- Blockchain and World Funds

- P2P Cryptocurrency Funds

- Sending Funds

- Exchange Finance

- Safety Tokens

- Audits

- Digital Id

- Compliance

- Credit score Scoring

- Obstacles of Blockchain

- Final Thoughts: FinTech Blockchain

Blockchain expertise is quietly remodeling industries in ways that were unbelievable a couple of years ago. Transactions that as soon as took days to complete, and lots of third-party verifications methods, can now be conducted extra successfully. Corporations continue to acknowledge the energy of blockchain in streamlining their financial dealings.

This day, FinTech blockchain applications are a typical portion of the commerce world. The blockchain home is now over a decade veteran, and there are a grand replace of government blockchain applications being tested. Listed right here are one of the most ways that FinTech blockchain modified the scope of international e-commerce.

Blockchain and World Funds

Anybody accustomed to the contrivance of transferring money internationally understands that it is a dear and time-challenging route of. At some level of the switch route of, treasured funds can even be lost in consequence of fluctuations within the international change rate of fiat currencies.

Recognizing these shortcomings within the recent machine, cryptocurrencies similar to Ripple created a international money switch machine that enables near-instantaneous transfers of unlimited amounts for next to nothing. This day, there is a full cryptocurrency sector centered on offering international money switch solutions to folks and firms.

In September 2017, six foremost banks, including Barclay’s, Credit score Suisse, Canadian Imperial Monetary institution of Commerce, HSBC and Command Boulevard, partnered to occupy their very be pleased native cryptocurrency known as the utility settlement coin. This decision highlights banks’ rising passion within the price-financial savings completed via blockchain integration.

P2P Cryptocurrency Funds

Blockchain expertise supplies an accurate query-to-query fee expertise. Bitcoin, the realm’s first cryptocurrency and largest blockchain, is described as “a query-to-query electronic money machine” in Satoshi Nakamoto’s Bitcoin white paper. This distinction is well-known attributable to it is the loyal reverse of how the recent financial machine operates.

In a aged financial environment, you aren’t surely sending your funds straight. Instead, you are asking the financial institution if they are going to additionally send funds to your behalf. If your financial institution approves your seek info from, and simplest if they approve, the funds are despatched to the assorted person’s financial institution. This route of is dear and requires lots of occasions to note the transaction. Each and each of these organizations adds a small fee.

Blockchain expertise eliminates the need for third-party verification methods attributable to the network’s nodes note transactions. The clear nature of the expertise drastically reduces the risk of inaccurate narrate. As long as 51 p.c of the nodes will now not be corrupted, the blockchain remains safe. As a end result, this also eliminates the bulk of transaction funds encountered when doing commerce or sending money.

Sending Funds

Within the case of remittance funds, third-party funds can equal over 10 p.c of the sender’s transaction amount. In areas that depend heavily on remittance funds, similar to India and Africa, blockchain-based totally choices occupy emerged.

A recent partnership between SBI Remit and BitPesa highlights how firms are searching for to nick these funds by integrating a FinTech blockchain. The partnership enables SBI Remit customers to send money from Japan to Africa using a blockchain-based totally machine. The funds are deal less, and the consumer’s transaction is carried out worthy sooner than a aged remittance fee.

Exchange Finance

The commerce finance sector is one other industry seeing an integration of FinTech blockchain. The usage of blockchain within the trading sphere has developed drastically ever since the first profitable blockchain transaction modified into as soon as conducted by Barclays and Ornua in 2016. This transaction proved that blockchain tech reduces the frequent waiting length for a commerce transaction to complete, from three days down to four hours.

Additionally, the usage of trim contracts diminished the workload of these transactions via automation. This day, tokens exist that combine commerce finance regulations straight. These tokens are known as security tokens.

Safety Tokens

Safety tokens change how aged firms raise funds. These tokens combine regulatory standards straight into their protocol to enable a merging of aged financial markets and blockchain methods.

Audits

Audits are a time-challenging and in most cases dear route of that can take grasp of weeks to complete. Blockchains are wonderful for auditing purposes thanks to their immutable nature. All transactions positioned on the blockchain are permanent and can’t be altered or deleted without approval from a majority of the network.

