- About IDEX

- How IDEX Works

- IDEX Yarn Safety

- IDEX Buying and selling Pairs

- IDEX Charges and Limits

- IDEX Customer Merit

- IDEX Neighborhood Sentiment: Is IDEX Legit?

- Final Tips: Can You Have confidence IDEX?

IDEX is an Ethereum-based fully mostly decentralized alternate featuring a large quantity of Ethereum and numerous ERC20 token trading pairs launched in 2017.

IDEX goals to bring the conveniences and user-friendly nature of centralized exchanges however with DEX-like custody and security. It employs dapper contracts that enable users to control their non-public keys and alternate in a stable, stare-to-stare atmosphere. It moreover components Ledger Nano S and Meta Masks Pockets integrations, safer picks for fund management than manually entering a non-public key, or trusting a third-party custodian.

When trading on IDEX, users aloof log out on transactions with their non-public key, however the alternate declares the transaction to the blockchain, enabling the alternate to update memoir balances and declare books in right-time. This offers IDEX the user trip of a centralized alternate with out sacrificing the safety and user alter of a decentralized alternate.

IDEX on the muse launched entirely on Ethereum because Layer-2s, and now Layer-3s, didn’t exist. It has since moved to exploring an IDEX-explicit “Layer-3” with the blueprint of making sure the lowest prices and performance doable.

In traditional human phrases, IDEX has transitioned from using the pricey Ethereum scandalous network to more inexpensive picks constructed on top of it, like Polygon and XCHAIN.

The next IDEX Evaluation explores how IDEX works, and whether this decentralized alternate is a lawful fit to your trading needs. Model, trading on IDEX from the United States is for the time being blocked.

About IDEX

IDEX launched in 2017 and has helped pioneer the trudge for the unique decentralized alternate. No matter it’s early entry into the DEX industry, nonetheless, it’s exercise scandalous has lagged. The alternate for the time being has about $2.65m in Total Value Locked, about 1/7th of the Tenth ideal DEX, Balancer.

How IDEX Works

Good contracts are the secret for any decentralized alternate. Users can manage all of their funds throughout the alternate’s dapper contract. Goodbye as no person else has their non-public key, their funds can’t be touched after they’ve been kept in the contract except they’ve signed off on them.

