- Hodlnaut Overview: Fleet Summary

- The Hodlnaut Team

- Hodlnaut Overview and Passion Charges: How Does Hodlnaut Compare?

- How Did Hodlnaut Accomplish Money?

- Hodlnaut’s Platform Security

- Hodlnaut Overview Closing Thoughts: How Did Hodlnaut Fail?

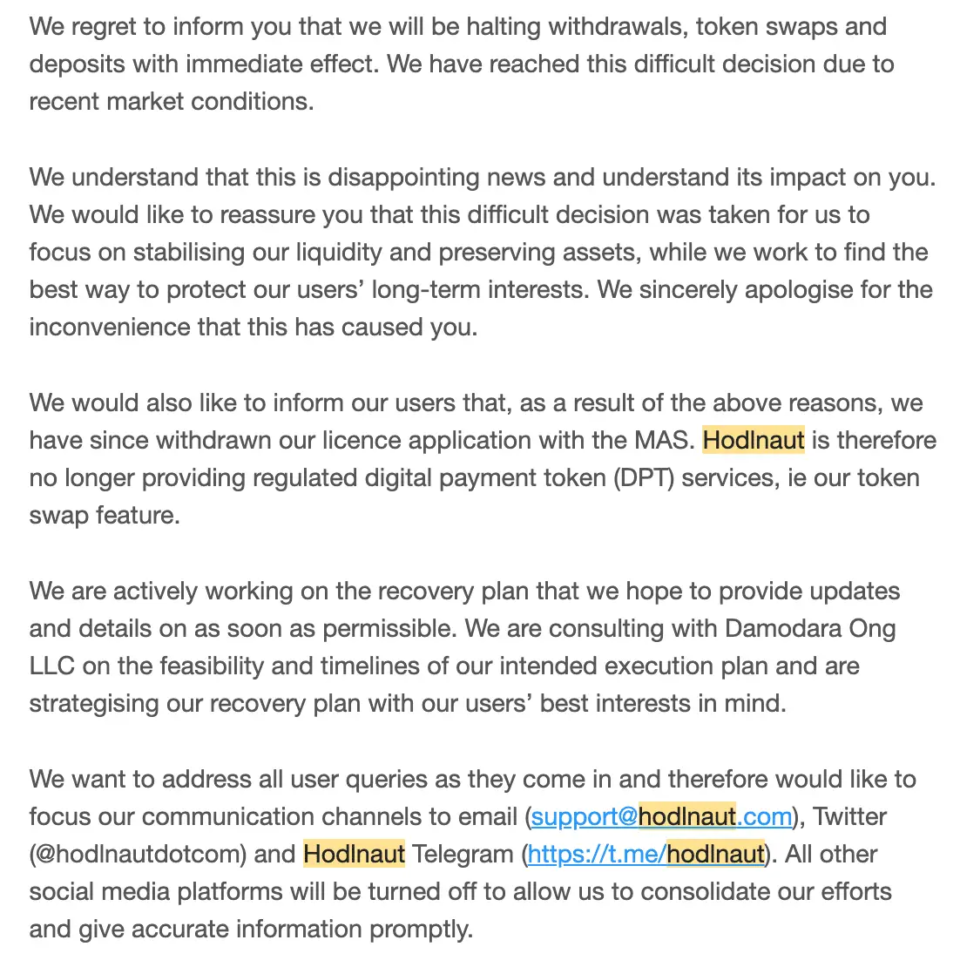

Hodlnaut used to be a Singapore-essentially essentially based cryptocurrency hobby myth firm that supplied compound hobby of 10% for stablecoin resources and 6% for Bitcoin. On August eighth, 2022, Hodlnaut suspended all withdrawals, token swaps, and deposits– making it one amongst a series of mid to huge-sized CeFi “crypto hobby myth” platforms suspending withdrawals and submitting for financial extinguish, resembling Celsius and Voyager.

The following Hodlnaut evaluation examines its hobby myth product, security practices, usability, and neighborhood belief.

