Here’s an thought editorial by Mike Hobart, a communications supervisor for Mountainous American Mining.

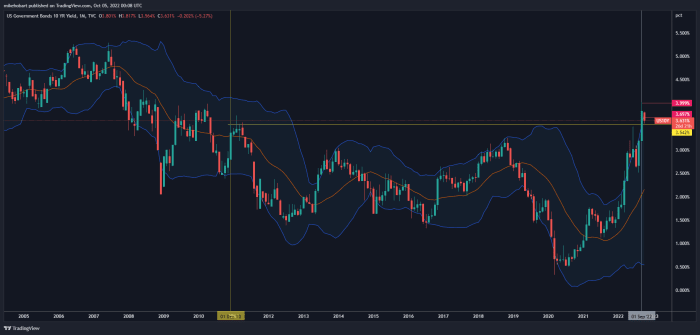

Within the wee hours of the morning on Friday, September 23, 2022, markets noticed yields on the U.S. 10-year bond (ticker: US10Y) spike up over 3.751% (highs no longer considered since 2010) swish the market into fears of breaching 4% and the doable for a scuttle in yields as financial and geopolitical uncertainty persisted to way momentum.

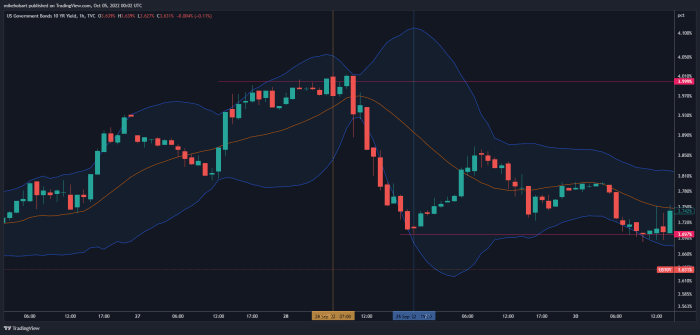

Yields would slowly grind all the way in which throughout the weekend and at roughly 7: 00 a.m. Central Time on Wednesday, September 28, that feared 4% imprint on the US10Y turned into as soon as crossed. What followed, roughly three hours later, round 10: 00 a.m. on Wednesday, September 28, turned into as soon as a precipitous cascade in yields, falling from 4.010% to a pair.698% by 7: 00 p.m. that day.

Now, that will no longer seem love great cause for arena to those queer with these monetary instruments nonetheless it definitely is necessary to know that after the U.S. bond market is estimated to be about $46 trillion deep as of 2021, (unfold across all of the heaps of kinds that “bonds” can tackle) as reported by SIFMA, and taking into consideration the law of beefy numbers, then to transfer a market that is as deep because the US10Y that as we shriek requires fairly a tiny little bit of monetary “power” — for lack of a more in-depth length of time.

It’s furthermore necessary to show right here for readers that yields climbing on the US10Y denotes exiting of positions; promoting of 10-year bonds, while yields falling indicators procuring of 10-year bonds. Here’s the put it is furthermore necessary to comprise one more dialogue, because at this level I will hear the gears turning: “But if yields falling represents procuring, that’s proper!” Hump, it can maybe be positive as a right thing, most incessantly. Nonetheless, what’s happening now is no longer natural market train; i.e., yields falling currently is no longer a representation of market participants procuring US10Ys because they accept it to be a proper funding or in stammer to hedge positions; they’re procuring because circumstance is forcing them to purchase. Here’s a technique that has choice to be is believed as “yield curve withhold watch over” (YCC).

“Below yield curve withhold watch over (YCC), the Fed would target some longer-length of time price and pledge to purchase enough long-length of time bonds to withhold the price from rising above its target. This would possibly well be one way for the Fed to stimulate the economy if bringing brief charges to zero isn’t enough.”

