Since the creation of Bitcoin, bodily gold and digital gold had been offered as foils to investors. But perspectives of every asset’s underlying mining industry are too most frequently lacking from the comparability conversations.

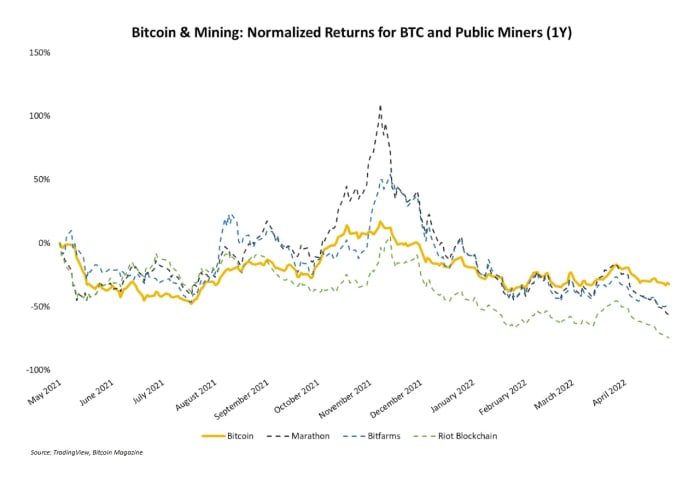

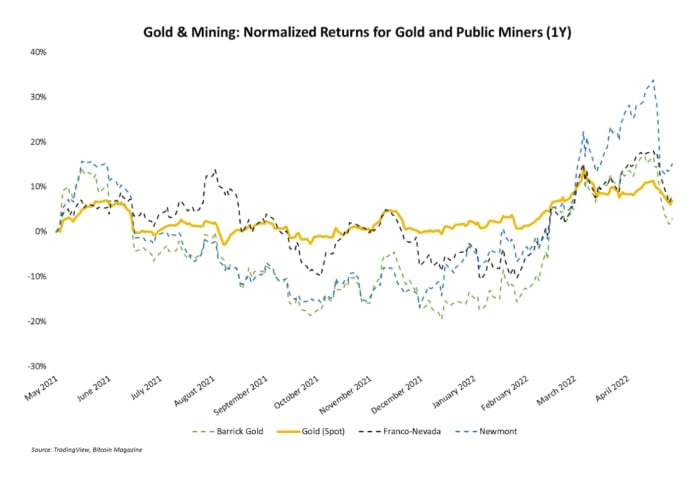

In train, the previous 12 months of market task possess highlighted some crucial idiosyncrasies and similarities between the yellow metal and its blockchain-essentially based mostly counterpart. Whereas bitcoin mining companies considerably outperformed gold miners various months within the past, the market trend has shifted to settle on gold. But will this dynamic final?

Overviewing among the most most in trend market data for bitcoin and gold miners is the aim for this article. Alongside the plot, the data will conceal special similarities and variations between the two industries exhibiting that, in many ways and despite relentless banter on Twitter, miners of gold and bitcoin possess more in frequent than is often assumed.

Mining Records Update

The whole charts on this share visualize assorted data units for the final public bitcoin and gold mining industries. The charts can even be unnecessary even though, on condition that die-hard gold advocate Peter Schiff has been awfully vocal about his current yellow metal lately.