Hodlnaut Overview: Fleet Summary

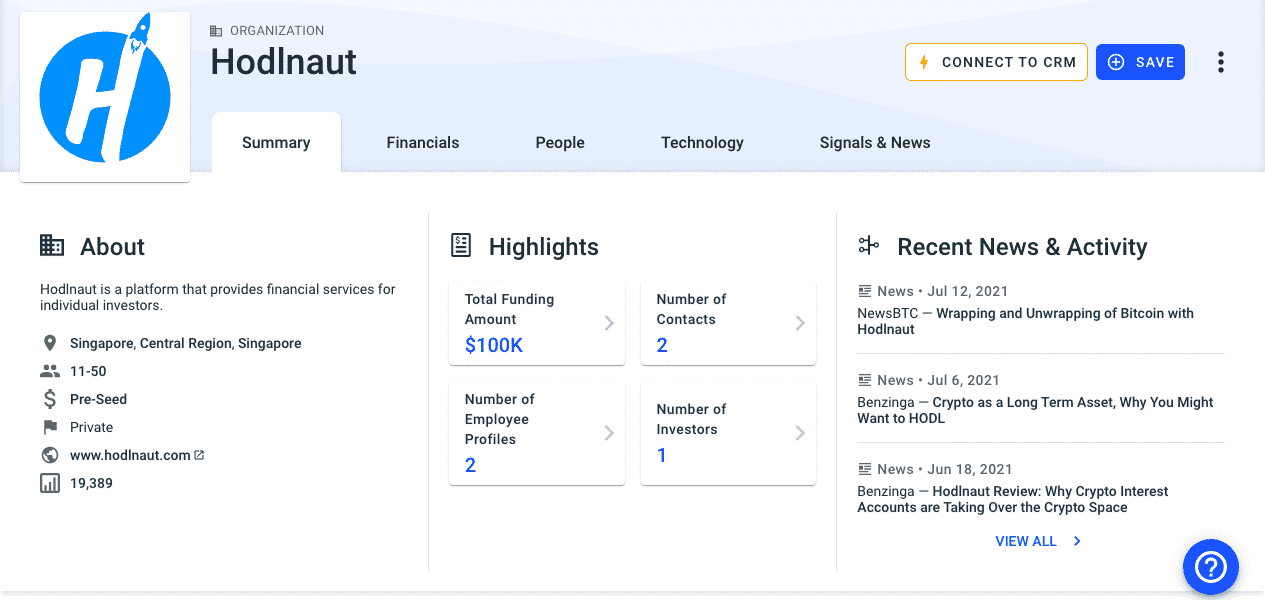

Hodlnaut used to be a Singapore-essentially essentially based firm essentially based in 2019., on hand worldwide, excluding areas prohibited by Hodlnaut Protection or Sanction Criminal guidelines.

Hodlnaut derived its identify from the crypto slang HODL (Withhold On for Dear Life), which is an engaging expression that refers to maintaining your digital resources in preference to selling them, despite the volatility of the market. Satirically, Hodlnaut ended up HODLing their potentialities’ resources in opposition to their will.

The latter section of the firm identify is within the motif of “astronaut.” The platform amassed about $250M in resources under its administration from over 5,000 users, in step with its put. Hodlnaut raised about $100,000 in funding from one pre-seed funding round with Antler, a Singaporean startup accelerator and mission capitalist company.

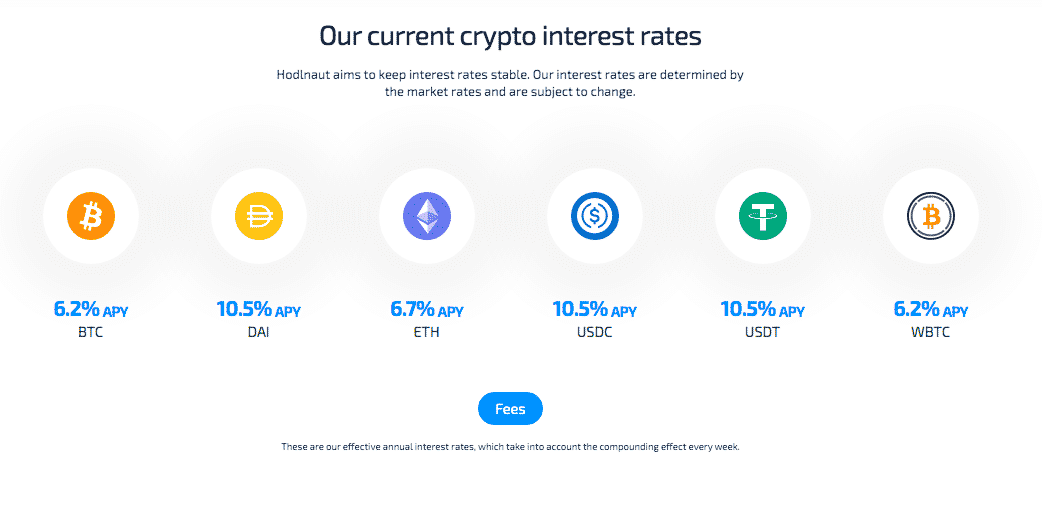

There is no minimal steadiness to qualify for crypto hobby. Hodlnaut offers:

- 6.2% APY on BTC

- 6.7% APY on ETH

- 10.5% APY on stablecoins.

Hodlnaut’s Token Swap let users alternate tokens without prolong within the app e.g, BTC to ETH

Deposits are free, and users can withdraw anytime– sooner than the freezing of all withdrawals.

