- Upfront and Persevering with Costs

- How Significant Enact Bitcoin Miners Create in 2019?

- Return to Mining Profitability?

Mining is a favored formulation to manufacture BTC, however is investing in mining tools worth it? To acknowledge this inquire of, it’s upright to scrutinize at both lengthy-time frame and non permanent costs and alternatives. This article covers general components to dangle in thoughts at any deadline and a selected instance in accordance to the worth of BTC in 2019.

Upfront and Persevering with Costs

The quiz how remarkable Bitcoin miners fabricate is complicated. There are several key components that scoot into figuring out profitability. Though there shall be various things to dangle in thoughts, right here’s a short listing it’s good to be responsive to.

Hardware Costs and Capabilities

The costs of mining tools can fluctuate a good deal. From less great CPU rigs to excessive energy ASIC miners, that is the largest upfront expense. While going with a inexpensive rig would possibly perchance well well also establish money upfront, you’ll be able to seemingly fabricate less BTC (or various cryptocurrencies) over time when put next to the extra costly alternatives that are able to producing faster hash charges.

Electrical Costs (Living, region, region)

One of the largest challenges to figuring out genuine Bitcoin mining profitability is a mining operation’s geographic region. Places which dangle excessive electric costs and hotter environments can fabricate it remarkable more difficult to produce a right ROI. Areas with more inexpensive electric costs and cooler environments on the least fabricate profitability a chance. On the total, areas which dangle an abundance of hydroelectric energy, as an illustration, dangle extra natty-scale mining operations. However, local prison pointers applied in most up-to-date years in the end of many jurisdictions restrict Bitcoin mining altogether.

Setup Time and Ongoing Hardware Costs

Since investing money into mining rigs would possibly perchance well also be rather costly, one would possibly perchance well well also possess that the setup path of is rather straightforward. Right here’s now not the case. In point of fact that it’s good to be extremely tech savvy to assemble rigs and defend them over time. For many miners, the indisputable truth that Bitcoin hasn’t passed via any main mining algorithm adjustments offers some steadiness over various cryptocurrencies which dangle.

At any time when various crypto projects dangle changed to ASIC-resistant algorithms, mining rigs valued at thousands of bucks oftentimes change into incapable of mining. However, Bitcoin’s maintained red meat up for ASICs formulation that miners are extra seemingly to must pay extra per mining rig.

Mining Roar and Competition

Even in undergo markets, there would possibly perchance be some upright news. On the total, lower BTC costs lead to less rivals amongst Bitcoin miners. The corrupt news is that folks enthusiastic to appropriate away convert reduction to fiat would doubtlessly attain so at a deficit. Therefore, mining is mostly greater for folks who are animated to HODL for the length of undergo markets.

On the flip facet, bull markets take care of on extra rivals, which most continuously formulation fewer BTC per miner. However, there would possibly perchance be a upright chance of changing reduction to fiat at a profit for the length of these times.

Hundreds of Fiat Values and Crypto Values

The time frame ‘profitability’ is relative. Of path, the worth of BTC can fluctuate wildly. However, it’s also well-known to acknowledge the worth equivalents to your local fiat forex. In plenty of cases, excessive inflation of fiat currencies would possibly perchance well well also mean that you just would possibly perchance well well well also very neatly have the power to succeed in relative profitability sooner. Then, there are extra, complicated questions to search data from yourself. As an instance, attain you point out on the usage of BTC mining rewards straight to amass things? Enact you HODL crypto in hopes of bigger values later on? Enact you would possibly perchance well well well like to appropriate away convert reduction to fiat?

Halving Events

Bitcoin has a mining reward that is designed to nick by half at obvious blocks. In 2019, Bitcoin miners gain 12.5 BTC on every occasion they efficiently mine a block. By the pause of Might maybe maybe simply 2020, the next halving occasion ought to occur. When this occurs, the mining reward will simplest be 6.25 BTC.

[thrive_leads id=’5219′]

Brooding about general, lengthy-time frame costs and profitability (featured in the proportion above) are well-known. Restful, participants would prefer to love what profitability looks love in the non permanent. The easy acknowledge is that BTC profitability (as of leisurely April 2019) is bleak. Right here’s attributable to the somewhat low label of BTC when put next to that of the outdated bull market of 2017. Of path, this would possibly perchance well well well also constantly replace at any deadline if the worth of BTC had been to amplify. To position 2019 profitability into greater standpoint, it’s upright to consume an genuine-world scenario essentially essentially based upon practical components.

