Key Takeaways

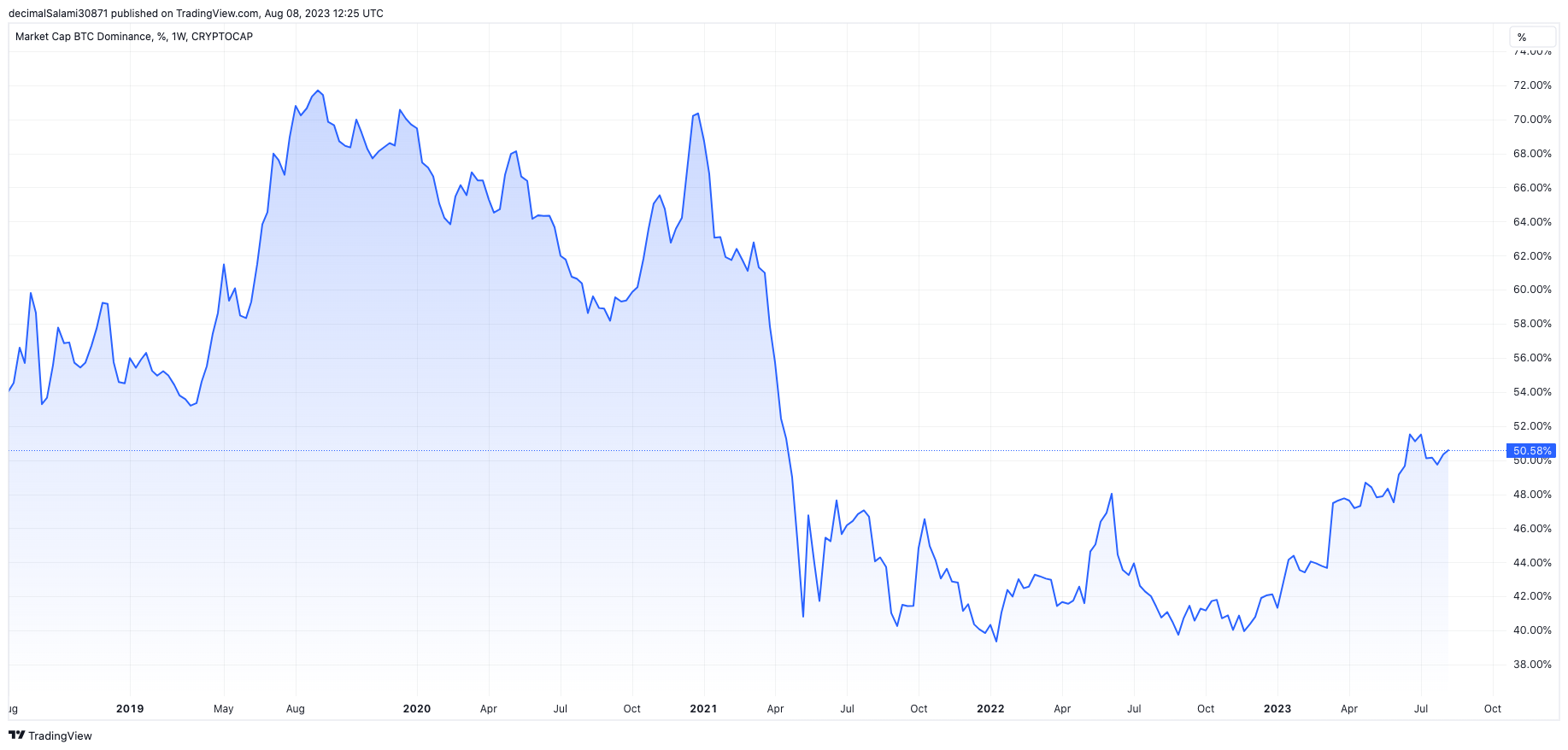

- Bitcoin dominance has risen above 50%, having started the yr at 42%

- Historically, dominance falls whereas market costs are rising within the sphere, marking the yr 2023 out as habitual

- This hammers home how Bitcoin is restful finding its feet, and why prudence needs to be taken when extrapolating past efficiency to the long disappear

- Bitcoin turned into once easiest launched in 2009 and had minimal liquidity for the predominant few years, meaning our pattern home of files is too brief to invent assumptions completely per the past

Bitcoin dominance, which measures the ratio of the Bitcoin market cap to the complete cryptocurrency market cap, has clambered support above 50%. With the duration of relative serenity within the crypto markets lately, it has been rangebound for the closing two months, even if dipped to 49% closing week.

On the choice hand, the dominance of the sphere’s biggest crypto has surged since the commence up of this yr, having been within the low 40’s because the book turned into once closed on the yr 2022.

The expand is the largest prolonged expansion in Bitcoin dominance since 2019, when it rose from fifty three% to 72% in a five-month duration starting up that April.

