The below is from a most up-to-date edition of the Deep Dive, Bitcoin Journal’s top class markets e-newsletter. To be amongst the first to assemble these insights and numerous on-chain bitcoin market prognosis straight to your inbox, subscribe now.

At this time, we’ll be having a peek at the evolving feature that the Chicago Mercantile Alternate (CME) has performed in the bitcoin futures market. In specific, we are able to think a few of the developments since the ProShares Bitcoin Draw Futures ETF (BITO) began trading in October 2021.

We covered the aptitude affect of a bitcoin futures ETF in The Day-after-day Dive #080 – Bitcoin Futures ETF Affect.

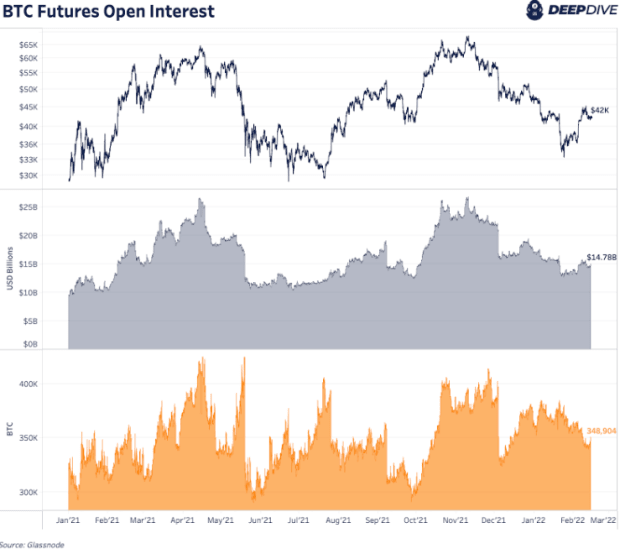

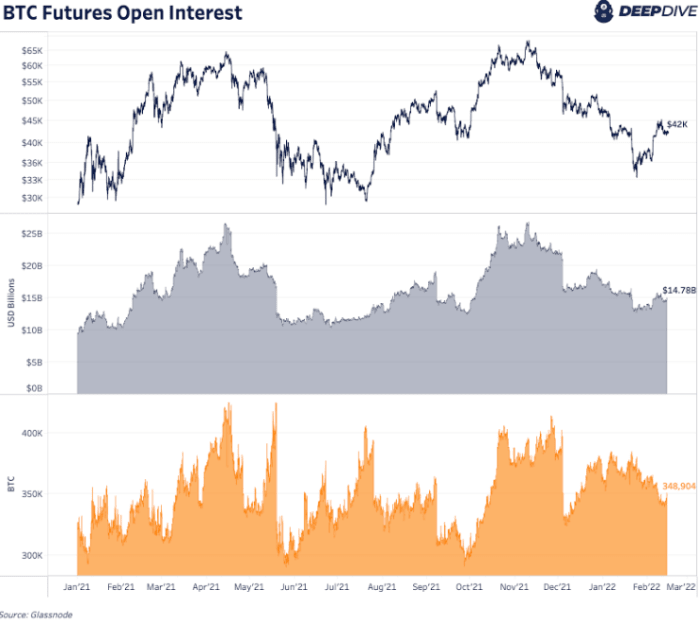

There might maybe be for the time being $14.7 billion of bitcoin futures beginning passion contracts all over varied exchanges and contract sorts, a settle such as 348,000 bitcoin.

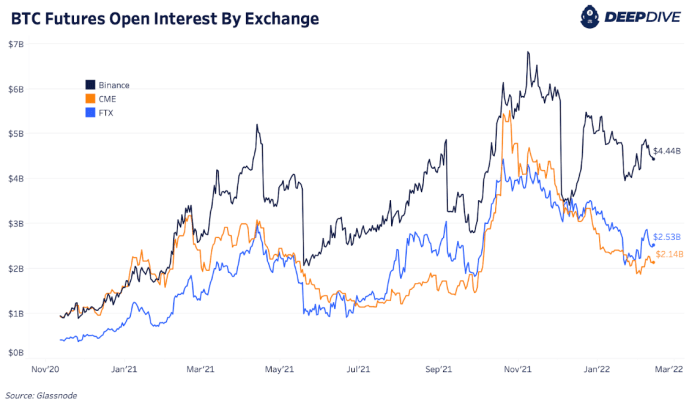

An prognosis of beginning passion by alternate displays Binance ($4.44 billion) as the market chief with FTX ($2.53 billion) and CME ($2.14 billion) following behind. These three exchanges delight in up the bulk of beginning passion contracts accounting for over 60% of the market.

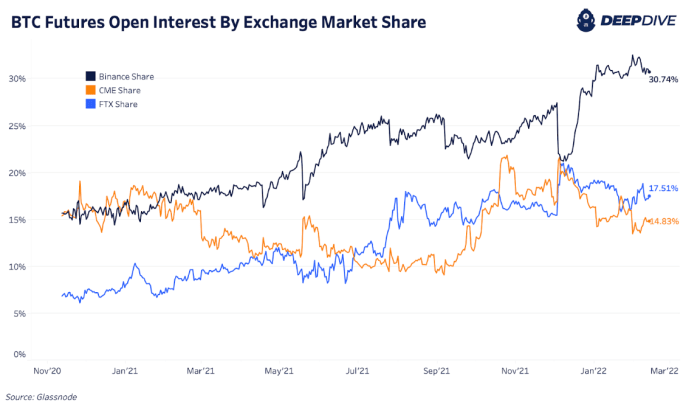

Via the percentage of aggregate beginning passion by alternate, 30.74% is for the time being held on Binance whereas FTX and CME preserve 17.51% and 14.83% of beginning passion every, respectively.

Amongst the most engrossing dynamics, in regards to inspecting the beginning passion of specific exchanges in the futures market, is the upward push of beginning passion in the CME main as much as the approval of the bitcoin futures ETF.

In early October, rumors began to traipse that a futures ETF turned into once coming near and bitcoin futures beginning passion on the CME (the place the in all probability futures ETF would commerce its holdings) extra than doubled to a peak of $5.5 billion in decrease than a month, temporarily becoming the market chief in beginning passion.