Melanion Capital has bought approval to list an ETF that tracks a basket of bitcoin-related stocks, an EU Ucits first.

Paris-primarily primarily based Melanion Capital, a derivatives and computer-pushed fund supervisor, has reportedly bought regulatory approval to open an swap-traded fund (ETF) that tracks Bitcoin-related stocks for investors all the plan thru the European Union (EU). Nonetheless, the fund also can now no longer be a bitcoin ETF since it goes to now no longer make investments in or protect BTC straight away.

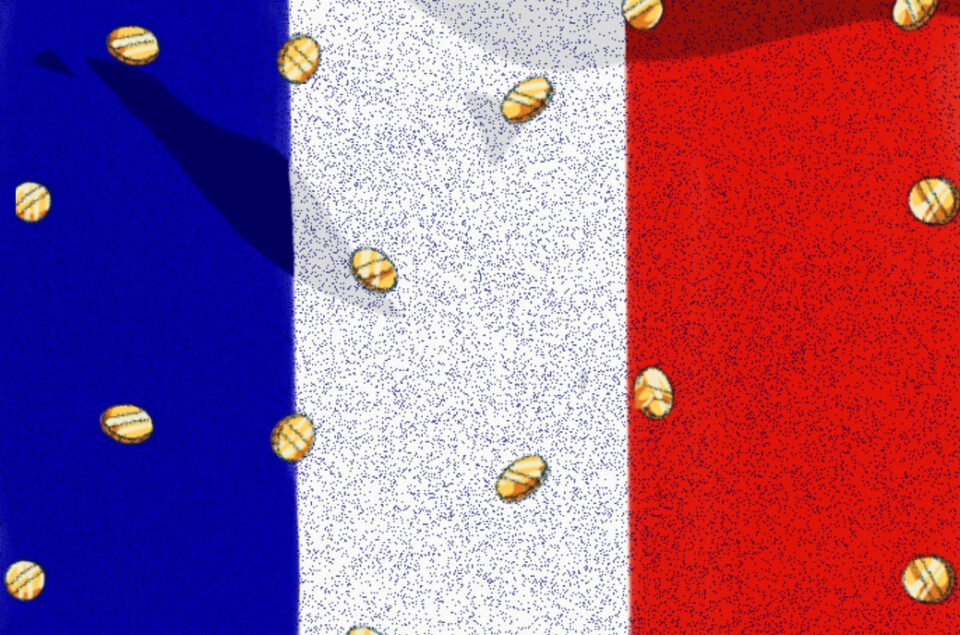

Per the Monetary Instances, Melanion’s ETF proposal bought approval from French regulators who dominated that it meets key EU requirements, identified as Ucits, meaning that is prone to be on hand within the total union’s 27 member states. The Paris-primarily primarily based firm’s ETF has change into one in all the key bitcoin-related funds to win the Ucits rating.

“I have not viewed any funds launched yet which are involved in digital assets below the Ucits umbrella,” Winston Penhall, a funds attorney at Keystone Guidelines in London, suggested the Monetary Instances. Traders within the EU are usually skeptical of inserting their money into non-Ucits funds since the rating affords high ranges of investor protection.

The Melanion BTC Equities Universe Ucits ETF will possible be fairness-primarily primarily based in jam of bitcoin-primarily primarily based. This can reportedly song a basket of up to 30 stocks, together with mining firms Argo, Insurrection, HIVE, and investment firm Galaxy Digital and broker Voyager Digital. Melanion acknowledged the stocks making up the fund would devour an alleged high correlation to the bitcoin market tag. Nonetheless, the fund might well per chance now no longer be conserving bitcoin straight away.

“Most pipes of the weak monetary machine end at access to bitcoin,” acknowledged Melanion CEO Jad Comair, per the account. “The ETF became a real sigh of affairs as a result of the sensibilities and politics currently surrounding bitcoin and bitcoin investing.”

The weighting of the fund will be certain by German fintech Bita, a application provider for calculating monetary indexes and quantitative investment ideas. Melanion’s ETF will reportedly price a 0.75% price as soon as it lists on Euronext in Paris. The itemizing date has now no longer been shared.