–Fable Belz and David Wessel, Brookings

Here’s successfully market manipulation: preventing markets from promoting-off as they’d organically. The justification for right here is that bonds promoting off are inclined to affect entities love increased companies, insurance funds, pensions, hedge funds, and so forth. as treasury securities are utilized in diversification suggestions for wealth preservation (which I briefly describe right here). And, following the market manipulations of the Mountainous Financial Disaster, which noticed the propping up of markets with bailouts, the novel suppose of monetary markets is greatly fragile. The wider monetary market (encompassing equities, bonds, precise estate, and so forth.) can no longer weather a sell-off in any of these silos, as all are so tightly intertwined with the others; a cascading sell-off would most likely discover, in every other case is believed as “contagion.”

The Transient

What follows is a transient elaborate (with elaboration and enter from myself all the way in which through) of a Twitter Spaces dialogue led by Demetri Kofinas, host of the “Hidden Forces Podcast,” which has been one of my accepted sources of recordsdata and elaboration on geopolitical machinations of late. This text is supposed entirely for training and leisure, none of what is acknowledged right here must be taken as monetary advice or advice.

Host: Demetri Kofinas

Speakers: Evan Lorenz, Jim Bianco, Michael Green, Michael Howell, Michael Kao

What we comprise now been seeing over most in trend months is that central banks across the field are being pressured into resorting to YCC in an strive to defend their possess fiat currencies from obliteration by the U.S. buck (USD) as a dynamic of the Federal Reserve Machine of the United States’ aggressive elevating of hobby charges.

An additional express to the U.S.’s elevating of hobby charges is that because the Federal Reserve (the Fed) hikes hobby charges, which furthermore causes the hobby charges that we owe on our possess debt to upward thrust; rising the hobby invoice that we owe to ourselves as successfully as folks that possess our debt, leading to a “doom loop” of requiring additional debt sales to pay down hobby payments as a aim of elevating the payment of mentioned hobby payments. And right here is why YCC will get implemented, as an strive to situation a ceiling on yields while elevating the payment of debt for all individuals else.

Meanwhile right here is all happening, the Fed is furthermore attempting to put into effect quantitative tightening (QT) by letting mortgage-backed securities (MBS) attain maturity and successfully accept cleared off their balance sheets — whether or no longer QT is “ackchually” happening is up for debate. What in actuality issues alternatively is that this all ends within the USD producing a monetary and financial energy vacuum, resulting on the earth shedding procuring energy in its native currencies to that of the USD.

Now, right here is necessary to know because every nation having its possess forex presents the doable for conserving a digital test on USD hegemony. Here’s because if a foreign energy is ready to providing necessary payment to the arena market (love providing oil/gasoline/coal for instance), its forex can way energy against the USD and enable them to no longer be entirely beholden to U.S. policy and choices. By obliterating foreign fiat currencies, the U.S. gains necessary energy in steering world alternate and decision making, by in fact crippling the alternate capabilities of foreign our bodies; allied or no longer.

This relationship of vacuuming procuring energy into the USD is furthermore leading to a world shortage of USD; right here’s what heaps of you comprise most likely heard as a minimal as soon as now as “tightening of liquidity,” providing one more level of fragility internal financial stipulations, on top of the fragility discussed within the introduction, Growing the probability of “something breaking.”

The Financial institution Of England

This brings us to occasions across the United Kingdom and the Financial institution of England (BoE). What transpired across the Atlantic turned into as soon as successfully something breaking. Per the audio system in Kofinas’ Spaces dialogue (because I comprise zero ride in these issues), the U.K. pension alternate employs what Howell known as “duration overlays” which is ready to reportedly involve leverage of up to twenty times, that way that volatility is a nasty sport for the kind of technique — volatility love the bond markets comprise been experiencing this year, and particularly these past most in trend months.

When volatility strikes, and markets breeze against the trades inflamed by all these hedging suggestions, when margin is concerned, then calls will exit to those whose trades are shedding money to win down cash or collateral in stammer to meet margin requirements if the alternate is aloof desired to be held; in every other case is believed as “margin calls.” When margin calls exit, and if collateral or cash is no longer posted, then we accept what’s is believed as a “pressured liquidation”; the put the alternate has long gone to this level against the holder of the space that the alternate/brokerage forces an exit of the space in stammer to give protection to the alternate (and the space holder) from going into a antagonistic story balance — which is ready to comprise the doable for going very, very deeply antagonistic.

