FTX will kill Voyager’s sources discipline to court approval and a customer vote.

Key Takeaways

- FTX has won an public sale to kill sources belonging to the bankrupt crypto lender Voyager Digital.

- FTX’s $1.42 billion mutter covers $1.31 billion of crypto holdings and $111 million of different concerns.

- Voyager acknowledged that FTX’s most most unusual winning mutter is vital higher for customers than its previous mutter.

Bankrupt crypto lender Voyager Digital offered this day that FTX had won its sources at public sale.

FTX Wins Voyager Public sale

FTX has won Voyager Digital’s sources.

In accordance with an announcement, FTX’s winning mutter amounts to $1.42 billion. That covers Voyager’s $1.31 billion in crypto holdings plus extra concerns of $111 million.

Voyager also acknowledged that FTX’s closing mutter became once “vastly higher for customers than its usual mutter.” In July, the firm rejected an unsolicited “low-ball” mutter that FTX offered outside the legit public sale course of.

It reached out to over 90 parties to make a selection hobby in a sale. Despite the truth that it did no longer title any of those other parties, previous reports instructed that Binance, CrossTower, and Wave Monetary had been amongst the opposite bidders.

Voyager says that FTX’s winning mutter must mild be finalized. After a court approves the snatch agreement on October 19, customers must vote in pick on of FTX’s mutter. Within the period in-between, the Voyager Reliable Committee of Unsecured Collectors has already acknowledged its toughen for FTX’s mutter.

Voyager wired that the conclusion of the public sale would no longer alternate its claims closing date. Customers who imagine they are owed cash must file a inform earlier than October 3.

Additionally, the public sale has no longer resolved an scenario spherical Three Arrows Capital, which defaulted on a loan to Voyager this summer. The claims in opposition to Three Arrows Capital remain with the monetary trouble property; if those funds are recovered, they’ll be distributed to collectors.

Voyager noted this day that it selected the winning mutter in a “extremely competitive public sale course of that lasted two weeks.”

The agency halted user withdrawals on July 1 and declared monetary trouble days later. That monetary trouble course of resulted in this month’s public sale, which began on September 13.

Despite the truth that customers maintain mild no longer regained derive entry to to their funds, this day’s recordsdata is one step in direction of that aim.

Disclosure: On the time of writing, the author of this piece owned BTC, ETH, and other cryptocurrencies.

The guidelines on or accessed through this net characteristic is got from self sustaining sources we imagine to be correct and legit, nonetheless Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any recordsdata on or accessed through this net characteristic. Decentral Media, Inc. is no longer an investment advisor. We attain no longer give personalized investment recommendation or other monetary recommendation. The guidelines on this net characteristic is discipline to alternate with out stare. Some or the total recordsdata on this net characteristic would possibly perchance perhaps perhaps also merely change into out of date, or it’ll be or change into incomplete or erroneous. We would possibly perchance perhaps perhaps also merely, nonetheless usually are no longer obligated to, change any out of date, incomplete, or erroneous recordsdata.

You need to no longer at all originate an investment resolution on an ICO, IEO, or other investment based totally on the tips on this net characteristic, and you’ll want to no longer at all clarify or otherwise rely on any of the tips on this net characteristic as investment recommendation. We strongly indicate that you consult a licensed investment advisor or other qualified monetary professional must you are in the hunt for investment recommendation on an ICO, IEO, or other investment. We attain no longer accept compensation in any ticket for inspecting or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized gross sales, securities, or commodities.

Seek for corpulent phrases and prerequisites.

Three Arrows Capital Defaults on Voyager Digital

Three Arrows Capital has did no longer pay aid $665 million in loans from Voyager Digital, which this day issued the agency’s first stare of default. Voyager possibilities is no longer going to be impacted…

Voyager Says FTX’s Buyout Provide Used to be Misleading “Low-Ball Expose,” S…

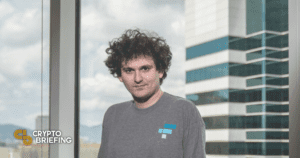

Commenting on Voyager’s response to the proposal, FTX founder and CEO Sam-Bankman Fried acknowledged that only the monetary trouble lawyers would derive pleasure from dragging out the lawsuits, while the shoppers would…

Mashinsky Is Out: Celsius CEO Resigns

Celsius filed for Chapter 11 monetary trouble in July. Mashinsky Steps Down From Celsius Alex Mashinsky has resigned as Celsius’ CEO. A Tuesday press originate offered that Mashinsky had stepped down…