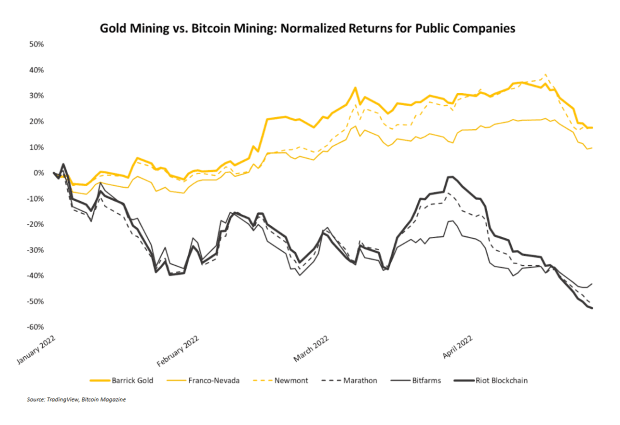

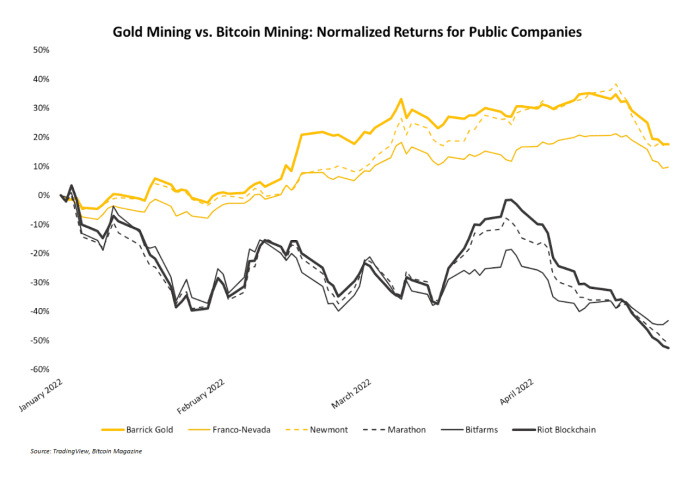

The normalized yr-to-date efficiency of some top gold companies compared to a couple of top bitcoin mining companies are almost replicate photos of every assorted. The road chart underneath reveals these two groups – gold and bitcoin companies – and their traits in 2022. Beneficial properties for public gold mining companies are within the double-digit percentages whereas trace movements for bitcoin miners are roughly the equal nonetheless within the unsuitable plot.

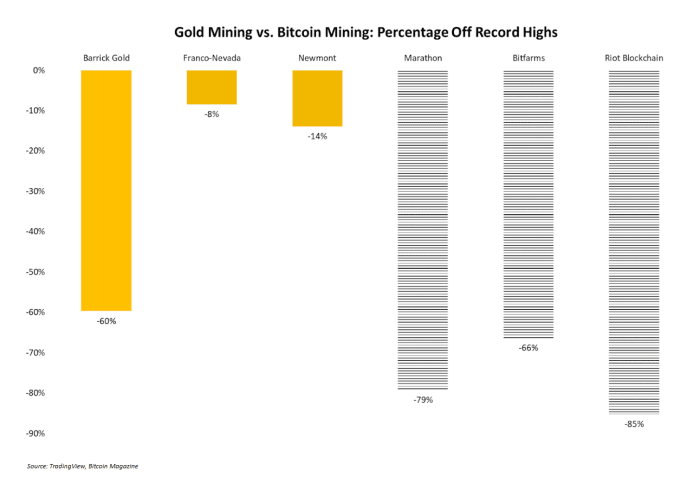

Comparing these companies in step with how a ways underneath their all-time trace highs also demonstrates the present relative strength of bodily gold compared to digital gold. The bar chart underneath reveals this data. Readers will glimpse Barrick Gold is aloof well underneath its excessive situation various years within the past despite the present total strength of the gold market. Bitcoin mining companies, by comparability, are sitting between 60-80% lower than their highs.

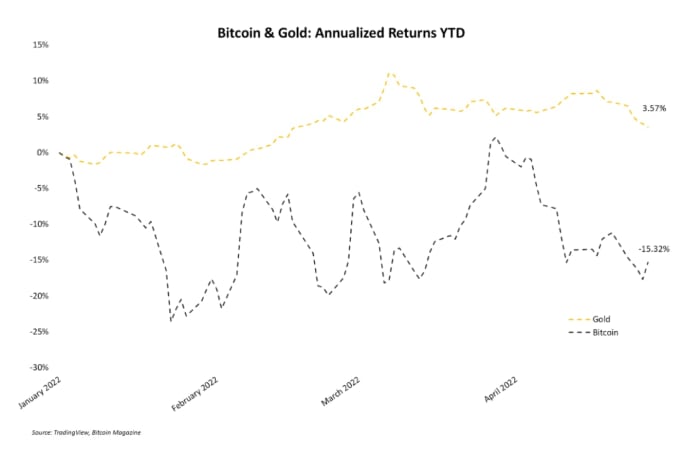

All this data tracks carefully with the returns for gold and bitcoin themselves, as one would rely on.

