Key Takeaways

- GMX is a decentralized alternate built on Avalanche and Arbitrum.

- It lets DeFi users commerce with up to 30x leverage in a permissionless system.

- GMX offers a tender user abilities that’s completely suited to retail DeFi merchants.

GMX users can “prolonged” or “brief” up to 30 times the size of their collateral by borrowing funds from a tidy liquidity pool.

Decentralized Leverage

GMX is a usual decentralized alternate that makes a speciality of perpetual futures trading. Launched on the Ethereum Layer 2 community Arbitrum in leisurely 2021 and later deployed to Avalanche, the venture has hasty gained traction by providing users leverage of up to 30 times their deposited collateral.

Leverage trading—the act of borrowing funds from monetary platforms so as to elongate one’s publicity to imprint movements—has became an mandatory phase of the crypto ecosystem in fresh years. Among rather about a things, it permits market contributors to make the most of imprint downturns, decrease chance in unsure stipulations, and bet immense on an asset after they possess got conviction.

There are several systems of taking on leverage in crypto. Binance, FTX, and rather about a centralized exchanges provide customers the capacity to borrow funds for trading functions. Binance and FTX each and every let customers borrow a maximum of up to 20 times their preliminary deposit. DeFi protocols love Aave and MakerDAO ache loans against crypto collateral in a permissionless system. Extra no longer too prolonged ago, worn finance companies love GME Team and ProShares possess started providing their institutional customers gain admission to to leveraged products equivalent to solutions on Ethereum futures contracts and Bitcoin Short ETFs to their institutional merchants.

GMX differs from such products and providers in that it’s a decentralized alternate that offers leverage trading products and providers. In that appreciate, it combines a identical abilities to rather about a DeFi exchanges love Uniswap with the leverage trading products and providers offered by the likes of Binance. On GMX, users can absorb to 30x leverage on BTC, ETH, AVAX, UNI, and LINK trades. In rather about a words, if a trader deposited $1,000 price of collateral to GMX, they’d be in a put to borrow up to $30,000 from its liquidity pool. In this records, we unpack GMX’s providing to ascertain whether or no longer it’s protected, and must you would possibly per chance aloof use it in your subsequent excessive conviction bet.

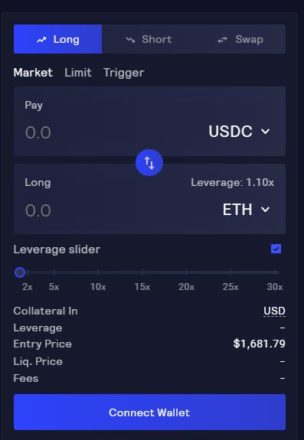

Trading on GMX

Trading on GMX is supported by a multi-asset GLP pool price better than $254 million at press time. Not like many more than a number of leveraged trading products and providers, users borrow funds from a liquidity pool containing BTC, ETH, USDC, DAI, USDT, FRAX, UNI and LINK in desire to a single entity.

Users can accelerate “prolonged,” “brief,” or simply swap tokens on the alternate. Merchants accelerate prolonged on an asset after they question its imprint to elongate, they generally brief in expectation of being in a put to rob an asset back at a decrease imprint. On GMX, users can make a choice out a minimal leverage stage of 1.1x their deposit and a maximum stage of 30x on prolonged and brief trades.

GMX is powered by Chainlink Oracles. It makes use of an combination imprint feed from leading quantity exchanges to diminish liquidation chance from temporary wicks. A liquidation happens when a user’s collateral becomes insufficient to back a commerce; the platform then forcefully closes the position and pockets the deposit to duvet its losses.

When a user opens a commerce or deposits collateral, GMX takes a snapshot of its greenback imprint. The imprint of the collateral would no longer alternate throughout the commerce even though the price of the underlying asset does.

Trading charges to open or shut a position contrivance in at 0.1%. A variable borrow fee also gets deducted from the deposit every hour. Swap charges are 0.33%. As the protocol itself serves as the counterparty, there’s minimal imprint impact when coming into and exiting trades. GMX claims it’ll compose tidy trades precisely at effect imprint looking on the depth of the liquidity in its trading pool.

When a user wishes to accelerate prolonged, they’ll present collateral in the token they’re having a bet on. Any earnings they receive are paid in the identical asset. For shorts, collateral is limited to GMX’s supported stablecoins—USDC, USDT, DAI, or FRAX. Earnings on shorts are paid in the stablecoin faded.

Tokenomics and Liquidity

The protocol has two native tokens: GMX and GLP.

GMX is the utility and governance token. It must presently be staked for a 22.95% hobby charge on Arbitrum and 22.79% on Avalanche.

Stakers can form three forms of rewards after they lock up GMX: escrowed GMX (esGMX), multiplier aspects, and ETH or AVAX rewards. esGMX is a derivative that can moreover be staked or redeemed for GMX over a timeframe, whereas multiplier aspects reward prolonged-timeframe GMX stakers by boosting the hobby charge on their holdings. Additionally, 30% of the charges generated from swaps and leverage trading are remodeled to ETH (on Arbitrum) or AVAX (on Avalanche) and distributed to staked GMX holders.