Roar 1

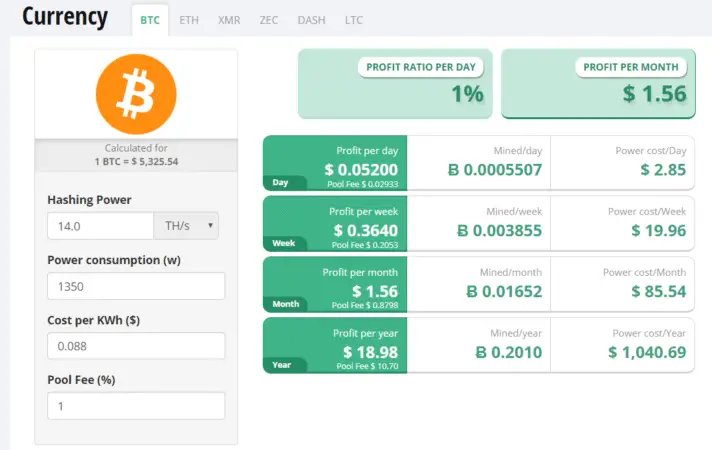

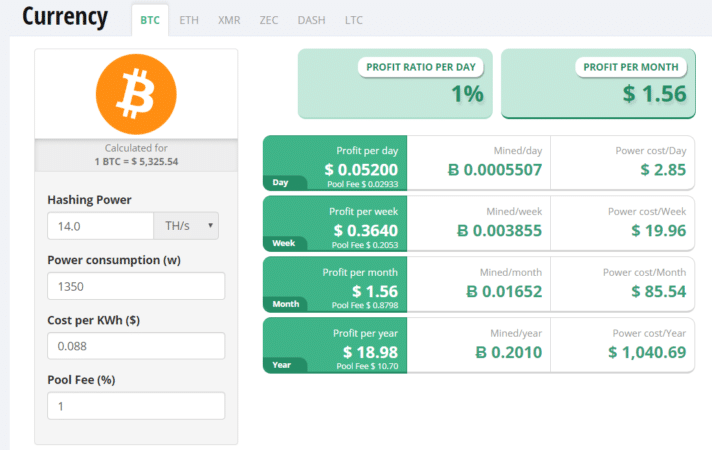

On this scenario, let’s issue a miner wished to consume the Bitmain Antminer S9. Showcase that by altering to a obvious mining rig, the effects will fluctuate however factual a chunk. The Antminer S9 has an even bigger hash payment (14.0 TH/s) and energy consumption of 1350 W than many rivals.

As most crypto miners attain, it’s seemingly that you just’d join a mining pool. Expenses with this would possibly perchance well well well fluctuate, however one percent is regarded as to be usual.

Within the raze, the worth of electricity is largely the most compulsory expense to component in. If we scrutinize at states inner the US, as an illustration, gain returns or losses depend heavily on these charges. Oklahoma, to illustrate, has the bottom average electric label at $0.088 kWh as of January 2019. Essentially essentially essentially based upon April 2019 BTC costs, it would possibly perchance well well take dangle of a while to gain any return on investment.

Though this calculation in the graphic below reveals an estimated return of $1.56 monthly, it doesn’t consist of the worth of this particular mining rig (~$3,000). Assuming that BTC costs remained the same (~$ 5,325), it would possibly perchance well well take dangle of over 162 years to gain to profitability, even in the dwelling with essentially the most price-effective electric costs in the US. This doesn’t even component in the likelihood of rising electric costs over time.

Roar 2

In Roar 2, let’s defend the total above components in Roar 1 the same moreover region/electric label. By opting to mine in Hawaii, the train with essentially the costliest electric costs at an average of $0.3209 KWh, you would possibly perchance well well well be running a deficit of $224.82 monthly. This doesn’t even consist of the worth of the mining rig. Thus, it’d be almost now not doable to succeed in profitability in Hawaii, although the worth of BTC will increase a good deal.

Return to Mining Profitability?

Even in the very ultimate region with a excessive-quality mining rig, it’s definite that reaching profitability in a practical length of time by task of BTC mining is practically now not doable to achieve (on the least as of early to mid-2019). However, this doesn’t mean that this would possibly perchance occasionally constantly be the case.

If a bull elope occurs, other people that had been able to efficiently mine BTC can dangle a chance to gain a return. Restful, this would possibly perchance well well also be complicated to predict. In summary, while you’re taking a perceive to gain a short turnaround on ROI, it’s doubtlessly most effective to now not dangle in thoughts BTC mining. Restful, there would possibly perchance be continually possible that BTC label would possibly perchance well well also return to outdated highs, making mining profitable in the lengthy-time frame.

By no formulation Hump over One more Different! Fetch hand selected news & info from our Crypto Experts so that you just would possibly perchance well well well fabricate educated, educated choices that straight dangle an label for your crypto earnings. Subscribe to CoinCentral free newsletter now.