For Bitcoin, the starting up to 2022 has now now not been in particular energetic. The main cryptocurrency has largely traded in a ramification between $36,000 and $46,000, once in a whereas deviating from this advise for temporary classes. No longer surprisingly, this trace action has caused bitcoin’s market volatility to incessantly decline.

In the intervening time, gold has enjoyed a gorgeous stable start to the yr, incessantly trading higher since January. The chart underneath reveals yr-to-date returns for bitcoin and the yellow metal.

Measured in share drops from all-time highs, gold wins again. (Creep forward and laugh, Schiff.) On the time of writing, gold is roughly 6% off its anecdote excessive whereas digital gold is trading over 40% lower than its excessive point, reached in unhurried 2021.

Honey Badger Habits

Bitcoin being outperformed by a yellow metal isn’t the norm for the relationship between these two markets, nevertheless. For the length of 2021, as an example, bitcoin and its mining companies enjoyed a stable and prolonged uptrend in trace whereas gold and gold miners lagged considerably. Some charts shown in a while this article conceal this duration.

But for now, as bitcoin sits in a gorgeous puny trace vary and volatility drops, gold is taking heart stage. So, will it final?

Useless to screech, right here is an start demand for which predictive solutions are hard to present. In comparison with gold mining companies, bitcoin miners are a a ways newer and no more established or surroundings pleasant industry, that can possess stable results on their trace efficiency. With time, it’s cheap to rely on these nascent traits to be outgrown. Also, hedge funds which may be energetic within the gold market are reportedly increasing their bearish bets on the metal, which may also signal gold’s end to-term future.

Miners Can Be Chums

Placing apart the market data and trace comparisons for now, these two mining industries possess more in frequent than is in total acknowledged. Reward gold and bitcoin together within the equal tweet, and loads of innovation-versus-antiquity animosity is quite instinctively utilized as an undertone to whatever is written. But both assets signify asset classes most licensed by assorted faculties of political libertarians and financial freethinkers, although generational divides most frequently overshadow the two investor groups.

Gold and bitcoin miners both proceed experiencing the whole weight of environmental ire from non-earnings organizations, journalists, and politicians whose platforms and private producers require lambasting purportedly horrifying crimes against the climate. Although some bitcoin investors (including this author) fancy to once in a whereas plod fun at photos of gold mining websites compared to bitcoin mining farms on social media, reality is that both forms of miners are and seemingly repeatedly can be carefully disfavored by environmental groups.

One assorted powerful similarity is how both of these groups of companies replace compared to their underlying asset. Gold and bitcoin mining companies replace in public markets as successfully leveraged bets on whatever commodity the company mines. When either bitcoin or gold moves in a direction, publicly-traded mining companies for either asset agree to scramble well with nonetheless with more exaggerated moves up and down.

The chart underneath visualizes 12 months of normalized trace action for bitcoin and a few mining companies included in charts shown earlier on this article. It’s easy to glimpse when bitcoin moves up or down how mining inventory costs agree to with higher share moves.

This relationship is even more pronounced within the equal chart constructure for gold and gold miners. Over the equal duration (previous 12 months), classes where gold traded lower had been followed by even higher downward moves by gold companies. The replacement is upright for gold’s most in trend few months of bullish trace action.

Conclusion

Bitcoin and bitcoin mining companies underperforming gold as they wish to start 2022 is anomalous nonetheless now now not unexplainable. Gold bugs can possess their laughs for now, nonetheless the honey badger is handiest sound asleep. And although social media banter most frequently pits these two assets and their investors against every assorted, gold and bitcoin miners possess more in frequent than is often known. Each forms of miners are, in many ways, more so brothers-in-hands than enemy opponents. Especially on environmental factors, although digital gold replaces a distinguished part of the yellow metal’s market, both forms of mining share a frequent bond in being brutalized by woke environmentalists. Despite all the issues, for now gold can expertise its second to outshine bitcoin because at final digital gold can be attend within the motive force’s seat.

Here’s a customer put up by Zack Voell. Opinions expressed are completely their very beget and enact now now not necessarily think those of BTC Inc or Bitcoin Journal.