TLDR

- Gold’s market capitalization hit $30 trillion as costs reached $4,357 per ounce, making it 14.5 cases greater than Bitcoin’s $2.1 trillion market cap

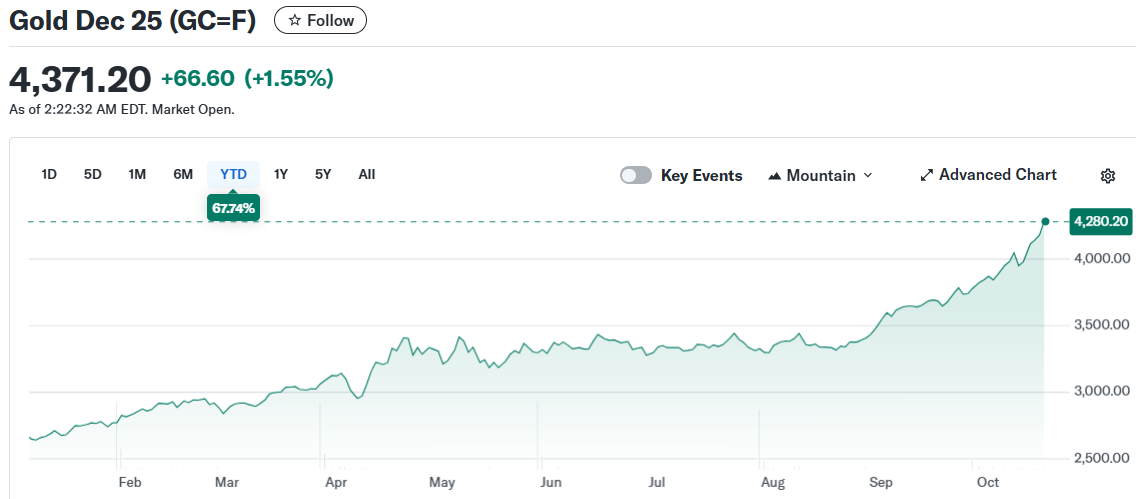

- Gold has surged 64% since January 2025 whereas Bitcoin has only won 16%, with gold up nearly about 60% year-to-date when compared to Bitcoin’s 13%

- Analysts predict capital will rotate from gold into Bitcoin when the gold market cools, with some calling it “the change after the change”

- Crypto merchants are combating 66% of positions being short on Hyperliquid, with only 35% of merchants winning amid high leverage

- Bitcoin skilled a $19 billion deleveraging event, one in all the greatest in its ancient previous, with funding charges dropping to 2022 FTX-cave in phases

Gold reached a market capitalization of $30 trillion on Thursday because the dear metallic hit a brand contemporary all-time high of $4,357 per ounce. The milestone puts gold’s tag at 14.5 cases greater than Bitcoin’s contemporary market cap of roughly $2.1 trillion.

The gold market is now 1.5 cases greater than the blended market capitalization of the seven greatest tech companies. Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta and Tesla collectively whole round $20 trillion in market tag.

Gold has surged 64% since January 1, 2025, driven by merchants seeking security from greenback debasement, geopolitical tensions and change tariff concerns. The principal metallic has greater than doubled in tag since the initiating of 2024.

Bitcoin has underperformed this year with only a 16% shatter from January 1 phases. The cryptocurrency currently trades nearly 14% below its all-time high in spite of frequent expectations of a bull market.

Analysts Predict Bitcoin Rotation

Crypto analyst Sykodelic famous that gold added over $300 billion to its market cap in a single day. The analyst pointed out that gold has been including a whole Bitcoin market cap price of tag each and per week.

Many market observers contain capital will float into Bitcoin once gold’s rally slows. Project investor Joe Consorti urged Bitcoin can also profit if it reduces its correlation with US equities and captures gold outflows.

Analyst Merlijn the Provider seen that the M2 worldwide money provide is rising and gold is performing smartly whereas Bitcoin remains flat. The analyst stated that this divergence in general doesn’t final long, with liquidity finally flowing into riskier belongings.

BITCOIN IS LAGGING BEHIND GLOBAL LIQUIDITY AND GOLD.

M2 is surging.

Gold is ripping.

Bitcoin is dozing.This divergence never lasts.

Liquidity consistently finds bother.The get-up rally will seemingly be brutal. pic.twitter.com/VQXAqhUUEH

— Merlijn The Provider (@MerlijnTrader) October 16, 2025

Crypto Merchants Face Losses

Recordsdata from trading platform Hyperliquid shows crypto merchants are positioned poorly for the scorching market ambiance. Ideally suited 34% of positions are long, with trusty 35% of merchants exhibiting profits.

The majority of merchants are caught in shedding short positions as market volatility will increase. Common everyday profit and loss for customers has dropped to trusty beneath $50,000, indicating fixed losses.

Celeb trader Machi Substantial Brother’s account dropped from $43 million in profits to over $13 million in losses. The case highlights how overleveraged bets on Bitcoin’s rebound proceed to fail.

Market Deleveraging Tournament

Glassnode’s most up to the moment market represent documented a $19 billion deleveraging event in Bitcoin markets. The evaluate firm described it as one in all the greatest deleveraging events in Bitcoin’s ancient previous.

Funding charges in finding fallen to phases final seen for the length of the 2022 FTX cave in. ETF inflows in finding turned negative, whereas long-time duration holders are selling into strength.

Glassnode warns that Bitcoin dangers deeper contraction below $108,000 except contemporary quiz emerges. The contemporary market sits in what the firm calls a “reset share.”

Merchants on prediction market Kalshi shriek confidence that 2025 will seemingly be the year gold outperforms Bitcoin. Despite Bitcoin trading 13% greater year-to-date, gold’s nearly about 60% shatter has some distance exceeded cryptocurrency returns.

Gold’s upward thrust has been driven by geopolitical stress, cooling inflation and expectations of charge cuts. Bitcoin’s speculative structure, depending on ETF flows and derivatives leverage, has now not captured the identical momentum because the mature safe-haven asset.