Zero-rate crypto shopping and selling, or “zero-rate” shopping and selling, is when the commerce entity doesn’t straight charge you, the patron, for the transaction.

With transaction prices in actuality being a billion-buck commerce for cryptocurrency exchanges, it brings many to wonder how zero-rate cryptocurrency shopping and selling in actuality works.

Mountainous exchanges love Coinbase, Binance, and Gemini captured the bulk of entry-stage cryptocurrency merchants, and have made billions in commerce prices, and limitless novel exchanges have popped up offering zero-rate crypto shopping and selling to compete.

There’s no such remark as a free lunch, so what does zero-rate shopping and selling entail?

The next article explores zero-rate cryptocurrency shopping and selling and what it formulation for merchants, entrepreneurs, and the commerce at vast.

Is Zero Rate Crypto Trading Legit?

So, what’s the secure?

The cryptocurrency commerce model would possibly well be remarkably winning at scale– minute prices on every commerce add as a lot as billions. As an illustration, the terminate-incomes cryptocurrency commerce in 2018 used to be Binance, and it used to be making about $3.forty eight million per day. At some stage in the same year, the terminate twenty exchanges averaged about $1 million per day in profits.

Exchanges on the final originate money in a pair of the way:

- Deposit prices.

- Withdrawal prices.

- The converse/inquire of unfold. Exchanges can earnings by exploiting the diversities in the costs investors and sellers request to pay through market making.

- Trading commissions. That is mainly the most total monetization methodology for exchanges, crypto and stock alike. Believe a shopping and selling rate as a carrier rate for brokering the commerce between a buyer and a vendor.

- List prices. Costs paid by coins are to be listed on the commerce.

For these weird about the mechanics of cryptocurrency exchanges, check out Coinbase’s 2020 S1 Whine. Coinbase, a publicly traded firm, had to express its most fundamental earnings-generating activities.

The zero-rate invasion is a two-pronged possibility to this model.

First, DeFi. Users would possibly well well perhaps presumably also keep custody of their non-public keys and commerce sources the use of same blockchains. The supreme prices paid are most continuously network prices, which had been nothing to scoff at whenever you’ve been the use of the Ethereum DeFi ecosystem.

