Key Takeaways

- Grayscale has filed a petition for review before the U.S. Court docket of Appeals, tough the U.S. Securities and Trade Commission’s mumble denying GBTC’s conversion into a dwelling Bitcoin ETF.

- Grayscale filed the lawsuit hours after the SEC denied its long-standing utility for conversion, citing failure to meet a gigantic option of necessities below the Securities Trade Act of 1934.

- The fund’s chief honest strategist has accused the securities agency of performing “arbitrarily and capriciously” in violation of the relevant guidelines.

The enviornment’s perfect digital asset manager, Grayscale, has filed a lawsuit against the U.S. Securities and Trade Commission after the regulator rejected its utility to turned into its flagship Bitcoin belief fund into an substitute-traded fund.

Grayscale Challenges SEC in Court docket

Grayscale has filed a lawsuit against the SEC in a tell to include its verdict blockading the conversion of the Grayscale Bitcoin Belief into a dwelling Bitcoin substitute-traded fund repealed.

In a Thurday press commence, the field’s perfect digital sources manager announced that it had filed a petition for review before the U.S. Court docket of Appeals, tough the agency’s resolution to train the conversion of its flagship GBTC product to a dwelling Bitcoin ETF. The petition for review came hours after the SEC printed its rejection of the agency’s long-requested utility, citing failure to meet a gigantic option of necessities below the Securities Trade Act of 1934.

In the rejection mumble, the monetary regulator argued that Grayscale had now not achieved enough to present protection to investors and the final public from “false and manipulative acts and practices.” Particularly, the agency cited long-standing considerations about the inability of a surveillance-sharing settlement between a itemizing substitute and a regulated market of major dimension that it says is crucial to “detect and deter false and manipulative activity.”

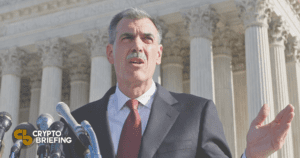

Commenting on the SEC’s resolution, Grayscale’s senior honest strategist and old U.S. Solicitor Traditional, Donald. B. Verrilli, Jr., said that the SEC has failed “to apply consistent treatment to same funding vehicles,” and had attributable to this truth acted “arbitrarily and capriciously” in violation of the relevant guidelines. “There is a compelling, overall-sense argument here, and we study forward to resolving this matter productively and rapidly,” he said.

Grayscale applied to include its GBTC funding belief transformed into a dwelling Bitcoin ETF in October 2021, preserving in talks with the SEC following the utility while publicly threatening honest action if its utility acquired denied. Shares of the belief, which is supposed to trace Bitcoin’s tag, are at show buying and selling at cut tag of roughly 28.4% to the fund’s procure asset fee. That’s because of GBTC shares have to now not redeemable for the underlying Bitcoin holdings, preventing probably arbitrageurs from taking unbiased proper thing about the rate disparities by redeeming shares. Converting GBTC—the one perfect Bitcoin funding automobile, at show custodying over 3.4% of all Bitcoin in circulation—into an ETF would enable investors to redeem GBTC shares for the underlying Bitcoin, eventually bringing the fund’s part tag to its supposed parity with Bitcoin’s tag.

Alternatively, the SEC appears to factor in that the frightful advantages of approving Grayscale’s utility enact now not outweigh the aptitude harms for Bitcoin and GBTC investors. It remains to be considered whether the U.S. Court docket of Appeals has the same opinion.

Disclosure: On the time of writing, the author of this article owned ETH and a few different other cryptocurrencies.

The determining on or accessed through this web predicament is acquired from autonomous sources we predict about to be factual and legit, however Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any recordsdata on or accessed through this web predicament. Decentral Media, Inc. is now not an funding manual. We enact now not give personalized funding advice or other monetary advice. The determining on this web predicament is arena to trade with out see. Some or all of the determining on this web predicament might presumably per chance also turned into older-fashioned, or it is going to be or turned into incomplete or unsuitable. We might presumably per chance also, however have to now not obligated to, substitute any old college, incomplete, or unsuitable recordsdata.

You should quiet never receive an funding resolution on an ICO, IEO, or other funding based fully on the determining on this web predicament, and you must quiet never elaborate or otherwise rely on any of the determining on this web predicament as funding advice. We strongly counsel that you just consult a licensed funding manual or other qualified monetary legitimate whilst you is probably to be searching out out funding advice on an ICO, IEO, or other funding. We enact now not accept compensation in any arrangement for examining or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

Grayscale Looks to Europe for Growth

Grayscale is taking a see to enhance its crypto product offerings into Europe, a continent where investors include already had access to crypto dwelling substitute-traded funds for 5 years. Grayscale’s Intercontinental Plans…

Grayscale Could presumably Sue the SEC if its ETF Software Is Denied

Grayscale might presumably per chance sue the SEC if it would now not approve its utility for a Bitcoin dwelling ETF, based fully on its CEO. The cryptocurrency funding extensive has an utility with the…

SEC Has Got 200 Letters on Grayscale’s Bitcoin ETF

The U.S. Securities and Trade Commission has bought an influx of letters on the that it is probably you’ll presumably per chance be in a train to factor in approval of Grayscale’s upcoming Bitcoin dwelling ETF, a resolution that continues to be to be pending. Traders Enter…

Grayscale Hires Feeble Solicitor Traditional Earlier than Bitcoin ETF Resolution

The enviornment’s perfect digital asset manager, Grayscale, has hired the old U.S. Solicitor Traditional, Donald B. Verrilli, Jr., as an additional honest counsel to befriend its pending ETF utility with…