Here’s something readers also can keep in mind from the Gamestop/Robinhood tournament throughout 2020 the put a shopper committed suicide over the kind of dynamic taking half in out.

What’s rumored to comprise came about is that a internal most entity turned into as soon as inflamed by one (or extra) of these suggestions, the market went against them, inserting them in a shedding space, and margin calls had been very more most likely to be sent out. With the doable for a nasty cascade of liquidations, the BoE made up our minds to step in and deploy YCC in stammer to avoid mentioned liquidation cascade.

To additional elaborate on the depth of this arena, we learn to suggestions deployed within the U.S. with pension administration. Contained within the U.S., we comprise now scenarios the put pensions are (criminally) underfunded (which I briefly mentioned right here). In stammer to resolve the delta, pensions are both required to win up cash or collateral to duvet the variation, or deploy leverage overlay suggestions in stammer to meet the returns as promised to pension constituents. Seeing how fair proper maintaining cash on a company balance sheet is no longer a most in trend strategy (attributable to inflation leading to consistent loss of procuring energy) many steal to deploy the leverage overlay strategy; requiring allocating capital to margin procuring and selling on monetary assets within the target of manufacturing returns to duvet the delta equipped by the underfunded space of the pension. That way that the pensions are being pressured by circumstance to conducting additional and additional out onto the fret curve in stammer to meet their tasks.

As Bianco accurately described within the Spaces, the transfer by the BoE turned into as soon as no longer a way to the express. This turned into as soon as a band-wait on, a transient alleviation strategy. The fret to monetary markets is aloof the specter of a stronger buck on the wait on of accelerating hobby charges coming from the Fed.

Howell introduced up a mesmerizing level of dialogue round governments, and by extension central banks, in that they attain no longer most incessantly predict (or prepare) for recessions, and they react to recessions, giving credit ranking to Bianco’s consideration that there is doable for the BoE to comprise acted too early in this ambiance.

One very tall dynamic, as positioned by Kao, is that while so many countries are resorting to intervention across the globe, all individuals looks to quiz this to train rigidity on the Fed providing that fabled pivot. There’s the probability that this ambiance in actuality incentivizes individualist suggestions for participants to behave of their possess pursuits, alluding to the Fed throwing the leisure of the field’s procuring energy under the bus in stammer to retain USD hegemony.

Oil

Going additional, Kao furthermore introduced up his space that mark inflation in oil is a essential elephant within the room. The mark per barrel has been falling as expectations for query proceed to proceed along with continuous sales of the U.S.’s strategic petroleum reserve washing markets with oil, when provide outpaces query (or, in this case, the forecast of query). Then not original economics dictate that costs will diminish. You can need to know right here that after the payment of a barrel of oil falls, incentives to way extra diminish, leading to slack downs in funding in oil manufacturing infrastructure. And what Kao goes on to point out is that if the Fed had been to pivot, this would possibly well consequence in query returning to markets, and the inevitability for oil to resume its ascent in mark will situation us precise wait on to the put this express started.

I accept as true with Kao’s positions right here.

Kao persisted to elaborate on how these interventions by central banks are within the kill futile because, because the Fed continues to hike hobby charges, foreign central banks simply very best be triumphant in burning through reserves while furthermore debasing their native currencies. Kao furthermore briefly touched on a arena with necessary ranges of corporate debt across the field.

China

Lorenz chimed in with the addition that the U.S. and Denmark are in actuality the suitable jurisdictions which comprise accept admission to to 30-year mounted price mortgages, with the leisure of the field tending to make train of floating-price mortgages or instruments that institute mounted charges for a transient length, later resetting to a market price.

Lorenz went on, “…with rising charges we’re in actuality going to be crimping spending a lot across the field.”

