The below is from a recent model of the Deep Dive, Bitcoin Journal’s top rate markets newsletter. To be among the predominant to gather these insights and completely different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

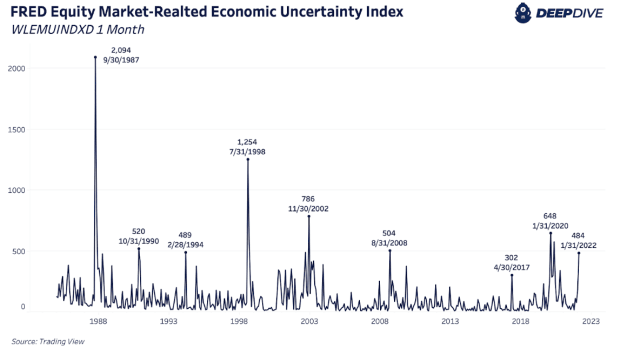

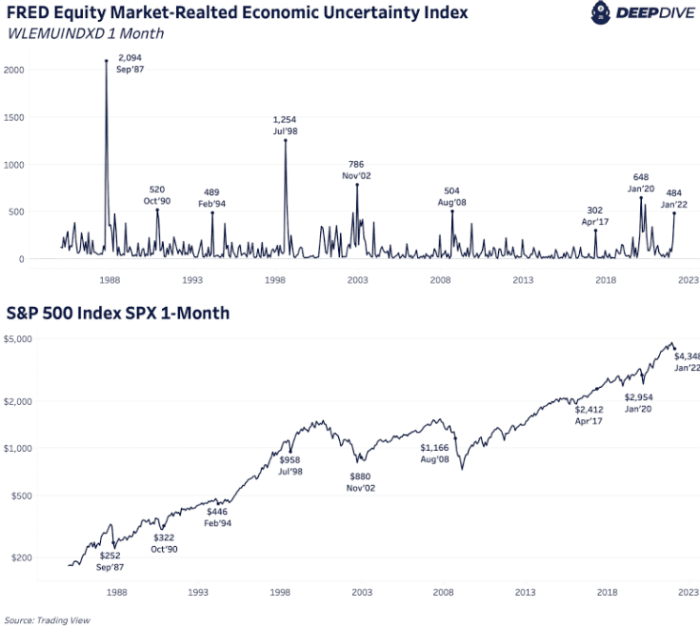

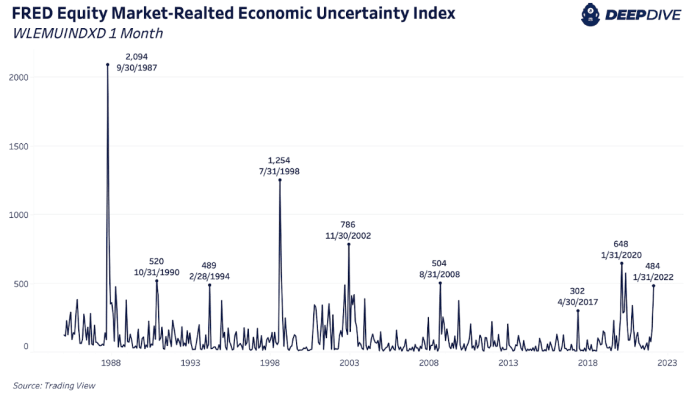

The FRED Equity-Connected Financial Uncertainty Index reached its sixth-absolute most practical discovering out ever this day, as liquidity continues to dry up for threat sources. Spikes in this index most often coincide with predominant drawdown durations in the S&P 500 Index.

FRED equity market-connected economic uncertainty demonstrates elementary macroeconomic considerations and in the terminate impacts the bitcoin word.

As inflation has reached 40-one year highs in the U.S. (as well to high readings in the center of the remaining of the sphere), investment-grade bonds truly ceased to exist with nominal yields a long way below the inflation rate with out accounting for credit rating (default) threat by any ability.

We have continued to disclose in The Deep Dive that bitcoin’s financial opponents isn’t appropriate gold, nonetheless moderately the financial top rate that has nestled itself into global bond and even equity markets amidst the all the pieces bubble.

The The total lot Bubble

We continue to make exercise of the time frame “The total lot Bubble” in The Deep Dive to body the disclose of the world financial arrangement, nonetheless what’s going to we truly point out?

The Federal Reserve Board, and its actions as “lender of ultimate resort” for the U.S. greenback (with the greenback serving as the sphere reserve forex) maintain acted as a volatility suppression draw for an extended time.

Most notably starting with Alan Greenspan and the “Greenspan place” (later to be is named the Fed place), financial markets got here to learn that the Fed would put the day by bailing out credit rating markets and keeping the easy money flowing. Now in 2022, with the Fed’s fund rate mute on the zero lower bound, the Fed has turn out to be a political liability, and is caught underprepared attempting to tighten as liquidity all over financial markets is pulling again.

In The Day-to-day Dive #142 we discussed the implications of the latest credit rating market sell-off:

“The consequences of the falling costs in debt devices is increased financing charges in the broader economy, as a forty-one year high in the patron word index alongside with a rather hawkish Federal Reserve Board has lenders having a test increased yields.

“What wishes to be watched going forward is how credit rating markets substitute, as this has a enlighten impact on equity markets from a company financing standpoint nonetheless also a market valuation standpoint.

“This is something we can take care of a truly shut ogle on over the upcoming months, into a attainable Fed rate hike cycle.”