammoth spikes in coin days destroyed as (rightfully so) investors sign some beneficial properties on their funding. The tip of the 2013, 2017, and most currently 2021 saw mammoth amounts of coin days destroyed, and that’s also considered rather clearly beneath:

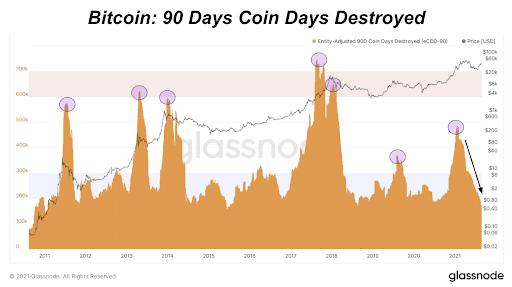

When taking a behold on the 90-day rolling sum (different from inviting average) of coin days destroyed, decided dispositions emerge over the history of bitcoin.

Curiously enough on the opposite hand, is that not like other bull runs that saw a blow-off top, the steep downtrend in 90-days coin days destroyed that adopted the mammoth spike within the metric and the local price top, we now agree with considered price acknowledge in a important technique, currently up around 70% over the final five weeks, yet the 90 days coin days destroyed metric continues to philosophize no to shut to 5-365 days lows.