Investment bank Goldman Sachs lately held two roundtable classes for chief investment officers of hedge funds. The bank found that they behold bitcoin as their least popular investment. In incompatibility, the most contemporary Financial institution of America Fund Manager Survey found that “lengthy bitcoin” used to be essentially the most crowded alternate.

CIOs Model Their Most and Least Popular Investments

Goldman Sachs printed a cover Saturday after conducting a look to discover what investments chief investment officers (CIOs) decide on within the most contemporary market. Goldman Sachs strategist Timothy Moe wrote:

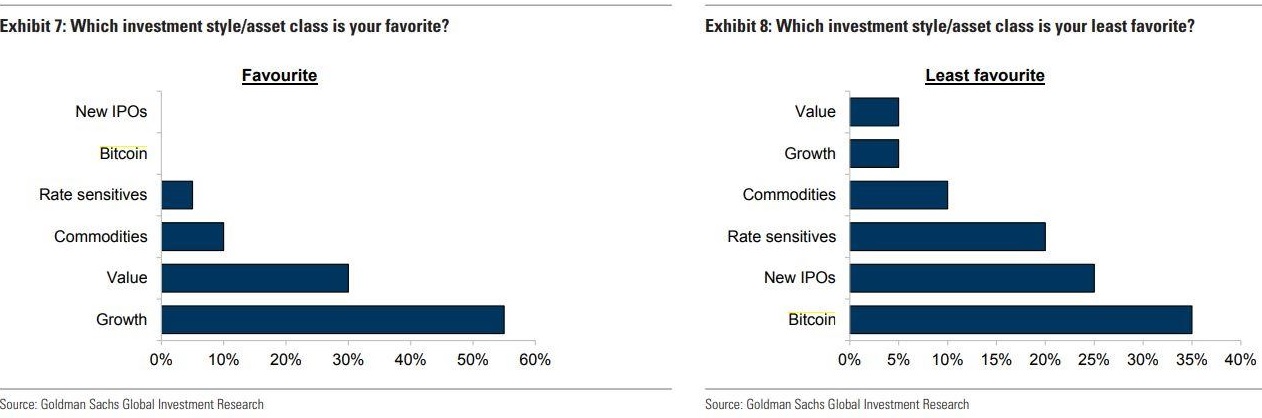

We held two CIO roundtable classes earlier this week, which were attended by 25 CIOs from various lengthy-finest and hedge funds. Their most popular is improve type nonetheless least popular on bitcoin.

Apart from improve type, the CIOs liked mark type after which commodities. Their least popular investment used to be bitcoin, adopted by original IPOs, and payment-soundless investments.

No longer like Goldman Sachs, Financial institution of America (BofA) found that bitcoin used to be a most traditional alternate among asset managers it surveyed. The bank’s Fund Manager Survey for Would possibly maybe, by which 216 fund managers with $625 billion in total property below administration (AUM) participated, confirmed that “lengthy bitcoin” used to be essentially the most crowded alternate within the sector. In the old month, lengthy bitcoin used to be the 2nd-most crowded alternate.

No longer like the surveyed CIOs, Goldman Sachs’ analysts are rather bullish on the outlook of bitcoin. They lately said that terror of missing out (FOMO) is riding institutional investors to the cryptocurrency. Moreover, the bank lately declared bitcoin an investable asset and a original asset class.

Goldman Sachs has also established a cryptocurrency purchasing and selling desk with the aim to present a elephantine spectrum of crypto investments. The company said that institutional quiz for BTC continues to grow significantly.