Some Bitcoin indicators bellow similarities between the submit-ATH be aware hurry and contemporary vogue, implying that there’ll doubtless be one closing push up earlier than a bigger tumble.

Indicators May perchance well Expose At the contemporary time’s Ticket Action Is Associated To That After $64.5k ATH

As explained by a CryptoQuant analyst, there seem like many similarities between the Bitcoin indicators of the submit all-time-high (ATH) period and that of contemporary day.

There are three main metrics of relevance right here. The first is the substitute reserve, which exhibits the volume of BTC currently being held on centralized substitute wallets.

Right here is how this indicator’s fee has changed at some stage in the previous year:

The BTC substitute reserve after the ATH vs this day

Taking a look for at the above graph, there does seem like a similarity between the two periods. Both had declining prices besides to declining substitute reserves.

Subsequent is the estimated leverage ratio, a trademark that exhibits how mighty leverage is mature by traders on common. It’s calculated by taking the commence interest divided by the unreal reserve.

The leverage ratio appears to be like to be plunging down

Right here too a similarity will also be considered as the indicator appears to be like to have sharply dropped down at some stage in each contemporary day and the submit-ATH period.

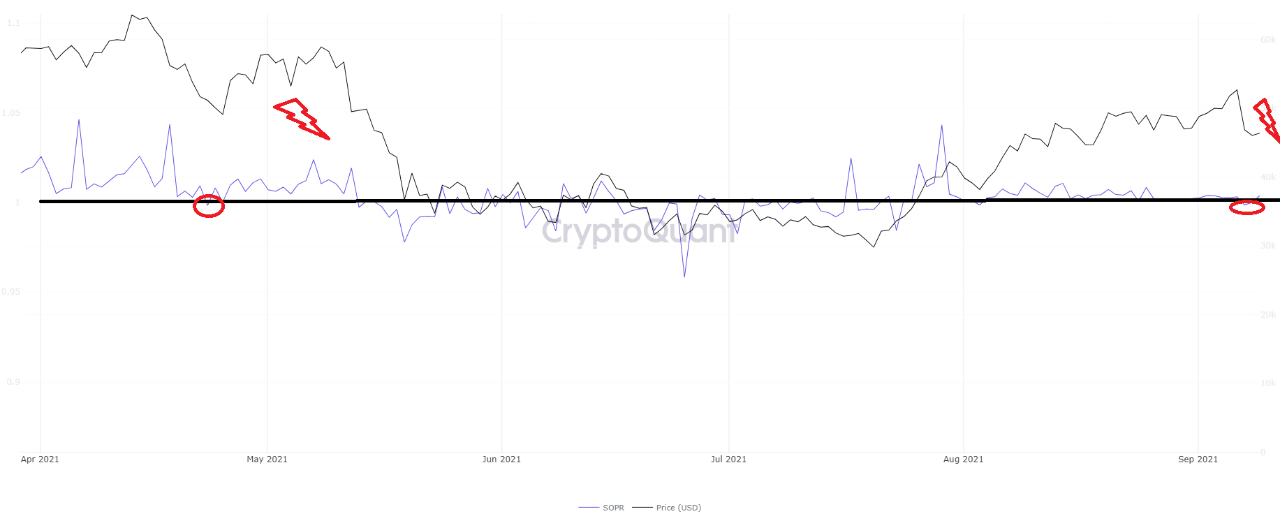

Indirectly, there would possibly possibly be the Spent Output Profit Ratio (SOPR), which is calculated by taking the ratio of realized fee (in USD) to the rate of introduction of a spent output.

In less advanced terms, the indicator exhibits whether or no longer Bitcoin wallets are selling their money at a income or a loss. The below chart exhibits the trends for this metric.

The BTC SOPR over the previous six months

Seems cherish the rate of the SOPR dropped down below 1 at some stage in each these periods. The kind of fee indicates that investors were selling BTC at a loss (while values above 1 would suggest the more than a few).

If the contemporary vogue truly is similar to the submit-ATH one as these indicators would appear to signify, then it manner BTC’s be aware would possibly possibly well perchance pass up soon and originate a local peak. And factual cherish closing time, a mighty tumble would possibly possibly well perchance also occur after that which takes the be aware to lower ranges. So that this uptrend would possibly possibly well perchance also turn out to be the closing pass up for a while.

BTC Ticket

At the time of writing, Bitcoin’s be aware floats around $45.7k, down 10% in the closing 7 days. Precise by technique of the last month, the cryptocurrency has dropped 1% in fee.