The GMX token also has a floor imprint fund. It’s faded to make optimistic the GLP pool has ample liquidity, present a reliable rush of ETH rewards for staked GMX and rob and burn GMX tokens so as to back a minimal imprint of GMX against ETH. The fund grows as a result of charges accumulated by contrivance of the GMX/ETH liquidity pair; it’s also supported by OlympusDAO bonds.

At time of writing, the final GMX present stands at 7,954,166 price better than $328 million, 86% of which is staked. The total present varies looking on esGMX redemptions, however the event crew has forecasted that the present will no longer exceed 13.25 million. Beyond that threshold, minting fresh GMX tokens shall be conditional on DAO approval.

The 2nd token, GLP, represents the index of sources faded in the protocol’s trading pool. GLP cash would possibly per chance moreover be minted the usage of sources from the index, equivalent to BTC or ETH, and would possibly per chance moreover be burned to redeem these sources. GLP holders present the liquidity merchants need to gain leverage. This fashion they book a profit when merchants protect a loss, they generally protect a loss when merchants book a profit. Additionally, they receive esGMX rewards and 70% of the charges the protocol generates. The charges are paid in both ETH or AVAX. GLP tokens are automatically staked and would possibly per chance very most real looking be redeemed, no longer bought. The fresh hobby charge is 31.38% on Arbitrum and 25.85% on Avalanche.

GLP’s imprint is contingent on the price of its underlying sources, as successfully as the publicity GMX users possess toward the market. Most notably, GLP suffers when GMX merchants brief the market and the price of pool sources also decreases. On the opposite hand, GLP holders stand to merit when GMX merchants accelerate brief and costs upward push, GMX merchants accelerate prolonged and costs decrease, and GMX merchants accelerate prolonged and costs upward push.

Closing Ideas

GMX is user-friendly. The trading abilities feels tender, and the plot offers users with thorough records. At any time when coming into or closing a position, it’s easy to search out the collateral dimension, leverage quantity, entry imprint, liquidation imprint, charges, on hand liquidity, slippage, spread, and PnL (earnings and losses). The protocol’s interface offers an abundance of records linked to its sources below management, trading volumes, charges, and trader positions. The win position also particulars GMX and GLP’s market capitalizations and highlights the venture’s partnerships, integrations, and linked neighborhood projects. It moreover entails a documentation part, which offers records on the alternate’s rather about a parts, and suggests systems to bridge to Arbitrum or Avalanche, or to execute GMX and GLP tokens. As a consequence of its detailed dashboards, GMX offers off an impact of transparency. As a consequence, the protocol’s mechanisms are relatively easy to grab.

With its permissionless accessibility and leveraged trading providing, GMX combines the abilities of each and every decentralized and centralized exchanges, exhibiting that DeFi protocols are aloof breaking fresh floor on on each day foundation foundation. The protocol’s trading quantity has better than tripled in the previous two months and now ranges between $290 million and $150 million day after day, indicating rising hobby amongst crypto natives. As GMX doesn’t but handle billions of bucks of quantity love its centralized counterparts, it’s presently a product most suited to miniature retail merchants. Restful, after fleet enhance over fresh months, GMX would possibly per chance soon entice the institutional market as extra immense gamers initiate to experiment with DeFi. With extra room for enhance forward, it’s successfully price conserving an detect on.

Disclosure: On the time of writing, the author of this part owned ETH and several other rather about a cryptocurrencies.

The records on or accessed by contrivance of this internet position is obtained from fair sources we predict about to be correct and reliable, however Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any records on or accessed by contrivance of this internet position. Decentral Media, Inc. is no longer an funding e book. We originate no longer give personalized funding suggestion or rather about a monetary suggestion. The records on this internet position is topic to alternate without search for. Some or all of the records on this internet position would possibly per chance became outdated, or it’s miles likely to be or became incomplete or unsuitable. We would possibly per chance, however will no longer be obligated to, update any outdated, incomplete, or unsuitable records.

It’s most likely you’ll even aloof by no system gain an funding resolution on an ICO, IEO, or rather about a funding primarily based fully on the records on this internet position, and also you would possibly per chance aloof by no system elaborate or otherwise rely on any of the records on this internet position as funding suggestion. We strongly counsel that you just seek the suggestion of a licensed funding e book or rather about a qualified monetary professional must you is also in quest of funding suggestion on an ICO, IEO, or rather about a funding. We originate no longer settle for compensation in any compose for analyzing or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

Glance fat phrases and conditions.

Newbie’s Files: Perpetual Trading on dYdX

Crypto Briefing explains systems to utilize dYdX, one of the quickest-rising platforms for decentralized perpetuals trading on the Ethereum blockchain. An Introduction to Perpetual Trading on dYdX Since launching in…

DeFi Exchanges dYdX, Uniswap Soar Amid China Crackdown

The decentralized exchanges dYdX and Uniswap possess jumped in imprint after experiencing a well-known lengthen in trading quantity following China’s latest announcement of a crackdown on digital sources. Chinese Investors…

Arbitrum Leads Ethereum Layer 2 Elope With $3.3B Locked

Arbitrum, an Optimistic Rollup, has strengthened itself as the tip Layer 2 respond on Ethereum. The total imprint locked on the community reached has $3.3 billion, jumping 17.78% in the…