Particularly, the upward thrust of Bitcoin’s dominance this time around contrasts with what now we comprise viewed within the past regard the timing of cycles. Despite its low volatility when comparing to diversified major asset classes, Bitcoin can most frequently be viewed because the bottom-beta option within digital assets.

Particularly, the upward thrust of Bitcoin’s dominance this time around contrasts with what now we comprise viewed within the past regard the timing of cycles. Despite its low volatility when comparing to diversified major asset classes, Bitcoin can most frequently be viewed because the bottom-beta option within digital assets.

In old cycles, the dominance has therefore tended to descend in bull markets as altcoins outpace Bitcoin’s positive aspects. The pattern has tended to be as follows:

- Have market

- Bitcoin rises, dominance jumps

- Altcoins upward thrust extra, dominance falls

This time around, the altcoins comprise no longer fulfilled their terminate of the cleave tag.

Crypto market is changing fundamentally

There are about a theories which spring to tips to demonstrate these occurences. The first is that Bitcoin is surroundings aside itself from the the rest of the crypto market. Law is one part right here – Bitcoin has proven to be extra immune than many alternative coins within the home, many of whom were weighed down by the crackdown within the US around securities guidelines.

The SEC explicitly named many tokens as securities, including SOL (Solana), MATIC (Polygon) and ADA (Cardano). While Ripple won a landmark case (at least partly) in opposition to the SEC closing month, providing hope for the long disappear appropriate route of those proceedings, the unheard of hostility proven by lawmakers within the US has without a doubt served to dampen token costs. Bitcoin, alternatively, appears to be in its possess genre, focusing on “commodity” voice in region of a security.

Then there is the elephant within the room: the complete sordid remark that has taken region within the crypto industrial over the final eighteen months. From the Terra death spiral to the Celsius scandal to the FTX “deceit”, crypto has taken a beating. This has without a doubt affected Bitcoin too (as its tag chart will so obviously demonstrate), however it’s a ways sublime to thunder that the portion of the crypto home that lies extra out on the probability curve might fetch it more durable to decide up belief from institutions and trad-fi actors (or to decide up it to commence up with, if it never had it within the predominant region).

Many comprise continuously argued that Bitcoin is ruin free the the rest of crypto, lots in state that the faction who promote this aggressively were labelled with the moniker “Bitcoin maximalists”. As least as a ways as law goes, it appears lawmakers is probably going to be coming around towards furthermore surroundings aside out the asset from the the rest of the group.

Bitcoin has suffered immensely within the closing yr, alternatively less so tag-wise than diversified coins, whereas its community has remained online, continuously, without a hitch. There are a lot of diversified cryptos who can argue the identical, however whether or no longer elegant or unfair, they is probably going to be getting caught up within the reputational crossfire a tiny of extra than Bitcoin is.

Past these speculative theories, maybe the final observe lesson of all is to be responsive to how fickle diverse the developments within the future of the crypto are. Are we the truth is bowled over that Bitcoin dominance has risen and altcoins comprise no longer caught up because the clear sentiment continues? Why? Which potential of historical past?

Allow us to remind ourselves that “historical past” pertains to barely a minute right here. Bitcoin turned into once launched in 2009, and didn’t trade with any kind of staunch liquidity till maybe 2015 (if even). Altcoins were even later. The pattern size which now we comprise to work with right here is much too tiny to invent any kind of concrete conclusions. Compare this to the inventory market, or bonds, where we are able to invent all kinds of return and probability assumptions to fit correctly into our Dim-Litterman units or so forth.

No longer easiest is the pattern size tiny, however the timing is critical, too. Bitcoin turned into once borne out of the embers of one of many final observe crashes in financial historical past, launched two months sooner than the inventory market bottomed in March 2009. Following those tumultuous years, we embarked upon one of many longest bull markets in historical past. Risk assets went parabolic as generationally-low hobby charges fuelled dizzying positive aspects.

Which potential of this truth, till closing yr, Bitcoin – and crypto – had easiest ever skilled a low-hobby charge, free money economy of up-easiest probability assets. I the truth is comprise spent a lot of time having fun with Bitcoin units, and my no 1 takeaway is that, pretty simply, we don’t know.

The field is restful understanding what cryptocurrency is. One day, we are able to know precisely the model to model this thing, correct luxuriate in pension funds know precisely the model to practice Markowitz idea to inventory/bond portfolios. There’ll come a day when an efficient frontier portfolio has magic Cyber internet money in it.

Nonetheless we aren’t there but. Hence, we are able to absolutely lean on the past few years for steerage, however striking too much weight into this incredibly brief and bespoke duration (which furthermore integrated a once-in-a-lifetime pandemic that observed the realm economy all accurate now lock down) might be misguided.

Perspective is wished. And we don’t comprise a loyal ample standpoint but to bag that standpoint.