The Hodlnaut Team

Hodlnaut used to be essentially based by CEO Juntao Zhu and CTO Simon Lee. The duo previously essentially based Cypher Forge, a cryptocurrency alternate execution platform.

Zhu spent over three years as an analyst and developer with the Swiss wealth administration company Credit score Suisse.

Lee spent over three years in engineering administration roles. The two founders preserve a combined 9 years of experience in application building, finance, and engineering.

Hodlnaut Overview and Passion Charges: How Does Hodlnaut Compare?

Hodlnaut supported six cryptocurrencies: BTC, ETH, DAI, USDC, USDT, and WBTC, offering between 6.2% and 10.5% APY.

How Did Hodlnaut Accomplish Money?

Admire most other crypto hobby accounts claimed to preserve out, Hodlnaut extinct your resources as collateral to provide loans to corporate collectors, making revenue the variation between the hobby it’s going to pay users and what it charges to provide loans to its institutional borrowers.

“We own extremely stringent capital necessities barely than our counterparties,” commented Zhu, in 2021. “In any case, we’re very selective with whom we lend to. We greatest lend to corporate entities with devoted credit score ratings, and we can test this with them all the intention via the onboarding direction of. The mortgage-to-cost (LTV) Ratio of our loans is generally 70% or decrease.”

The crew illustrious the platform also made money by earning hobby from lending its resources to decentralized protocols.

Within the lend a hand of the scenes, Hodlnaut had converted $317 million of particular person funds (nearly every thing) into UST to originate a 20% APY on Anchor Protocol, a dApp on the Terra blockchain.

Hodlnaut took a severe hit when UST, the algorithmic stablecoin began to fail in declaring its 1:1 peg in May presumably 2022 and misplaced a majority of its cost. It did not suppose to its users its involvement and allowed users to continue to deposit and withdraw as frequent. On July 14th, the Singapore Police Power demanded the the relaxation of the resources be transferred to them, which also used to be no longer communicated to its users.

On August eighth, 2022, Hodlnaut suspended all withdrawals citing “most up-to-date market instances,” also revealing on a blog post it owed about $281 million and greatest had $88 million remaining.

Hodlnaut is presently in financial extinguish lawsuits.

Hodlnaut’s Platform Security

The platform required users to enviornment up 2FA sooner than they’ll originate a withdrawal, which helps wait on accounts safe and kill unauthorized withdrawals. Hodlnaut extinct industry-long-established encryption and other security regulations to make certain that resources and data on its platform are safe.

Hodlnaut has by no intention been hacked, and its losses were due essentially to unhappy option-making and horrible risk administration by its owners.

Hodlnaut’s well-known custodian used to be Fireblocks, a digital asset custody resolution that employs a technique of how to be obvious the safety of resources. Fireblocks holds resources in a mix of offline chilly storage and insured sizzling wallets; all particular person deposits are by no intention within the identical enviornment without prolong.

Hodlnaut gave the option of shopping insurance on your crypto via a partnership with European firm Nexus Mutual, which paid out appropriate about $1 million out of an estimated $193 million shortfall. The Nexus blog post specifies, “members who safe their deposit with Custody Conceal from Nexus Mutual got the first-ever on-chain payouts for a custodial loss match.”

The Hodlnaut insurance with Nexus stood at $22 million.

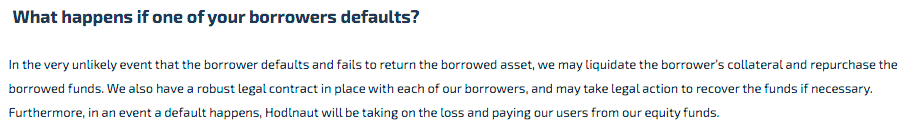

Hodlnaut outlined its procedures within the case of a borrower default.

Hodlnaut used to be licensed by the Singapore Fintech Affiliation, which is identified by the Monetary Authority of Singapore

Hodlnaut Overview Closing Thoughts: How Did Hodlnaut Fail?

Hodlnaut supplied a aggressive product in an an increasing selection of aggressive industry, but in preference to producing its charges from cryptocurrency lending, as it had specified, it plunged a majority of its potentialities’ funds into an algorithmically traded stablecoin. When Terra collapsed, so did any of Hodlnaut’s hopes of remaining solvent.

The give intention of UST also triggered a domino perform, wiping out billions of bucks of cost from the cryptocurrency industry.

Hodlnaut’s irresponsible risk administration has left hundreds of millions of its potentialities’ money in financial extinguish court docket, and it’s a tiny excerpt of 2022 crypto hobby myth disasters.

Never Fade over One other Different! Accumulate hand selected files & info from our Crypto Experts so you may maybe originate trained, knowledgeable choices that without prolong own an impress on your crypto profits. Subscribe to CoinCentral free newsletter now.