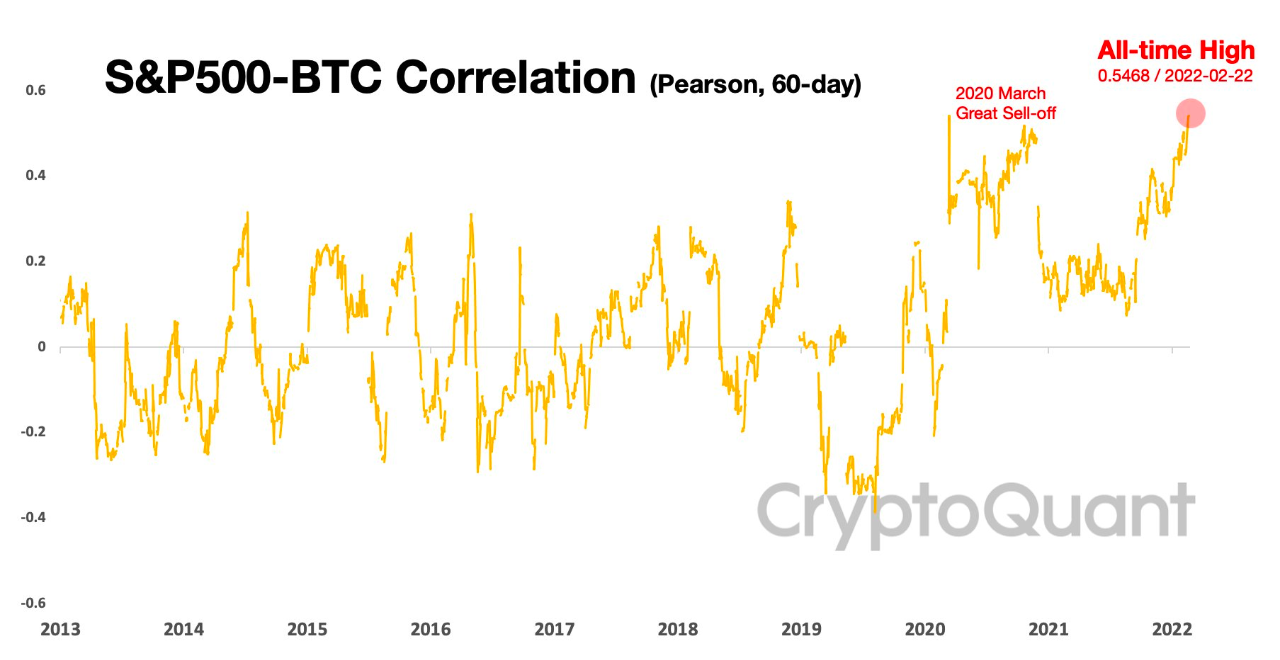

Files displays the Bitcoin correlation with S&P 500, and hence the inventory market, has now role a brand sleek all-time excessive (ATH).

Bitcoin Correlation With S&P 500 Reaches Fresh Excessive

As pointed out by an analyst in a CryptoQuant post, the BTC correlation with the inventory market is currently at an all-time excessive, additional negative the “stable haven” fable.

The “Bitcoin correlation with S&P 500” is a trademark that measures how strongly the price of BTC reacts to volatility in S&P 500, along with the route of the response.

When the indicator has values higher than zero, it capability there’s a particular correlation between the inventory market and the price of the crypto for the time being. “Certain” right here capability that BTC moves within the identical route as S&P 500.

On the opposite hand, correlation values no longer up to zero imply that BTC reacts to S&P 500’s designate changes by sharp within the reverse route.

Related Reading | Bitcoin Plunges Below $40 As Russia Has Reportedly Given Its Forces Repeat To Attack Ukraine

Values of the indicator precisely equal to zero naturally mean that there’s rarely always any correlation between the 2 property. Now, right here’s a chart that displays the event within the S&P 500 and Bitcoin correlation for the explanation that three hundred and sixty five days 2013:

The indicator's designate over the history of the crypto | Source: CryptoQuant

As that you can gaze within the above graph, the correlation between Bitcoin and S&P 500 swung between particular and negative whereas excellent low for primarily the most section of BTC’s history.

Related Reading | Why Bitcoin Won’t Crack Over Unique Endure Assault, Subsequent Doubtless Target For BTC

On the opposite hand, since gradual 2019-early 2020, the 2 property bask in change into strongly, positively correlated. At some level of 2020, the metric had a break attributable to the COVID promote off, nonetheless the indicator sharply rose at some level of the 2nd half of 2021 and 2022 to this level.

The correlation between the Bitcoin and the inventory market has now role a brand sleek all-time excessive (ATH) of +0.5468 this month.

Such excessive correlation between the property has additional build a dent on the fable of “digital gold” as the crypto is no longer the stable haven it once used to be.

BTC Trace

At the time of writing, Bitcoin’s designate floats around $39okay, down 12% within the excellent seven days. Over the last month, the crypto has won 10% in designate.

The below chart displays the event within the price of BTC over the excellent five days.

BTC's designate appears to be like to made some restoration over the excellent couple of days | Source: BTCUSD on TradingView

Just a few days support, the price of Bitcoin plunged down, touching as diminutive as $36.4k. Since then, the price of the coin has shown some restoration, breaking above the $39okay stage all any other time recently. Within the within the meantime, it’s unclear whether or no longer this sleek uptrend will excellent.

Featured listing from Unsplash.com, charts from TradingView.com, CryptoQuant.com