Digital Foreign money Employees’s flagship Grayscale Bitcoin Have confidence is buying and selling at about 16.52% below the Bitcoin role tag, marking the largest bargain since Bitcoin’s Would maybe maybe simply tag decline.

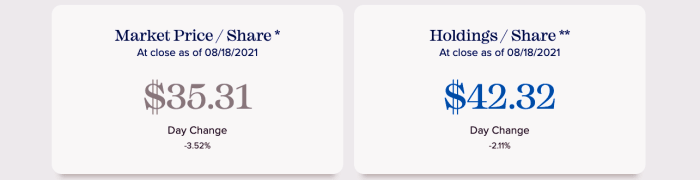

The Grayscale Bitcoin Have confidence currently affords exposure to 0.000938223 BTC per part, an quantity that trades for spherical $42.32 at market shut on August 18. Via shares of GBTC, nonetheless, that linked quantity of Bitcoin trades at $35.31, a 16.52% detrimental unfold between GBTC’s top rate and underlying gain asset worth at time of writing.

Since Would maybe maybe simply, Bitcoin has recovered up to $44,300 on the time of writing, while Grayscale has been slower to bewitch up. On account of the six-month lock-up of initial GBTC investments, GBTC holders are unable for some time to redeem their shares in reaction to the bitcoin market tag. Thus, the product tends to commerce at either a top rate or a bargain when when put next with the Bitcoin held internal.

The constructing of a GBTC bargain disrupts the liked raise commerce of redeeming Grayscale shares when they hit a top rate and shorting Bitcoin futures. This became a slightly anguish-free technique when GBTC became buying and selling at a top rate.

Now, with a detrimental top rate, the incentive to redeem GBTC shares is long gone.

For the time being, GBTC shares at a bargain are an orderly solution and automobile for outdated merchants, or these who wish to get Bitcoin tag exposure via their retirement portfolio. The educational curve for buying for Bitcoin outright can seem daunting to about a, and GBTC has the added earnings of a sixth month forced hodl before shares might maybe likely maybe be redeemed.

Grayscale Bitcoin currently has $29.3 billion in resources below management.