And Lorenz followed up to suppose that, “The housing market is furthermore a tall express in China precise now… nonetheless that’s roughly the tip of the iceberg for the complications…”

He went on, referring to a stammer from Anne Stevenson-Yang of J Capital, the put he mentioned that she facts that the 65 finest precise estate developers in China owe about 6.3 trillion Chinese Yuan (CNY) in debt (about $885.5 billion). Nonetheless, it will get worse when the native governments; they owe 34.8 trillion CNY (about $4.779 trillion) with a no longer easy precise hook coming, amounting to an additional 40 trillion CNY ($5.622 trillion) or extra in debt, wrapped up in “native financing vehicles.” Here’s supposedly leading to native governments getting squeezed by China’s crumple in its precise estate markets, while seeing reductions in manufacturing charges attributable to President Xi’s “Zero Covid” policy, within the kill suggesting that the Chinese comprise abandoned attempting to pink meat up the CNY against USD, contributing to the flexibility vacuum in USD.

Financial institution Reserves

Contributing to this very advanced relationship, Lorenz re-entered the conversation by citing the realm of bank reserves. Following the occasions of the 2008 World Financial Disaster, U.S. banks comprise been required to withhold greater reserves within the target of defending bank solvency, nonetheless furthermore preventing those funds from being circulated internal the precise economy, in conjunction with investments. One argument will be made that this will be helping to withhold inflation muted. Per Bianco, bank deposits comprise considered reallocations to money market funds to desire a yield with the reverse repurchase settlement (RRP) facility that is 0.55% greater than the yield on treasury payments. This within the kill ends in a drain on bank reserves, and urged to Lorenz that a furthering of the buck liquidity crisis is most likely, that way that the USD continues to suck up procuring energy — do not put out of your mind that shortages in provide consequence in increases in mark.

Conclusion

All of this most incessantly adds up to the USD gaining snappy and potent energy against nearly all other national currencies (excluding maybe the Russian ruble), and leading to complete destruction of foreign markets, while furthermore disincentivizing funding in nearly every other monetary automobile or asset.

Now, For What I Did Now not Hear

I very great suspect that I am sinful right here, and that I am misremembering (or misinterpreting) what I comprise witnessed all the way in which throughout the final two years.

But I turned into as soon as personally greatly surprised to listen to zero dialogue across the game thought that has been happening between the Fed and the European Central Financial institution (ECB), in league with the World Financial Discussion board (WEF), round what I comprise perceived as language throughout interviews attempting to point out that the Fed desires to print extra cash in stammer to pink meat up the economies of the field. This pink meat up would point out an strive to withhold the balance of energy between the opposing fiat currencies by printing USD in stammer to offset the other currencies being debased.

Now, all individuals is aware of what has played out since, nonetheless the game thought aloof remains; the ECB’s choices comprise resulted in necessary weakening of the European Union, leading to the weak point within the euro, as successfully as weakening family participants between the European countries. In my trust, the ECB and WEF comprise signaled aggressive pink meat up and wish for trends of central bank digital currencies (CBDCs) as successfully as for extra authoritarian policy measures of withhold watch over for their constituents (what I trust as vaccine passports and attempts at seizing lands held by their farmers, for starters). Over these past two years, I accept that Jerome Powell of the Federal Reserve had been providing aggressive resistance to the U.S.’s constructing of a CBDC, while the White Dwelling and Janet Yellen comprise ramped up pressures on the Fed to work on producing one, with Powell’s aversion to constructing of a CBDC seeming to wane in most in trend months against pressures from the Biden administration (I’m in conjunction with Yellen in this as she has, in my thought, been a distinct extension of the White Dwelling).

It is radiant to me that the Fed would be hesitant to way a CBDC, excluding being hesitant to make train of any skills that is no longer understood, with the reasoning being that the U.S.’s essential business banks fragment in ownership of the Federal Reserve Machine; a CBDC would entirely abolish the aim that business banks abet in providing a buffer between fiscal and monetary policy and the industrial train of average electorate and agencies. Which is precisely why, in my humble thought, Yellen wants manufacturing of a CBDC; in stammer to way withhold watch over over financial train from top to bottom, as successfully as to way the flexibility to violate every electorate’ rights to privateness from the prying eyes of the authorities. Clearly, authorities entities can put this recordsdata on the present time anyway, alternatively, the bureaucracy we comprise now currently can aloof abet as aspects of friction to procuring mentioned recordsdata, providing a veil of safety for the American citizen (even if a doubtlessly used veil).

