All by this bull cycle, the crypto market has been surfing off Bitcoin’s crest and taking half in the bullish momentum. Nonetheless, investors hope for a seismic explosion to impulse Altcoins to unusual highs.

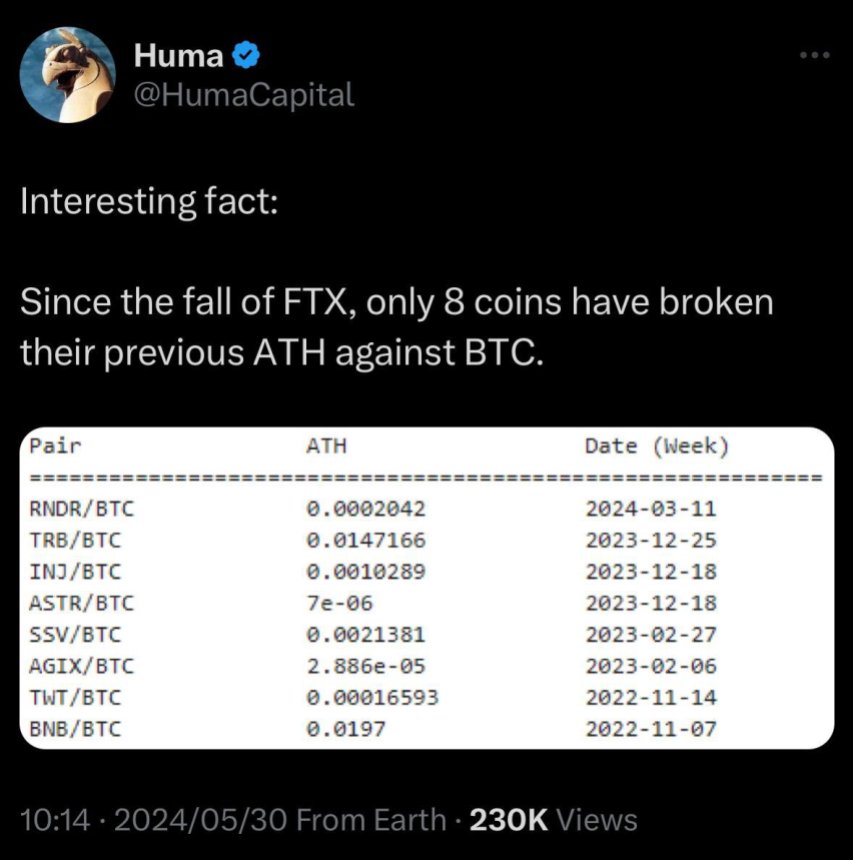

As the crypto industry awaits, on-line stories revealed that, since FTX’s tumble, only eight altcoins savor hit a peculiar all-time high (ATH) against Bitcoin. A crypto analyst shared his strategies on the matter.

Altcoins Underperforming Against Bitcoin This Cycle

On Friday, Crypto analyst Miles Deutscher shared a intelligent fact about the crypto market. Since November 2022, appropriate eight altcoins savor broken their outdated ATH against the flagship cryptocurrency.

To originate this feat, tokens include Render (RNDR), Tellor (TRB), Injective (INJ), Astar (ASTR), SSV Community (SSV), SingularityNET (AGIX), Correct Wallet Token (TWT), and Binance Coin (BNB).

It’s worth noting that RNDR turn into essentially the most fashionable one to attract this on March 11 and that the listing only comprises altcoins launched earlier than FTX’s fall down.

Deutscher defined that despite his initial shock, the news made sense to him and highlighted some takeaways in step with the singularities of this flee.

First, the analyst considers that asset different dynamics changed from outdated cycles. Traders had been “punished” for being overexposed to decided sectors like L2 and gaming and “rewarded” for taking part in others like Memecoins and AI.

In distinction, in the closing cycle, “it’s most likely you’ll maybe well generally guess on the leisure and beat $BTC.” In response to the analyst, the market will seemingly continue experiencing boom sector outperformance despite the retail liquidity injection.

He also defined that “crypto is an consideration economic system,” and money will drift the build consideration is. Which means that, even the initiatives with essentially the most appealing know-how gained’t draw if there isn’t an thrilling motive to purchase.

Deutscher’s second takeaway highlights the market’s unusual ATH dilution. As he aspects out, thousands of unusual merchandise are being launched day after day, and “low drift/high FDV VC coins are launching in the billions.” These launches are apparently outpacing the unusual liquidity, resulting in Altcoins struggling with efficiency.

Extra Room To Net Up

The analyst’s third point explains that the bull flee has been led by Bitcoin and situation BTC trade-traded funds (ETH). In response to this, he considers it unsurprising that altcoins savor “now now not steadily pumped” so some distance.

A range of crypto analysts and consultants portion this thought. Alex Krüger beforehand stated that the cycle has been “nearly entirely” driven by the Bitcoin ETFs’ momentum.

Deutscher sees Altcoins’ underperformance as a bullish signal since Bitcoin’s dominance has been instrumental in outdated cycles. To him, this efficiency permits “extra space to play gain up” and can power altcoins to unseen highs.

The analyst believes the market needs every other catalyst for a appropriate Altcoins season. No matter this, he highlights that many investors savor had a story Q1 “even in mildly bullish prerequisites for a lot of alts.”

In the discontinuance, Deutscher considers there is aloof room to invent substantial earnings this cycle “even without the face-melting altseason we all crave.”

Featured List from Unsplash.com, Chart from TradingView.com

Disclaimer: The guidelines stumbled on on NewsBTC is for tutorial purposes

only. It would now not symbolize the opinions of NewsBTC on whether to purchase, promote or retain any

investments and naturally investing carries dangers. You have to well well maybe even be told to habits your own

study earlier than making any funding decisions. Employ knowledge offered on this web situation

entirely at your own hassle.