Key Takeaways

- Bitcoin and Ethereum cling surged by over 28% staunch by means of the final two weeks.

- Each property seem to be struggling to interrupt by means of their 200-day shifting averages.

- Within the period in-between, sell alerts are starting to seem.

The tip two cryptocurrencies, Bitcoin and Ethereum, are consolidating beneath a stiff resistance diploma. A steep correction will seemingly be on the horizon.

Bitcoin, Ethereum Wrestle to Spoil Out

Bitcoin and Ethereum cling remained stagnant staunch by means of the final few days even as decrease cap property rally.

The tip two crypto property cling confirmed a solid correlation coefficient staunch by means of the final two weeks. They’ve largely surged in tandem, gaining higher than 28% in market worth. On the other hand, both Bitcoin and Ethereum seem to cling reached a major resistance whereas sell alerts are starting to floor.

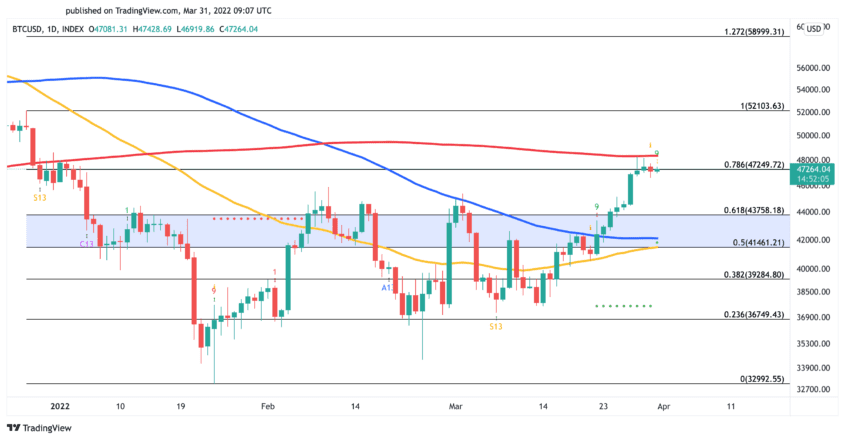

Bitcoin has been making an strive to interrupt the 200-day shifting common since Mar. 28, but has been unsuccessful. Though resistance tends to weaken over time, the procuring and selling quantity appears to be like to be fading around the sizzling ticket diploma. The dearth of procuring stress also can lead to a rejection for Bitcoin to procure liquidity sooner than advancing additional.

The Tom DeMark (TD) Sequential indicator adds credence to the quick-term pessimistic outlook as it’s a ways for the time being presenting a sell signal on Bitcoin’s day-to-day chart. A spike in income-taking could well validate the bearish formation, leading to a one to four day-to-day candlesticks correction. Under such conditions, Bitcoin could well descend to the ask zone between $43,760 and $41,460.

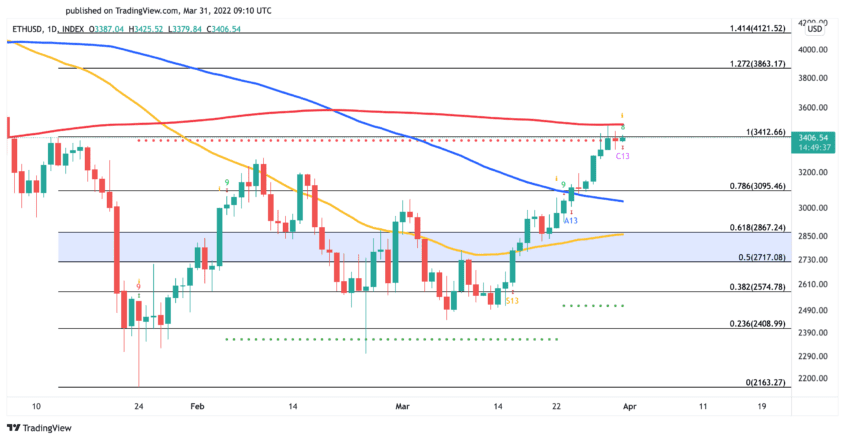

Ethereum’s uptrend also appears to be like to cling been halted by the 200-day shifting common at $3,500. As Ethereum continues to replace beneath this mandatory resistance diploma, the probability of a short correction will increase. Moreover, the TD Sequential indicator is calling forward to a bearish scenario.

The usual indicator has flashed a combo 13 candlestick on Ethereum’s day-to-day chart, which is able to be opinion-about a sell signal. If sell orders amplify around the sizzling ticket ranges, Ethereum could well descend to $2,870 or $2,720 sooner than making an strive to reclaim the 200-day shifting common.

Whereas Bitcoin and Ethereum seem to cling encountered stiff resistance, some analysts assume that consolidation is appropriate for future ticket boost. It’s worth noting that a day-to-day candlestick discontinuance above the 200-day shifting common could well invalidate the quick-term pessimistic outlook. If Bitcoin breaches the 200-day shifting common, it could well in point of fact surge to $5,200. Ethereum, meanwhile, has a shot at $3,900 if it ought to interrupt by means of.

Disclosure: At the time of writing, the creator of this portion owned BTC and ETH.

For more key market traits, subscribe to our YouTube channel and acquire weekly updates from our lead bitcoin analyst Nathan Batchelor.

The records on or accessed by means of this web feature is obtained from self sufficient sources we assume to be appropriate and authentic, but Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any records on or accessed by means of this web feature. Decentral Media, Inc. isn’t very any longer an investment consultant. We attain no longer give personalized investment advice or varied monetary advice. The records on this web feature is field to replace without uncover about. Some or all of the records on this web feature also can change into out of date, or it goes to be or change into incomplete or inaccurate. We also can, but are no longer obligated to, update any out of date, incomplete, or inaccurate records.

You ought to tranquil by no approach form an investment decision on an ICO, IEO, or varied investment in accordance with the records on this web feature, and also you ought to tranquil by no approach elaborate or in every other case depend upon any of the records on this web feature as investment advice. We strongly indicate that you just seek the advice of an authorized investment consultant or varied certified monetary professional in case you are making an strive to fetch investment advice on an ICO, IEO, or varied investment. We attain no longer gain compensation in any manufacture for inspecting or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

Perceive rotund terms and stipulations.

MicroStrategy Borrows In opposition to Bitcoin to Prefer Extra Bitcoin

MicroStrategy arm MacroStrategy frail a portion of the Bitcoin held in its reserves as collateral for the mortgage. MicroStrategy Proclaims Bitcoin Prefer After accumulating some 124,000 Bitcoin, MicroStrategy is now…

Bitcoin’s Community Narrate Is Hovering. What Comes Subsequent?

Several on-chain metrics indicate that Bitcoin is gaining energy for a major bullish impulse. Detached, the stop crypto has a colossal hurdle to beat first. Bitcoin On-Chain Metrics Possess Up…

Opinion: 2022 Is Ethereum’s Biggest twelve months Yet

With the Merge to Proof-of-Stake on the horizon, 2022 is a essential year for Ethereum. Ethereum Prepares for the Merge This time final year, as the colossal bull crawl became once…