The present divergence in U.S. Treasury yields, the put shorter-timeframe yields had been declining while longer-timeframe yields are on the upward thrust, has sparked critical curiosity all by monetary markets. This vogue supplies severe insights into macroeconomic prerequisites and ability suggestions for Bitcoin merchants navigating these uncertain instances.

We’ve these days seen a divergence in U.S. Treasury yields, with shorter-timeframe yields declining while longer-timeframe yields are rising. 🏦

What attain you think this signals for the federal government bond market, Bitcoin, and the broader monetary markets? 🤓

Let me know 👇 pic.twitter.com/eJmj6hhyKV

— Bitcoin Magazine Respectable (@BitcoinMagPro) January 27, 2025

Treasury Yield Dynamics

Treasury yields replicate the return merchants search data from to preserve U.S. government debt, and they are a severe barometer for the financial system and monetary policy expectations. Right here’s a snapshot of what’s occurring:

- Non everlasting yields falling: Declining yields on short-timeframe Treasury bonds, such because the 6-month yield, point out that markets are wanting forward to the Federal Reserve will pivot to price cuts in accordance with financial slowdown dangers or decrease inflation expectations.

- Lengthy-timeframe yields rising: Within the interim, rising yields on longer-timeframe bonds, cherish the 10-yr Treasury yield, point to growing concerns about persistent inflation, fiscal deficits, or greater-timeframe premiums required by merchants for conserving long-length debt.

This divergence in yields on the total hints at a spirited financial landscape and can inspire as a signal for merchants to recalibrate their portfolios.

Why Treasury Yields Matter for Bitcoin Investors

Bitcoin’s odd properties as a non-sovereign, decentralized asset invent it significantly sensitive to macroeconomic trends. The present yield setting may perchance presumably well perchance form Bitcoin’s account and efficiency in lots of how:

- Inflation Hedge Appeal:

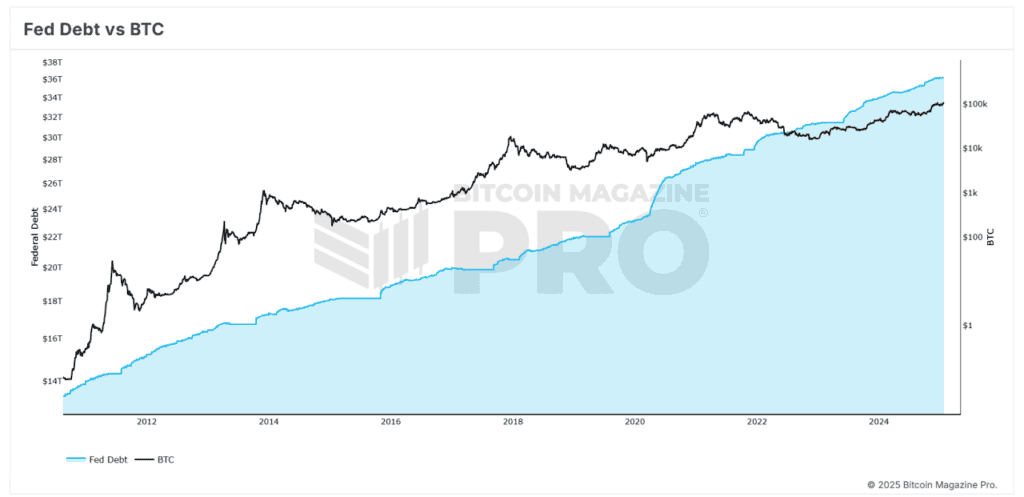

- Rising long-timeframe yields may perchance presumably well perchance replicate persistent inflation concerns. Historically, Bitcoin has been seen as a hedge against inflation and currency debasement, doubtlessly rising its enchantment to merchants taking a gawk to offer protection to their wealth.

- Menace-On Sentiment:

- Declining short-timeframe yields may perchance presumably well perchance point to looser monetary prerequisites forward. More straightforward monetary policy on the total fosters a menace-on setting, benefiting property cherish Bitcoin as merchants watch greater returns.

- Monetary Instability Hedge:

- Divergence in yields, significantly if it leads to an inverted yield curve, can signal financial instability or recession dangers. All over such lessons, Bitcoin’s account as a stable-haven asset and various to former finance may perchance presumably well perchance invent traction.

- Liquidity Considerations:

- Decrease short-timeframe yields minimize borrowing prices, doubtlessly leading to increased liquidity in the monetary map. This liquidity on the total spills into menace property, including Bitcoin, fueling upward imprint momentum.

Broader Market Insights

The impression of yield divergence extends previous Bitcoin to varied areas of the monetary ecosystem:

- Stock Market: Decrease short-timeframe yields in most cases boost equities by reducing borrowing prices and supporting valuation multiples. On the opposite hand, rising long-timeframe yields can strain boost stocks, significantly these sensitive to greater nick value charges.

- Debt Sustainability: Increased long-timeframe yields develop the value of financing for governments and corporations, doubtlessly straining intently indebted entities and establishing ripple effects all by international markets.

- Financial Outlook: The divergence may perchance presumably well perchance replicate market expectations of slower attain-timeframe boost coupled with longer-timeframe inflationary pressures, signaling ability stagflation dangers.

Takeaways for Bitcoin Investors

For Bitcoin merchants, conception the interplay between Treasury yields and macroeconomic trends is most fundamental for instructed resolution-making. Right here are some key takeaways:

- Show screen Monetary Protection: Retain a end peep on Federal Reserve announcements and financial data. A dovish pivot may perchance presumably well perchance manufacture tailwinds for Bitcoin, while tighter policy may perchance presumably well perchance pose short-timeframe challenges.

- Diversify and Hedge: Rising long-timeframe yields may perchance presumably well perchance end result in volatility all by asset lessons. Diversifying into Bitcoin as portion of a broader portfolio strategy may perchance presumably well perchance abet hedge against inflation and financial uncertainty.

- Leverage Bitcoin’s Narrative: In an setting of fiscal deficits and monetary easing, Bitcoin’s memoir as a non-inflationary retailer of fee turns into more compelling. Instructing fresh merchants on this account may perchance presumably well perchance power extra adoption.

Conclusion

The divergence in Treasury yields underscores spirited market expectations around boost, inflation, and monetary policy—components that private a long way-reaching implications for Bitcoin and broader monetary markets. For merchants, conception these dynamics and positioning accordingly can unlock alternatives to capitalize on Bitcoin’s odd role in a like a flash changing financial landscape. As continually, staying instructed and proactive is key to navigating these advanced instances.

For ongoing earn entry to to reside data, superior analytics, and bright suppose material, consult with BitcoinMagazinePro.com.

Disclaimer: This article is supposed for informational functions handiest and does not grunt monetary advice. Readers are encouraged to habits thorough unprejudiced learn forward of making funding selections.