This week could model a pivotal second within the first quarter of 2024 for your total crypto market and the two biggest cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), as main central banks, led by the Financial institution of Japan and the US Federal Reserve (Fed), put collectively to impart their passion rate selections.

In step with crypto futures trade Blofin, these announcements will procedure the tone for financial policy within the arrival months. The affect of steady-haven sentiment has ended in a pullback in each and every BTC and ETH costs, with merchants expressing elevated optimism for BTC.

Bitcoin Price Meander Differ Projected At 9.78%

As per a most modern on-chain prognosis document launched by the trade, crypto merchants are expecting BTC’s tag motion differ to reach 9.78% over the next seven days, with a projected 30-day differ of 20.33%.

On the opposite hand, whatever the expected volatility, the document indicates that merchants live bullish on BTC within the medium to very long timeframe.

Skewness prognosis means that tag declines and pullbacks are expected to induce volatility, however the duration of this round of pullback is anticipated to be pretty immediate. Possibility aversion to macro uncertainty is viewed as the main procedure off.

The most modern dealers’ gamma distribution helps the expected sizable change of BTC tag fluctuations, with gamma peaks round $65,000 and $75,000. With the quarterly settlement drawing approach, market makers’ have an effect on on BTC tag motion is step by step getting greater, offering reinforce during tag drops however making it anxious to surpass the $75,000 stage.

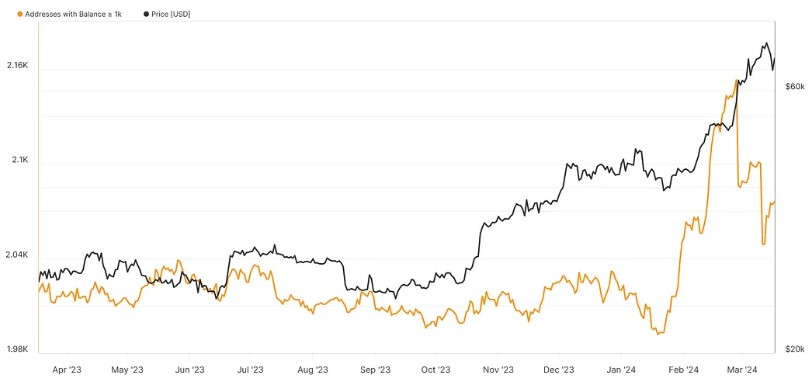

To boot to, on-chain knowledge reveals a decline in procedure investors’ enthusiasm for procuring for BTC, even supposing the quantity of addresses conserving more than 100 BTC continues to elongate, as viewed within the chart above. The reduced quantity of addresses conserving over 1,000 BTC means that indispensable holders occupy decided to promote at BTC’s original highs.

Despite caution over doable tag fluctuations, the hedging personal contributes to the rising possibility of BTC tag stabilization, making conserving BTC a favorable change.

Bearish Sentiment Dominates Front-Month Strategies For Ethereum

In step with the document, identical to BTC, merchants count on of pretty high volatility stages for ETH within the immediate timeframe, with projected tag motion ranges of 10% over seven days and 20.32% over 30 days. On the opposite hand, the document means that merchants are much less optimistic about ETH’s future efficiency when put next to Bitcoin.

Furthermore, Blofin finds that bearish sentiment dominates the entrance-month alternate strategies, whereas bullish sentiment stays favorable within the attend-months. Blofin emphasizes that expectations of rate cuts can also merely reinforce the ETH tag, however the pricing of Ethereum tail threat indicates “elevated pessimism” relating to indispensable events impacting the ETH tag, with procedure Ethereum ETFs viewed as a doable procedure off.

In the raze, Blofin explains that the high leverage of altcoins has long been a “supply of threat” within the cryptocurrency market. The most modern tag decline has ended in the liquidation of many extremely leveraged altcoin positions, resulting in decrease annualized funding charges for perpetual contracts.

This deleveraging of altcoins, coupled with their pretty slight market portion of decrease than 20%, has helped to mitigate threat and make contributions to market steadiness, essentially essentially based on the document. On the opposite hand, whatever the general decline in altcoin leverage, hypothesis in meme cash continues.

Currently, the worth of Bitcoin stands at $62,500, reflecting a indispensable decline of seven.5% contained within the closing 24 hours. Equally, Ethereum is procuring and selling at $3,276, experiencing a 6.8% plunge during the identical duration.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is equipped for instructional functions most productive. It does no longer signify the opinions of NewsBTC on whether to buy, promote or relief any investments and naturally investing carries risks. You have to be suggested to conduct your have research earlier than making any investment selections. Use data offered on this online page online fully at your have threat.