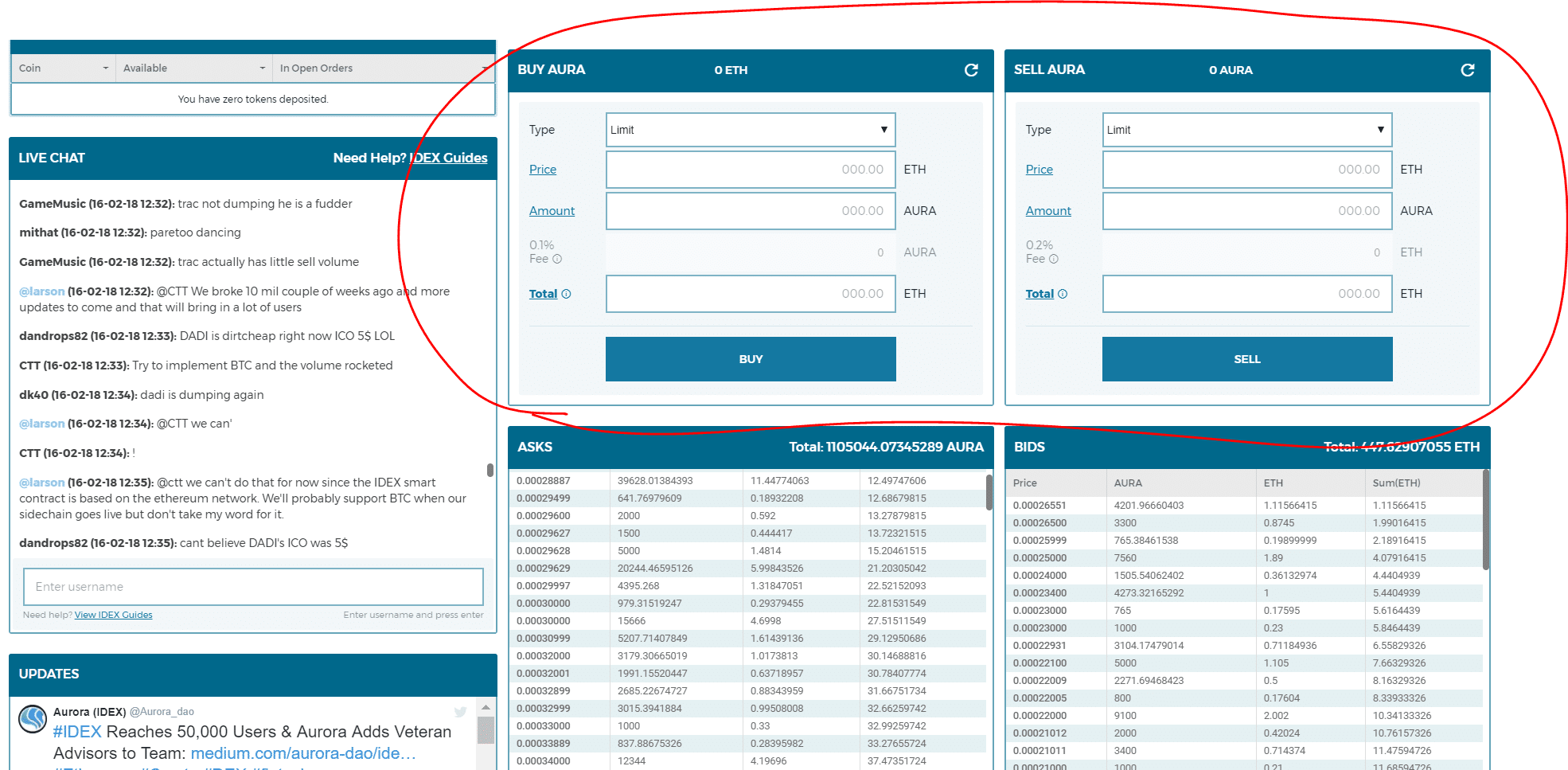

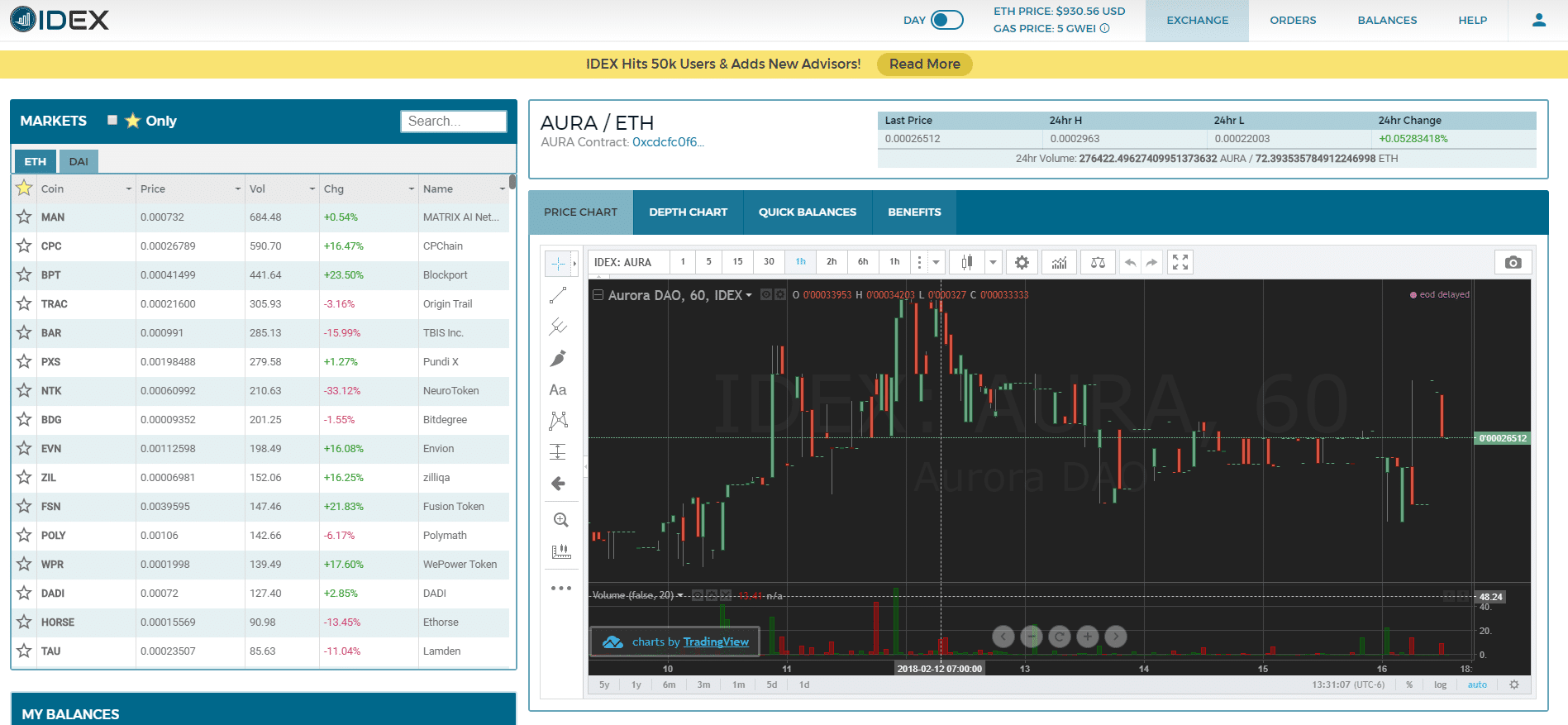

As soon as on the alternate, you’ll scrutinize that all the pieces or now not it is crucial to alternate is straight away in entrance of you: pockets balances, the trading chart, the declare guide, trading pairs, and other tools are all displayed on a single page. It might maybe maybe most likely appear overwhelming in the beginning to luxuriate in all of this bunched collectively, however we’ll be going over each and each part under–and having all the pieces on one page the truth is makes exchanging a chase.

