The below is from a new edition of the Deep Dive, Bitcoin Magazine’s top payment markets e-newsletter. To be amongst the first to come by these insights and various on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

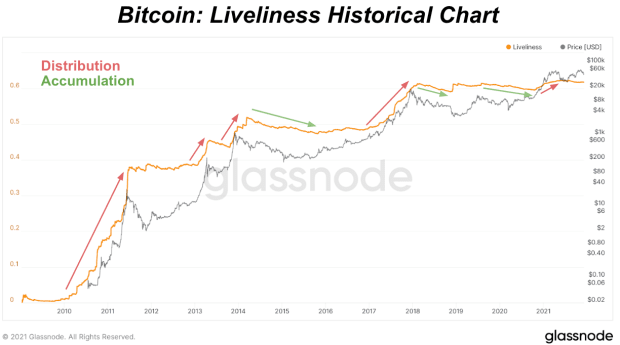

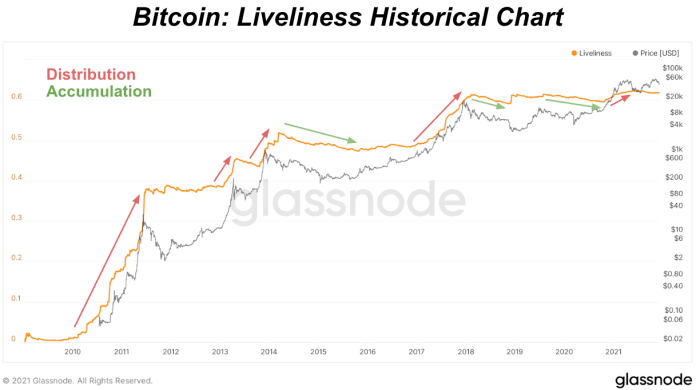

On the present time, we’re revisiting a priceless on-chain metric, Liveliness, that tracks the accumulation and distribution habits of HODLers. As a refresher, Liveliness is calculated as a ratio: the sum of all Coin Days Destroyed and the sum of all coin days ever created.

- Liveliness will increase as long-term holders distribute more coins, creating more coin days destroyed relative to coin days created.

- Liveliness decreases as long-term holders rating more coins, creating much less coin days destroyed relative to coin days created.

Throughout bitcoin’s ancient past, we stumble on obvious patterns of long-term holder distribution and accumulation that pressure bull and hold market cycles that may maybe well also honest also be with out problems tracked with Liveliness.

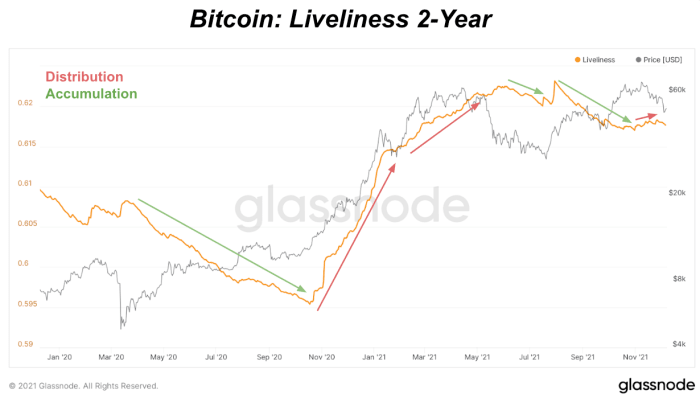

Over the final One year, we saw a rising Liveliness metric with long-term holders distributing more coins for the length of the outdated all-time high label rise from January through Could presumably also honest. After that got right here a sturdy duration of accumulation for the length of lower prices, up unless October where some long-term holder distribution began to take form. Over the final couple weeks with label doubtlessly reaching a bottom after the new deleveraging tournament, the Liveliness pattern looks to be like to gather started a shift help in direction of a duration of limited accumulation.

This may maybe well be a beautiful signal to stumble on long-term holders rating at these lower prices earlier than one other duration of distribution. Accelerated long-term holder distribution on the new bitcoin label would signal a insecurity from the “shipshape money” that bitcoin has more upside over the following few months.

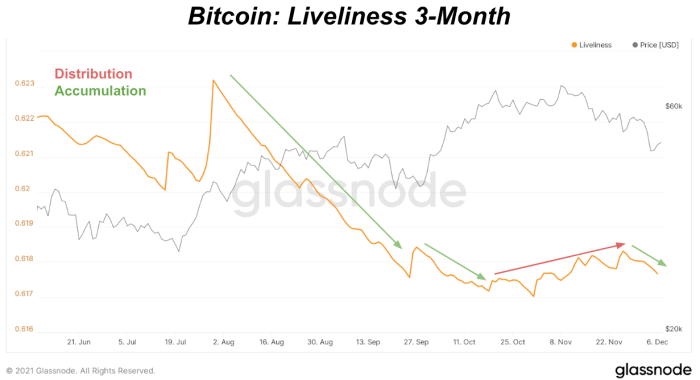

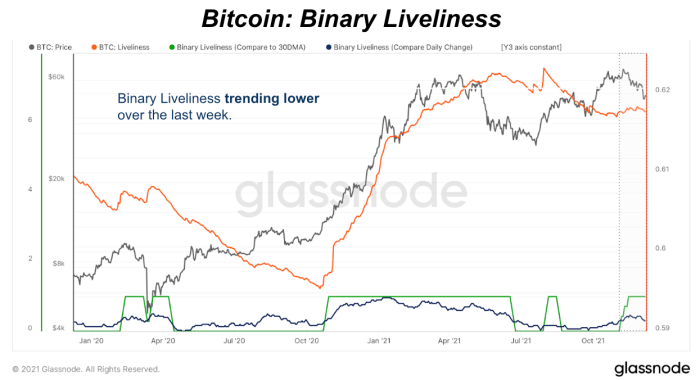

One other contrivance to survey the Liveliness pattern is to leer at Binary Liveliness. Binary Liveliness is designed to back title intervals of accumulation and high distribution by older coins. The fairway cost on the below chart will assemble 1 when Liveliness is better than its 30-day interesting practical. When it is below the frequent, it produces 0.

The blue line will return a 1 when Liveliness is better on the present time than yesterday or else it produces 0. A 30-day interesting practical is then utilized to these outcomes.

What the new records reveals, having a leer on the blue line, is that Binary Liveliness is beginning to pattern and sustain lower values which indicators Liveliness is in a skill new downtrend, or a duration of more long-term holder accumulation.