We’re going to continue our conversation of Bitcoin’s feature in humanitarianism, this time in the realm of non-public property rights. Nonetheless sooner than we focus on about that, now we want to imprint why personal property is so critical.

One amongst the indispensable drivers of commercial declare and better requirements of living is personal property rights.

That is the foundation that you bear the fruits of your labor to boot to the rest you snatch with the fruits of your labor. To illustrate this, let’s convey you’re working at a firm and also you put sufficient cash to use a vehicle. The cash you perform (which is the fruit of your labor) and the vehicle are each and every your property. The authorities has to guard your property from theft by other personal folks, and the authorities itself can no longer take your property without due cause and/or correct compensation.

Deepest property rights are critical as a result of they incentivize productiveness. Other persons are disincentivized to work if the cash they perform or the stuff they snatch might perchance perchance perchance perchance additionally additionally be confiscated all of a sudden or compensation.

And in a society where folks are disincentivized to work, there are fewer merchandise and products and companies readily available and no more innovation occurring. These three factors are the important thing drivers in bettering a discipline’s novel of living. Deepest property rights are the reason there are better automobiles yearly, better phones, computers and faster web.

Nonetheless, property rights don’t exist naturally. They’ll grasp to be enforced by a authorities that punishes folks for stealing other folks’s property to boot to no longer encroaching by itself citizen’s property. And, unfortunately, many countries spherical the sector develop no longer grasp a authorities that does this.

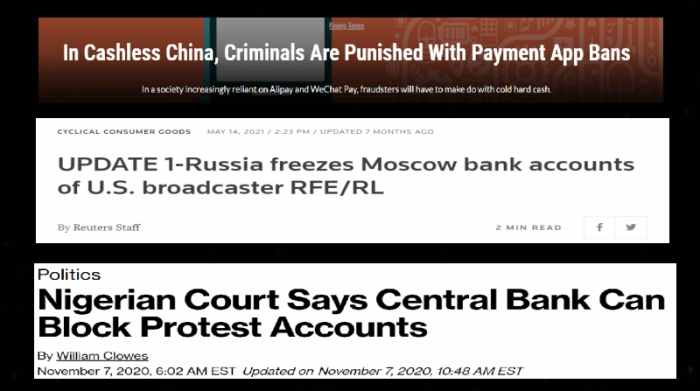

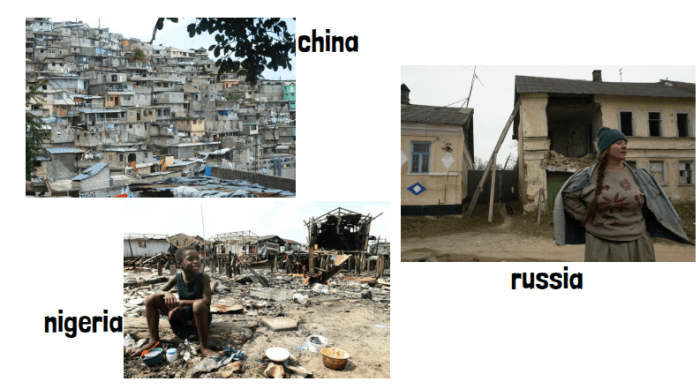

As an illustration, the Chinese language authorities will slash off folks from Alipay and WeChat Pay, current Chinese language fee methods, if they perform statements that go towards the contemporary authoritarian regime. Russia will freeze folks’s monetary institution accounts if they spread news that works towards the Kremlin and its interests. And in 2021, Nigeria iced up the monetary institution accounts of voters protesting towards the authorities.

The shortcoming of appreciate for personal property harms these countries’ voters and retains them in a worse train of living relative to other freer countries. It’s no longer a twist of fate that democratic countries are great wealthier than authoritarian countries.

How Does Bitcoin Give protection to Property Rights?

Bitcoin’s blockchain, by perform, makes it inconceivable for personal and public actors to take control of anyone else’s cash. The blockchain is proof towards theft and unitary control as a result of it is a decentralized system. The blockchain is spread across a community of computers, known as nodes, and to manipulate the blockchain, you might perchance perchance perchance presumably wish to manipulate no longer lower than 50% of the nodes in the community. That is a virtual impossibility as a result of the volume of energy and sources desired to manipulate 51% of the community will more than most likely be insurmountable by any functional measure this day. The blockchain has stood the test of time, in that 51% of it has but to stay below the control of a single actor, and as the selection of nodes grows, this becomes much less and no more prone to happen.

Electorate below an authoritarian authorities develop no longer wish to horror in regards to the authorities stealing their bitcoin, nor develop they wish to rely on inept failing governments to guard their property.

For millions of folks spherical the sector, bitcoin is their first likelihood to observe self-sovereignty over their bear cash. Their cash is below their control and they develop no longer wish to horror about anybody stealing it. Bitcoin helps them preserve the human correct to personal property.

That is a customer put up by Siby Suriyan. Opinions expressed are completely their bear and develop no longer basically replicate those of BTC Inc. or Bitcoin Journal.