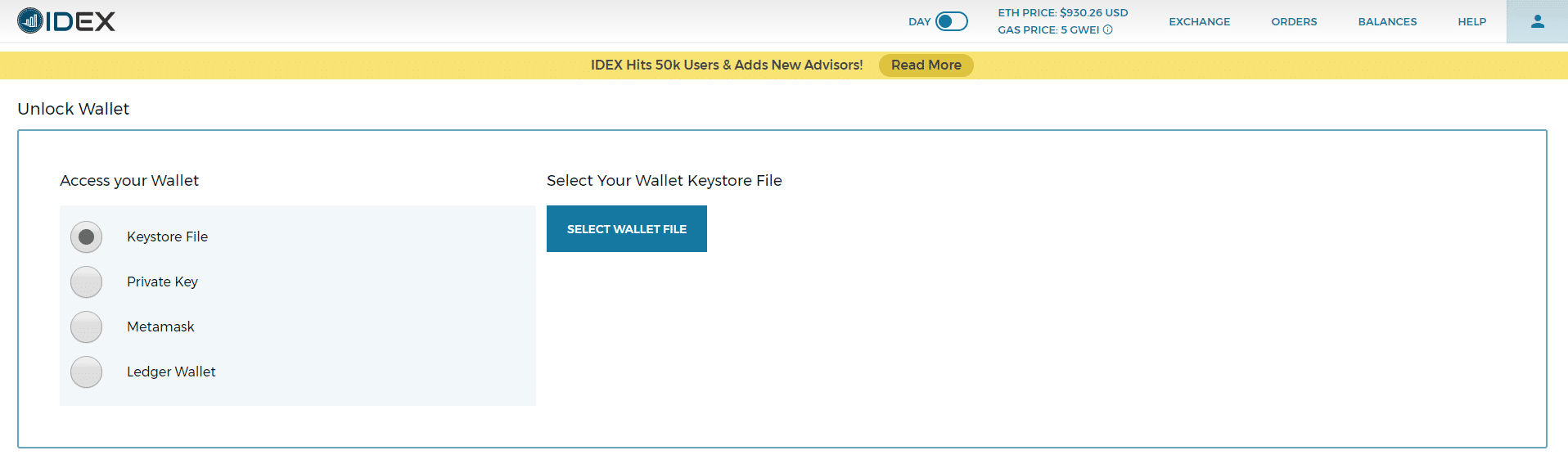

First issues first, you’ll must deposit funds into the alternate’s dapper contract to begin. On the highest shapely nook, there’s an memoir dropbox that enables you to integrate a new pockets or form one throughout the alternate. Even as you to settle to form one, the alternate will rating a non-public key for you and a Pockets Keystore File. Whether you’re making a new pockets or accessing an extinct one, you’ve got gotten four alternate strategies for opening a pockets on the alternate:

- Keystore File: You would moreover without delay add your non-public key using a KeyStore file for an Ethereum address you created on the alternate or in any other case.

- Manually Entered Non-public Key: You would moreover settle to manually enter your non-public key to liberate an Ethereum address’ funds.

- MetaMask: You would moreover liberate your MetaMask pockets and rating entry to it throughout the alternate.

- Ledger Nano S: You would moreover integrate your Ledger Nano S into the alternate and deposit funds without delay from it.

Hardware pockets integration is one in every of the ideal added advantages of using a decentralized alternate like IDEX. The utilization of a Ledger to alternate on IDEX insulates you from risks like malware and phishing assaults. Meta Masks will protect you from phishing assaults however now not malware; manually entering your non-public keys leaves your funds ripe for phishing and is in point of fact the most weak option for accessing funds.

If you’ve got your funds in hand on the alternate, or now not it is crucial to deposit them into the alternate’s dapper contract. It looks like a foolish extra step, however it’s the truth is on your make a choice, as this dapper contract retains your funds stable while you alternate and allows the alternate to broadcast transactions without delay to the network. You would moreover deposit from your pockets into the alternate throughout the Fleet Balances tab on the highest of the page and adjust the fuel model for this transaction at your leisure.

If you’ve got funds on the alternate, that you just might moreover begin trading. IDEX capability that you just can form market/restrict orders, and unlike other DEXs, that you just might moreover extinguish trades with out paying fuel.

Right here’s the set IDEX separates itself from the decentralized milieu. You would moreover extinguish trades on IDEX with out having to pay extra because all trades are accomplished by the alternate itself. Thus, must you log out on a alternate, you settle to label that alternate, however the alternate’s dapper contract is guilty of broadcasting it to the network, so till the transaction is distributed to be mined, that you just might moreover ask the alternate to rescind it.

Even as you’ve ever tried to have an declare on EtherDelta, you’ve speed the threat of having that transaction fail. From time to time, orders are claimed by greater than one party, and since the declare guide isn’t up so far till after a transaction is processed on the network, a extinct orderbook can consequence in users making an strive to label trades on orders that are already stuffed. IDEX’s machine cures this headache by updating the orderbook in right time after an declare is stuffed. This mannequin offers users the benefit of user-managed funds with the ease of a freshly up so far declare machine they’d rep on a centralized alternate.

IDEX Yarn Safety

Normally, decentralized exchanges characteristic security buffs that centralized exchanges, by construct, can now not enhance. IDEX isn’t any exception. The alternate itself runs as a node on the Ethereum network, so it comes replete with all of the safety a blockchain network entails for its users.

Further, the alternate’s dapper contracts protect funds locked in till the non-public key signs a transaction to cross them. You would protect your funds on the alternate and now not ruin a sweat over it being compromised like we’ve seen too repeatedly with centralized ones. The motive being, that there’s no central level of failure for a hacker to tap into funds. All funds are held in dapper contracts on the Ethereum blockchain, so there’s no threat of any individual hacking true into a pockets reserve because IDEX doesn’t protect user funds in a single.

The Ledger Nano S integration is one other of IDEX’s key advantages, and, fascinated by the alternate’s overall decentralized construction, it makes for one in every of essentially the most stable trading experiences accessible.