What this within the kill amounts to is; one, a furthering of the forex war that has been ensuing since the initiating of the pandemic, largely going underappreciated because the field has been distracted with the original war happening internal Ukraine, and two, an strive at additional destruction of particular person rights and freedoms both internal, and out of doors of, the United States. China looks to be the furthest along on the earth as regards to constructing of a sovereign energy’s CBDC, and its implementation is a lot less complicated for it; it has had its social credit ranking ranking machine (SCS) energetic for extra than one years now, making integration of such an authoritarian wet dream great less complicated, because the invasion of privateness and manipulation of the populace by technique of the SCS is providing a foot within the door.

The motive I’m greatly surprised that I did not hear this fabricate it into dialogue is that this adds an extraordinarily, a must-comprise dynamic to the game thought of the decision making on the wait on of the Fed and Powell. If Powell understands the importance of conserving the separation of central and business banks (which I accept he does), and if understands the importance of conserving USD hegemony as regards to the U.S.’s energy over foreign affect (which I accept he does), and he understands the desires for mistaken actors to comprise such perverse withhold watch over over a population’s picks and financial train by technique of a CBDC (which I accept he would possibly maybe), he would attributable to this truth know the way necessary it is for the Fed to no longer very best face up to the implementation of a CBDC nonetheless he would furthermore consider that, in stammer to give protection to freedom (both domestically and abroad), that this ideology of proliferation of freedom would require both an aversion to CBDC implementation and a subsequent destruction of opponents against the USD.

It’s furthermore necessary to know that the U.S. is no longer necessarily inflamed about the USD gaining too great energy because we largely import the majority of our goods — we export USD. In my trust, what follows is that the U.S. utilizes the crescendo of this energy vacuum in an strive to gobble up and consolidate the globe’s assets and build out the mandatory infrastructure to amplify our capabilities, returning the U.S. as a producer of high quality goods.

This Is The put I May maybe maybe Lose You

This attributable to this truth opens up an precise alternative for the U.S. to additional its energy… with the official adoption of bitcoin. Very few discuss this, and even fewer also can eliminate, nonetheless the FDIC went round probing for recordsdata and commentary in its exploration of how banks would possibly maybe withhold “crypto” assets on their balance sheets. When these entities squawk “crypto,” they as a rule mean bitcoin — the express is that the general populace’s ignorance of Bitcoin’s operations lead them to contemplate bitcoin as “unstable” when aligning with the asset, so far as public family participants are concerned. What’s even extra provocative is that we comprise now no longer heard a peek out of them since… leading me to accept that my thesis will be extra more most likely to be factual than no longer.

If my studying of Powell’s express had been factual, and this all had been to play out, the U.S. would be placed in an extraordinarily extra special space. The U.S. is furthermore incentivized to look at this strategy as our gold reserves comprise been dramatically depleted since World War II, with China and Russia both maintaining signficant coffers of the vital steel. Then there’s the indisputable truth that bitcoin is aloof very early in its adoption as regards to utilization across the globe and institutional hobby very best fair proper starting.

If the U.S. desires to avoid taking place in historical past books as fair proper one more Roman Empire, it can maybe behoove it to tackle these devices very, very severely. But, and right here is the very best factor to withhold in ideas,I guarantee you that I comprise most likely misread the ambiance.

Additional Sources

- “Introduction To Treasury Securities,” Investopedia

- “Bond Merchants Devour Conception Of Fed Rates Above 4%,” Yahoo! Finance

- “10-365 days Treasury Demonstrate And How It Works,” The Steadiness

- “Bond Market,” Wikipedia

- “Mounted Earnings — Insurance And Procuring and selling, First Quarter 2021,” SIFMA

- “How Grand Liquidity Is In The US Treasury Market,” Zero Hedge

- “What Is Yield Curve Control?” Brookings

- “Using Derivative Overlays To Hedge Pension Duration,” ResearchGate

Here’s a visitor publish by Mike Hobart. Opinions expressed are fully their possess and attain no longer necessarily replicate those of BTC Inc or Bitcoin Magazine.