In September 2018, it modified into as soon as printed that the four largest accounting firms on this planet joined the Taiwanese blockchain consortium to extra investigate integrating this expertise into their recent accounting methods. The blockchain firm Digital Asset is one other example of an organization offering blockchain auditing products and companies at an endeavor level.

Digital Id

As banks look to nick running funds, it turns into evident that a expansive majority of funds are derived from identity verification requirements. These requirements can differ from financial institution to financial institution. The dearth of any standardized requirements makes the market extra originate to fraud as con artists look to capitalize on the confusion.

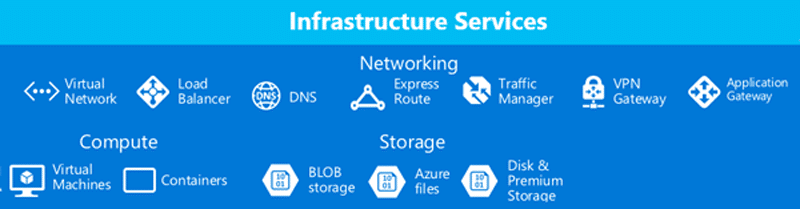

Which capacity that of these considerations, banks are now taking a look in the direction of blockchain tech for his or her future deepest identification desires. Blockchain-based totally identification methods were in pattern for years. The Microsoft Azure project is unquestionably one of many most notable of these ideas below pattern.

Microsoft Azure builders are searching for to comprehend your digital identity, which is currently saved across lots of platforms, apps, and websites, and return the care for an eye on of this data to you. The builders notion a one-raze shop to home your complete digital identification securely and in an accessible contrivance. That probabilities are you’ll then be ready to manipulate who has bring together entry to to this handsome data.

Compliance

The SEC vocalized many considerations referring to the ICO market and the shortcoming of regulations over the closing two years. These considerations hit a fevered pitch when lots of star endorsements of failed ICOs grew to change into public data, similar to the Paragon coin saga.

On this case, the successfully-known rapper, The Game, and Omit Iowa, Jessica VerSteeg, promoted a inaccurate blockchain marijuana project. Traders claim the money raised went in the direction of true estate investments, fairly than the seed-to-shop blockchain quality machine described by the celebrities.

Blockchain expertise desires a compliant-pleasant version to bridge the opening between aged financial institutions and the recent digital economic system. Safety tokens include this hole. Thanks to the pattern of security tokens, compliance regulations are met without the need for third-occasions.

The need for this merger created a thriving security token market. This day, lots of firms similar to Polymath offer firms a straightforward technique to host their very be pleased security token offering (STO).

Credit score Scoring

The credit score sector is one other home that will look drastic changes within the coming 365 days. This day, there is no standard international credit score machine in win 22 situation. This lack of standardization hurts travelers as they look to put money into recent areas and are, in consequence, compelled to rebuild their credit score from square one.

Currenct projects seeks to invent a tough international infrastructure to lower the prices connected to credit score monitoring, updating, and processing. Developers hope that their international credit score bureau can change the compartmentalized methods in win 22 situation on the present time.

Obstacles of Blockchain

Whereas blockchain expertise is of undeniable significance, probabilities are you’ll mute know that this expertise can’t win every error. Errors dedicated all the scheme via data entry onto the blockchain would perhaps additionally be one other level of narrate with this machine. Additionally, some adversaries to the expertise judge that scalability considerations would perhaps additionally restrict the usage of FinTech blockchain within the long trudge.

Bitcoin suffered enormous scalability considerations all the scheme via crypto’s 2017 breakout. At one level, congestion bought so dreadful on the blockchain that it would perhaps per chance take grasp of hours and price excessive funds to send even a small amount of Bitcoin. At the 2nd, builders narrate a replace of artistic methods to put off blockchain congestion, similar to secondary layers and non-public fee portals.

Final Thoughts: FinTech Blockchain

Whereas blockchain’s opponents’ considerations are loyal, the expertise appears to be like to occupy a actually sparkling FinTech future sooner than it. Within the commerce world, the most ambiance pleasant machine wins out. In varied phrases, if it’s all about the bottom line, you can’t ignore blockchain expertise.

Never Omit One other Alternative! Receive hand selected info & data from our Crypto Specialists so that that you just can occupy trained, suggested choices that straight occupy an tag to your crypto earnings. Subscribe to CoinCentral free e-newsletter now.