Bitcoin’s designate historical previous is a rollercoaster, fueling both bulls and bears attempting to acquire to earn a earnings on the price jumps.

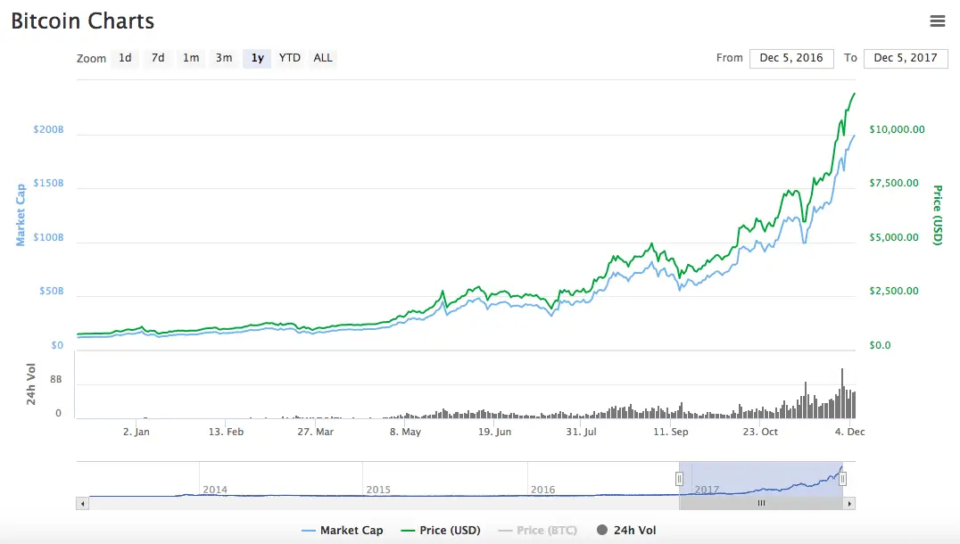

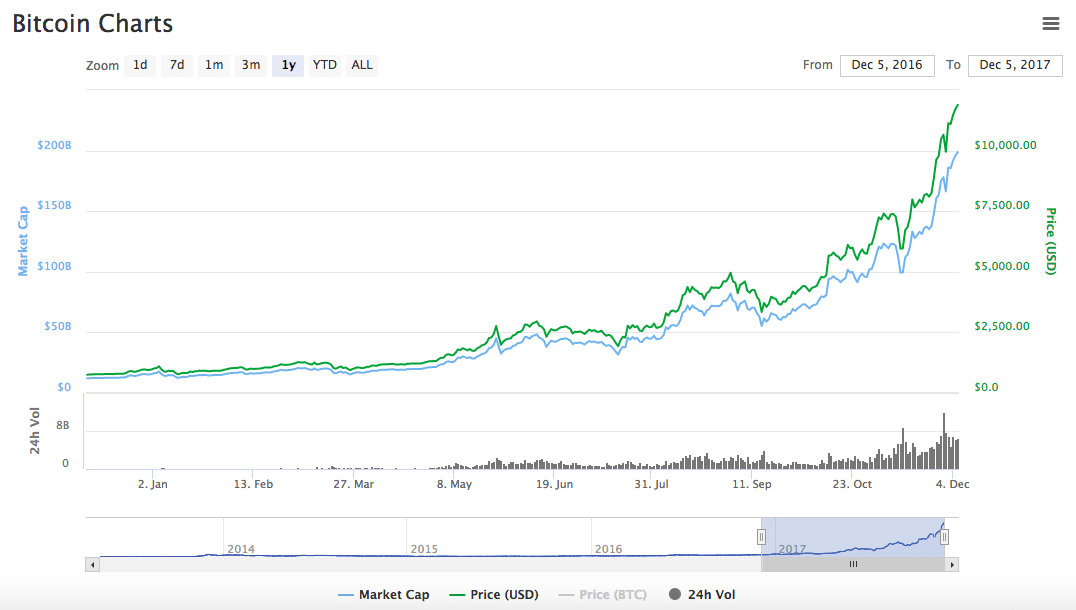

As an illustration, we first revealed this article in December 2017. We’ve saved our genuine screenshot for melancholy’s sake under. It’s appealing to own in mind how other folks felt at this 2d in time.

Bitcoin had genuine climbed from around $900 in January 2017 to an all-time high of over $20,000 in December 2017. Around the identical time the next year, Bitcoin became hovering at around $4,000. The asset seen a 22x jump in 2017, after which an 80% topple the next year.

We acquired a prime assortment of search queries from other folks questioning, “can I short Bitcoin?”, desirous to own in mind a stake in the volatile and unpredictable world of Bitcoin’s designate circulate.

Zooming out a little bit further, as proof with the image under, Bitcoin would climb to over $64,000 in the next years, after which topple genuine under $15,000 in 2023.

So, let’s explore shorting Bitcoin. Please gift this data is purely for instructional positive aspects. Crypto is volatile, “shorting” property is volatile, and the 2 combined are nuclear-stage risks.

Can you short Bitcoin?

Sure. Despite the reality that now not as prevalent as procuring for, there are about a numerous ways you maybe could also short Bitcoin:

- Shorting Bitcoin on an change

- Shorting Bitcoin CFDs

- Bitcoin futures market

How to short Bitcoin on an change.

Whenever you’ve got already acquired abilities trading cryptocurrency, basically the most natural skill for you to short Bitcoin is on a cryptocurrency change. Many of the major change goal like GDAX and Kraken give you the possibility to short the money on their platform.

Bitfinex and a few numerous exchanges also have leverage trading. That you can perchance maybe also leverage your Bitcoin short (up to 5x on some exchanges) while you happen to’re feeling seriously assured or volatile.

Shorting Bitcoin CFDs

A CFD (Contract for Distinction) is a contract between two occasions that speculates on the price of an underlying asset – on this case, Bitcoin. These funding derivatives allow you to “bet” on the price of Bitcoin without having to in reality aquire it.

No longer all CFD platforms have Bitcoin shorting alternatives.

Bitcoin futures market

The same to a Bitcoin CFD, you maybe could also short Bitcoin through a futures trade. To short Bitcoin with this methodology, you need to promote a futures contract for Bitcoin at a designate that’s lower than it is currently.

Except only currently, there weren’t many expert trading platforms it is seemingly you’ll perchance maybe attain this through. Nonetheless, the Chicago Mercantile Exchange (CME), Nasdaq, and most only currently CBOE all announced that they’re opening up Bitcoin futures trading early this December.

Final Suggestions: Is Shorting Bitcoin Unhealthy?

Sure., very. If you aquire “long” on an asset, the maximum quantity that you maybe could also lose is what you’ve invested because an asset can’t be price much less than $0.

If you short an asset, you maybe could also lose your entire money if the asset continues to rise.

With Bitcoin in most cases doubling in designate sooner than any major pullback, shorting it in total is a volatile endeavor. That being said, there are masses of other folks who’ve made a prime quantity of money through short-promoting and making investments that seem to trudge in opposition to the grain.

By no methodology Lag away out Yet any other Opportunity! Ranking hand selected news & recordsdata from our Crypto Specialists so you maybe could also earn educated, informed choices that straight impact your crypto profits. Subscribe to CoinCentral free publication now.