Key Takeaways

- Grayscale’s flagship product GBTC has registered a anecdote slash fee.

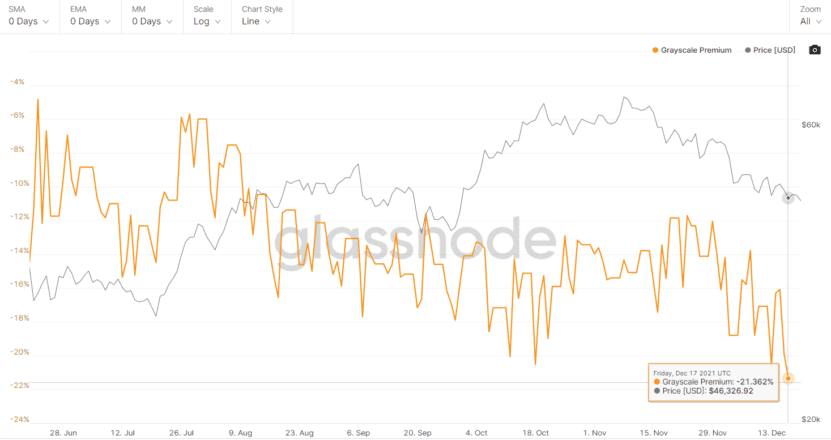

- Within the raze week’s end, the worth of 1 GBTC allotment turned into $34.42, which is 21.3% decrease than its underlying notice.

- The increasing slash fee on GBTC would possibly well possibly well ticket at weakening institutional ardour in the asset class.

As of closing week’s closing notice, Grayscale’s GBTC traded at a 21.3% slash fee to its underlying notice.

GBTC Hits Story Cleave fee

Grayscale’s flagship product has registered a anecdote slash fee.

GBTC’s closing recorded notice is 21.3% decrease than the underlying notice of Bitcoin held in opposition to it. Essentially based totally on Grayscale info, as of Dec. 17, 2021, the worth of 1 GBTC allotment turned into $34.42, whereas its earn asset notice turned into 0.00093 BTC, the identical of roughly $43.77. GBTC previously traded at a slash fee of over 20% in Would possibly possibly per chance, however the 21.3% markdown is a anecdote low.

Grayscale’s GBTC product lets merchants build exposure to Bitcoin through a non-public belief fund. Launched in September 2013, it holds $30.3 billion in resources below administration and factors regulated shares monitoring Bitcoin’s notice.

On account of the formula GBTC is structured, its shares on the entire substitute at a top fee or slash fee. On the assorted hand, the present slash fee of 21.3% is the biggest in GBTC’s eight-year history. The discrepancy in the underlying notice and market notice of GBTC is a significant indicator of institutional sentiment surrounding the end crypto asset.

The increasing slash fee on GBTC would possibly well possibly well per chance potentially ticket at weakening institutional ardour in the asset class. The anecdote low comes as Bitcoin has struggled to relief strength available in the market. It’s in the indicate time shopping and selling at roughly $46,000, down roughly 33% from its Nov. 10 all-time high notice of $69,044.

While GBTC has prolonged been a extreme investment car in the crypto home, the product has rather a lot of drawbacks, along side a six-month lockup duration and an annual administration fee of two%. Some no longer too prolonged in the past-launched Bitcoin futures ETF products offer institutional merchants opportunities to make investments with out going through a lockup duration at a smaller fee. As an instance, ProShares, which no longer too prolonged in the past launched the most principal Bitcoin futures ETF in the U.S., charges a fee of finest 0.95% yearly.

Within the face of accelerating competition from ETFs, Grayscale has applied to severely change GBTC to a station ETF with the Securities and Substitute Price. Grayscale is hoping that by titillating to an ETF product, it would possibly well possibly most likely well per chance be in a express to give greater pricing by removing the discrepancies seen between GBTC and Bitcoin’s station notice.

If authorized, Grayscale’s proposed fund would possibly well possibly well per chance change into the most principal station Bitcoin ETF to hit the U.S. stock market. On the assorted hand, there’s an cheap likelihood that the SEC will block Grayscale from making the switch anytime quickly. SEC Chair Gary Gensler has talked about on a couple of times that the company is no longer in desire of a station Bitcoin ETF product.

Disclosure: At the time of writing, the author of this portion owned ETH and other cryptocurrencies.

The solutions on or accessed through this online web page is bought from just sources we believe to be ethical and first fee, but Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any info on or accessed through this online web page. Decentral Media, Inc. is no longer an investment manual. We attain no longer give personalized investment advice or other monetary advice. The solutions on this online web page is discipline to substitute with out peek. Some or all of the records on this online web page would possibly well possibly well change into older-long-established, or it is going to be or change into incomplete or wrong. We would possibly well possibly well, but usually are no longer obligated to, update any old-long-established, incomplete, or wrong info.

That you just can well aloof never make an investment decision on an ICO, IEO, or other investment in step with the records on this online web page, and you’d aloof never elaborate or in another case rely on any of the records on this online web page as investment advice. We strongly imply that you consult an authorized investment manual or other qualified monetary legit whereas you are in quest of investment advice on an ICO, IEO, or other investment. We attain no longer accept compensation in any assemble for analyzing or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

Place a question to stout terms and prerequisites.

Grayscale Confirms It Will Observe for Bitcoin ETF

Grayscale will quickly apply to flip GBTC into an ETF. Largest Bitcoin Fund Operator Plans ETF Grayscale Investments has confirmed that it intends to use to severely change its Bitcoin belief…

Grayscale Strikes Help In opposition to SEC’s ETF Rejections

Grayscale has despatched a letter to the SEC expressing opposition to the regulator’s repeated rejection of Bitcoin station ETFs. Grayscale Notes Attach and Futures Discrimination Over the previous rather a lot of months,…

Grayscale Has Launched a Solana Belief

The enviornment’s most attention-grabbing digital asset administration company, Grayscale, has announced the initiating of the Grayscale Solana Belief, a brand sleek single-asset investment product offering institutional and high-earn-worth folk indirect exposure to…

Target market Be taught: Desire A $360 Subscription To Respectable BTC Vendor

We’re doing this because we wish to be greater at picking advertisers for Cryptobriefing.com and explaining to them, “Who’re our web page online visitors? What attain they care about?” Resolution our questions…