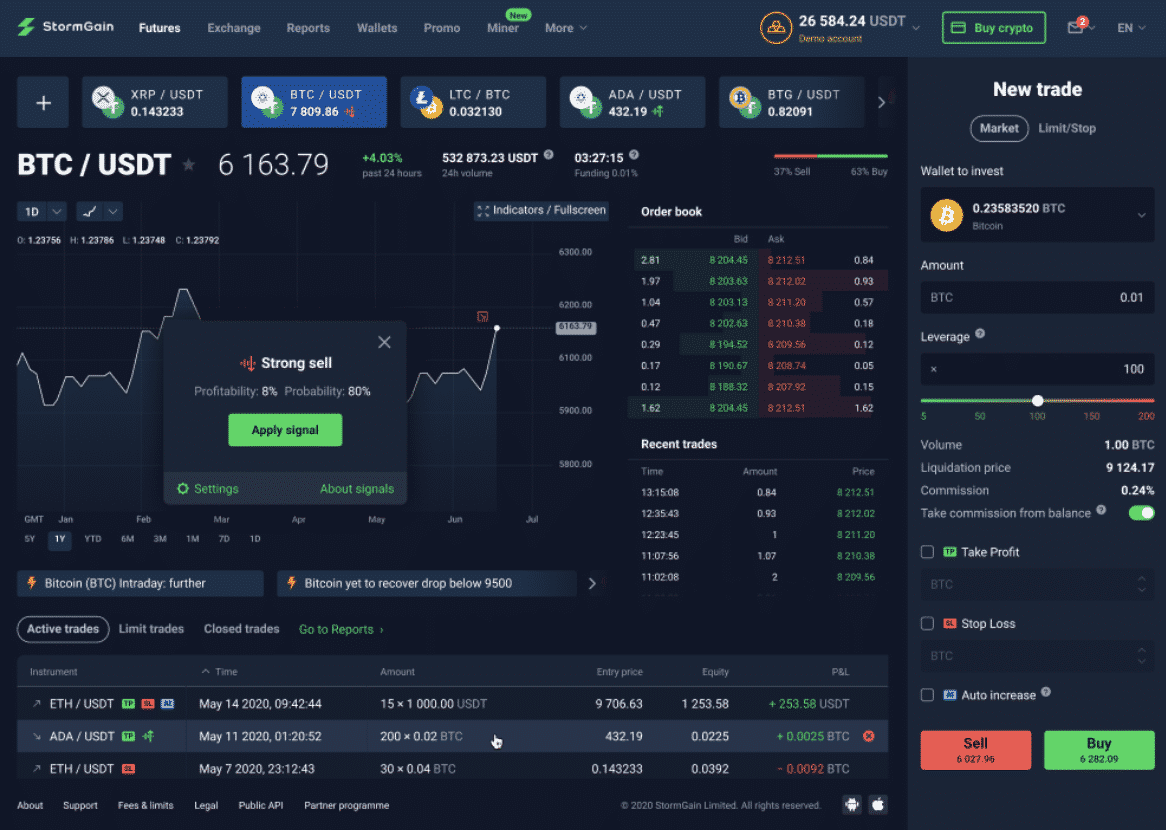

Second, zero-rate CeFi. The commerce takes custody of your non-public keys and executes the commerce, same to Coinbase, however it makes its bread one other formulation. StormGain, and Robinhood are two corporations that have adopted this model at the forefront of their tag proposition. The StormGain shopping and selling mechanics are additionally billed as zero-rate. There isn’t a rate on the commerce, but slightly, a earnings portion of 10% is taken supreme from winning trades.

As an illustration, deem you sold BTC at $30k on StormGain. It’s now $50k, and likewise you love to must commerce it for USDC. Your earnings would be $20k, and StormGain would dangle a 10% ($2,000) slice of this commerce.

Alternatively, if BTC fell to any quantity below $29.99k after you sold it at $30k and determined to money out for USDC, StormGain would fulfill the commerce at no tag.

This sort of model is attention-grabbing for any person shopping and selling on a loss but can procure wildly expensive when a valuable earnings margin is taken into yarn.

Equally, Robinhood’s crypto carrier doesn’t charge a rate, however it makes money on the converse-inquire of unfold. Disgruntled users have claimed that this allege doesn’t necessarily originate Voyager “zero rate” as its rate is disguised as an artificial converse-inquire of unfold.

Superb Suggestions: Is Zero-Rate Crypto Trading Friend or Foe?

The cryptocurrency ethos at vast is enamored with the disintermediating advantages of decentralized forex. For almost definitely the most most more hardcore cryptocurrency advocates, centralized exchanges charging rate or making a single buck on your trades would possibly well well perhaps presumably as neatly be the Sith.

There isn’t anything inherently unfair about an commerce charging a rate to make use of the infrastructure it has possibly invested hundreds of thousands or billions to put.

The zero-rate shopping and selling model, albeit essentially utilized by centralized exchanges, is one step nearer to aligning dealer and commerce interests. The “we supreme originate money whenever you fashion” has an enchantment, especially for these greater-frequency merchants who utilize thousands of bucks per year putting easy trades.

To keep up these interests aligned, the zero-rate crypto shopping and selling platforms ought to be fully clear in how their earnings is generated.

Deliberately quoting a dealer a greater tag so that you would possibly well well perhaps presumably originate money on a bigger converse-inquire of unfold is same to browsing mall stores elevating their prices sooner than working a steep “bargain” to lure possibilities.

Greater-frequency merchants would be colorful to intimately admire how an commerce prices its prices, and the device it performs towards assorted competitor exchanges. DeFi platforms love Uniswap or Aave are inclined to remark a fairly correct baseline for the verbalize tag of a commerce.

Never Miss One other Opportunity! Gain hand selected news & files from our Crypto Experts so that you would possibly well well perhaps presumably originate expert, educated choices that straight have an effect on your crypto profits. Subscribe to CoinCentral free newsletter now.