The absolute most sensible component you’d must apprehension about by plot of security is that if IDEX’s arena name service supplier is compromised and a hacker hijacks its URL. We saw this happen to Ether Delta, however if one thing like this had been to happen, your funds might maybe be stable as lengthy as you don’t manually enter your non-public keys into the unsuitable online page.

IDEX Buying and selling Pairs

As we went over earlier, the alternate deals completely with Ethereum and ERC20 tokens. Namely, IDEX offers 2 scandalous trading pairs– ETH and USDC.

As such, you acquired’t luxuriate in rating entry to to the relaxation outdoors the Ethereum family, however that aloof leaves you with lots of alternate strategies.

IDEX Charges and Limits

IDEX prices a 0.1% rate for market makers (those who label liquidity by making a new declare for the declare guide) and nil.2% for takers (those who take liquidity by filling an declare already on the guide). Takers are moreover to blame for paying the fuel rate for a transaction.

“Market takers are to blame for retaining the fuel prices connected to each and each alternate. Given our construct, the alternate must pay this fuel rate, priced in ether, when dispatching the alternate to the network after which deduct it from the balance of the market taker. When exchanging tokens for ether the amount of eth deducted suits that of the fuel rate. When exchanging ether for tokens, IDEX deducts an identical quantity of tokens per the price of the asset in ETH. This model is calculated using the average of the closing 10 trades.

Ethereum fuel prices luxuriate in been rising, and now and again this rate is increased than the IDEX alternate rate of 0.2%. These high fuel prices luxuriate in led us to institute declare minimums in an strive to decrease prices for our users.”

Thus, the taker rate will be greater than 0.2%, depending on the network’s online page online page visitors. This moreover plot that every and each body orders must be a minimal of 0.15 ETH for makers and nil.05 for takers so that the alternate can manage transaction prices effectively. As well as, there’s a 0.04 ETH minimal withdrawal amount for Ethereum and tokens alike. IDEX doesn’t luxuriate in trading or withdrawal limits.

IDEX Customer Merit

The alternate components a chat field the set users and enhance teams alike can solution queries and concerns. Alex and Phil Wearn, IDEX’s founders, are moreover active on the undertaking’s subreddit and in overall answer promptly to customer questions and complaints.

The drawl moreover components a contact make for reaching out to the crew and a Linktree link to loads of IDEX neighborhood channels.

IDEX Neighborhood Sentiment: Is IDEX Legit?

IDEX has been around since 2017– our initial evaluate of the alternate became printed in 2018. Since then, the alternate has remained comparatively scandal-free.

Final Tips: Can You Have confidence IDEX?

By all measures, IDEX lives up to its increasing recognition as EtherDelta’s extra handsome runt brother (presumably runt easiest applies to age right here, as IDEX the truth is outranks EtherDelta by trading volume). The bi-layered transaction settlement mannequin circumvents the identical pitfalls that plague EtherDelta’s machine, and it makes for a in overall simpler, much less demanding trading trip.

Soundless, this mannequin has its drawbacks, namely that it makes the alternate now not entirely trustless. You aloof alter your non-public keys, however you’re counting on the alternate to form trades for you, leaving the closing step of the process considerably centralized. Happily, the IDEX has launched the AURA token and their new staking mannequin to resolve this drawl of affairs, so request the alternate to turn out to be even extra decentralized as 2018 progresses.

It’s aloof beholden to the Ethereum blockchain like any Ethereum-powered DEX, and now and again of network disaster, users can speed into concerns. All issues regarded as, nonetheless, IDEX’s construct mitigates lots of the components that network congestion can trigger for a DEX, and its user trip/interface is cleaner than its competitors. IDEX is a rising huge name in the decentralized alternate region, and while you adore EtherDelta however rep your self wrathful from using it, it’s positively price making an strive out.

[wp-review id=”6328″]

By no plot Stagger over One more Different! Salvage hand chosen news & info from our Crypto Consultants so that you just might moreover label educated, told decisions that without delay have an effect on your crypto profits. Subscribe to CoinCentral free newsletter now.