The below is an excerpt from a fresh model of Bitcoin Journal Educated, Bitcoin Journal’s top charge markets e-newsletter. To be among the many main to salvage these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Charges On The Rise

The day gone by’s preliminary jobless claims data release came in below expectations, signaling a stronger labor market which is one other “correct data is unpleasant data” signpost.

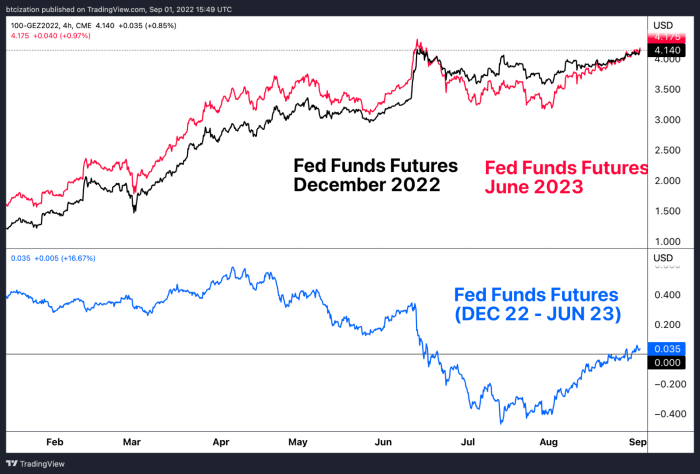

We can behold these varieties of tendencies play out thru the Eurodollar Futures curve the place the market’s expected federal funds charge is steepening (extra charge hikes), now expected to be over 4% within the 2nd half of of 2023. That’s in response to the Federal Reserve’s be pleased projections that they’ve told the market:

The S&P 500 Index now faces its fifth consecutive each day crimson candle and sits below some key technical areas that were maintaining as make stronger.

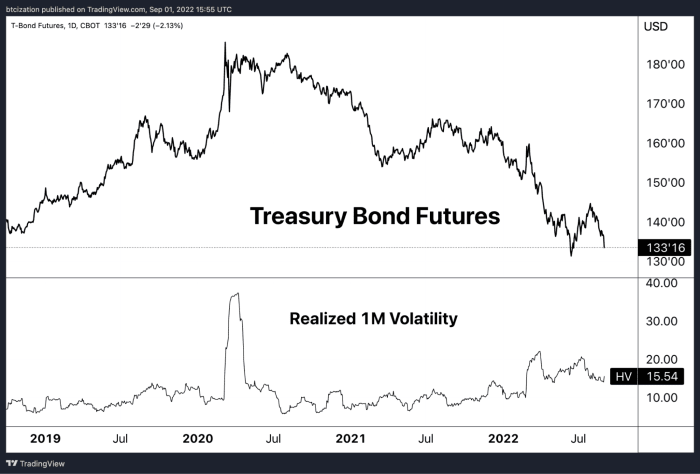

After months of compression, volatility is also on the pass with the VIX starting up to climb better alongside better 1-month realized volatility across bitcoin, equities and Treasury bond futures.

As we head into one other lengthy vacation weekend, it’s been an eventful day within the market with weak point and elevated promoting strain exhibiting up in a resolution of asset classes. About a of a truly worthy moves were persisted DXY strength as main market currencies continue to bleed in opposition to the U.S. buck and the upward thrust in sovereign debt yields with the U.S. 10-300 and sixty five days over 3.25%. Yields across main European economies (Germany, Italy, Spain and Greece) are transferring better in addition.

The argument for “rates absorb peaked” has thus far been a fallacious or on the least, early call, as the market has walked abet their consensus expectations for a Federal Reserve stop or pivot timeframe into early 2023. The thesis of a deflationary bust and fast return to a 2% inflation target continues to stare further away as a spread of the Federal Reserve board contributors are publicly emphasizing the absorb to stomp out inflation at all charges on a media screen-love tour, acknowledging that core complications absorb no longer abated. Jerome Powell’s Jackson Gap speech and Neal Kashkari’s fresh Oddlots look are clear examples of this.

Inflationary Undergo Market

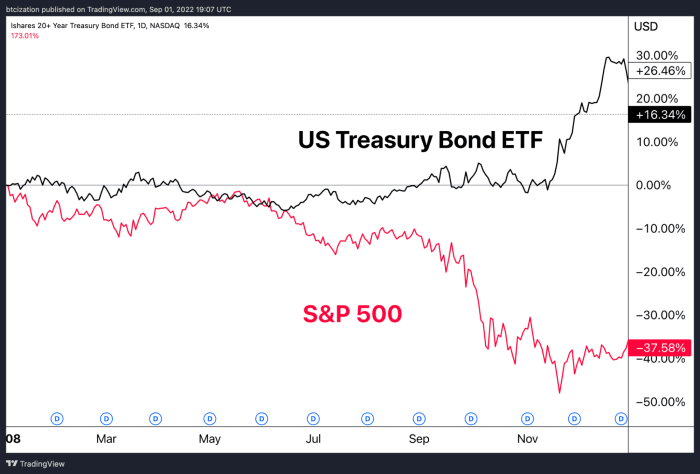

Comparisons to 2008 are faulty, which strategy of the diversified inflationary outlook and macroeconomic backdrop.

2022 is an inflationary undergo market, when when compared with 2008’s credit score-financed verbalize turned bust.

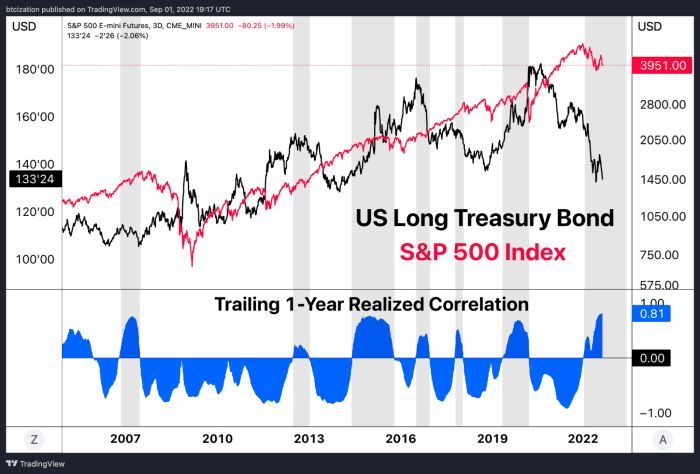

2008 was once a credit score-financed verbalize turned deflationary bust. 2022 is an inflationary undergo market, the place both equities and bonds absorb sold off in tandem. Out of the ordinary of the legacy financial and portfolio allocation is constructed upon the conclusion that bonds and stocks would possibly maybe maybe no longer raise a clear correlation to the downside, and portfolio managers “diversify” accordingly.

Equities and bonds were positively correlated over the final 300 and sixty five days all over a period the place equities went down. Here’s a prime for the submit quantitative easing fiat foreign money era.

In a prime for the submit-quantitative easing fiat foreign money era, equities and bonds were positively correlated as equities went down.

The clear correlation to the downside occurred again the day outdated to this, as bonds got smoked on a big pass to the downside. On the time of writing U.S. Treasury bond futures are -1.99% for an asset that traded with a volatility of 15.54% over the final month.