In accordance to Sharplink co-CEO Joseph Chalom, Ethereum could perchance witness a essential jump in complete price locked (TVL) next 365 days if sure onchain traits get.

Chalom assign aside a daring quantity on it: 10X TVL in 2026. That say ties together rising stablecoin exhaust, bigger tokenization of steady-world resources, and elevated passion from mountainous financial groups.

Stablecoin Exercise On Ethereum

Primarily based fully on reports, the total stablecoin market stands at about $308 billion now and could perchance grow to $500 billion by the cease of next 365 days, a rise of roughly 62%.

Over half of all stablecoin exercise — about 54% — occurs on Ethereum. That math issues: extra stablecoin flows on Ethereum tends to take the protocol’s TVL on memoir of reasonably about a those dollars sit down in orderly contracts for swaps, lending, and liquidity pools.

Sharplink Gaming holds 797,704 Ether, price roughly $2.30 billion at the time of e-newsletter, a signal that some public treasuries are already staking mountainous bets on the community.

Tokenized Sources Salvage Traction

Chalom additionally expects tokenized steady-world resources to enlarge suddenly, forecasting a $300 billion market for RWAs in 2026 and saying tokenized resources will 10X in AUM next 365 days as funds, shares, and bonds gain wrapped onchain.

In 2026, I maintain Ethereum’s Total Impress Locked (TVL) will enlarge 10X. Why and how? 🧵

Views ≠ investment advice.

— Joseph Chalom (@joechalom) December 26, 2025

He aspects to rising passion from mainstream firms like JPMorgan, Franklin Templeton, and BlackRock. Reviews cloak that sovereign wealth funds could perchance enlarge their Ethereum exposure by five- to tenfold, which could perchance bring substantial, affected person capital into tokenization initiatives and protocol deposits.

Ethereum Impress Action

Ethereum used to be trading near $2,921 on December 25, 2025, giving the community a market price of about $352 billion, whereas 24-hour trading quantity came in at roughly $11.47 billion.

Over the route of 2025, ETH moved through a plump market swing. It opened the 365 days round $3,298, climbed to about $4,390 in August, and stayed below its tale high of $4,942, earlier than sliding back to the $2,921 rental by 365 days-cease.

Impress swings had been heavy, with annual volatility discontinuance to 140%. Technical readings cloak mixed momentum. The weekly RSI sits at 41.7, placing Ethereum in a neutral-to-bearish zone, whereas the day-to-day MACD histogram stays destructive at -0.15. Impress toddle has additionally been boxed into a slim band between $2,774 and $3,038.

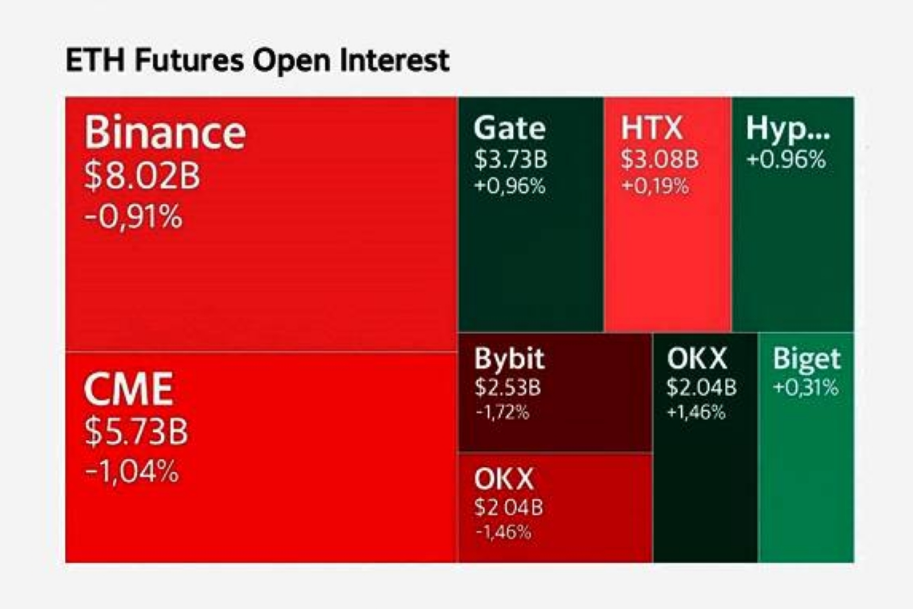

Futures data provides to the cautious tone. Total launch passion stands near $37 billion, down 0.62% over the last 24 hours, pointing to diminished exposure from traders. Liquidation data reveals extra than $100 million in probably long liquidations clustered between $2,880 and $2,910, an rental now viewed as a key stress point.

Market Signals And Dangers

Now not all people concurs that token flows will translate into swiftly mark features. In accordance to crypto analyst Benjamin Cowen, Ether will not be any longer probably to hit new highs next 365 days given novel Bitcoin prerequisites.

That caution strains up with technicals that time out vary-sure trading and with the indisputable fact that launch passion has eased a runt of. The liquidation cluster near $2,880–$2,910 reveals where leveraged positions could perchance be compelled out, and that make of stress can push mark moves faster than fundamentals.

Featured image from Gemini, chart from TradingView