The fund’s returns are in step with staking rewards paid quarterly and are most sharp accessible for shoppers with over $1 million in AUM.

Asset supervisor Grayscale announced on Mar. 29 the “Grayscale Dynamic Income Fund” (GDIF), its new staking-centered fund for qualified shoppers. Consistent with the company’s X submit, the fund “seeks to optimize profits within the originate of staking rewards associated with proof-of-stake digital resources.”

The GDIF decent page explains how Grayscale allocates shoppers’ funds to different proof-of-stake tokens, stakes them, and cashes the rewards weekly. The earnings are disbursed to shoppers quarterly, as does the rebalancing of the fund’s portfolio.

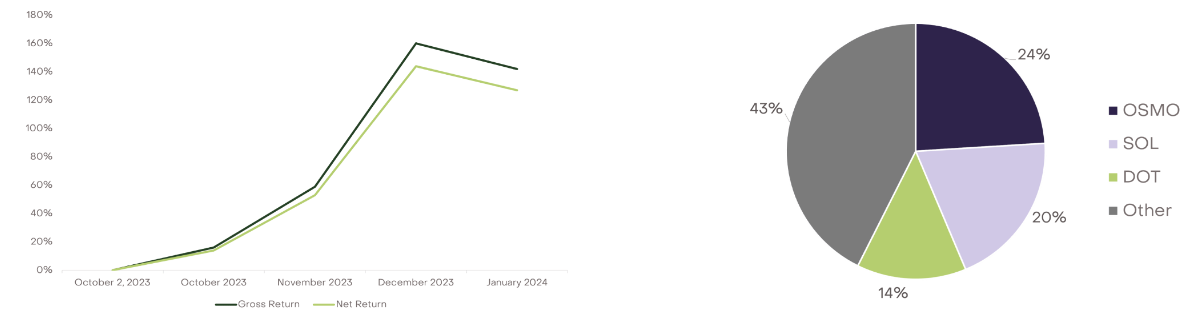

OSMO, the native token of Cosmos-based mostly fully mostly appchain Osmosis, represents 24% of the GDIF portfolio and its staking provides a median yield at a 12.7% annual share payment (APR). Solana (SOL) and Polkadot (DOT) are also two critical resources within the funds’ composition, with 20% and 14% shares respectively.

Furthermore, Grayscale states that the fund showed a gather return of over 140% from October 2023 to January, which contrivance charges and charges were already deducted. On the opposite hand, the fund is proscribed to shoppers with resources under administration of $1,1 million or a gather price of $2,2 million.

The data on or accessed by contrivance of this web site is obtained from independent sources we assume to be appropriate and authentic, nonetheless Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any data on or accessed by contrivance of this web site. Decentral Media, Inc. is no longer an funding advisor. We attain no longer give customized funding recommendation or different monetary recommendation. The data on this web site is subject to alternate without seek. Some or all the strategies on this web site would per chance well additionally turn out to be out of date, or it’ll be or turn out to be incomplete or inaccurate. We would per chance well additionally, nonetheless are no longer obligated to, change any out of date, incomplete, or inaccurate data.

Crypto Briefing would per chance well additionally boost articles with AI-generated relate material created by Crypto Briefing’s comprise proprietary AI platform. We utilize AI as a tool to raise hasty, precious and actionable data without losing the insight – and oversight – of experienced crypto natives. All AI augmented relate material is fastidiously reviewed, in conjunction with for factural accuracy, by our editors and writers, and continually attracts from extra than one predominant and secondary sources when accessible to contrivance our tales and articles.

It is advisable to to aloof by no contrivance assemble an funding option on an ICO, IEO, or different funding in step with the strategies on this web site, and you need to aloof by no contrivance account for or in every other case rely on any of the strategies on this web site as funding recommendation. We strongly counsel that you just consult a licensed funding advisor or different qualified monetary skilled whenever you is liable to be in search of funding recommendation on an ICO, IEO, or different funding. We attain no longer gather compensation in any originate for inspecting or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.