Residence » Training » Inquire of soundless dumb for US Ethereum ETFs one month after debut—here’s why

Sep. 5, 2024

Ethereum ETFs face regulatory hurdles and market downturns, impacting investor curiosity.

Key Takeaways

- Grayscale’s Ethereum ETF has viewed over $2.6 billion in outflows since its conversion.

- Regulatory uncertainty around staking functions impacts investor curiosity in Ethereum ETFs.

Half this article

The nine US change-traded funds (ETFs) monitoring the inform brand of Ethereum (ETH) were struggling to device contemporary capital since their loyal commence in dumb July.

Outflows from the Grayscale Ethereum Belief have contributed largely to the every day negative performance, with dumb quiz for other competing ETFs also taking half in a job.

In this article, we discuss the hot challenges dealing with inform Ethereum ETFs, their circumstances when when put next with inform Bitcoin ETFs, and the device in which they would well moreover be worthwhile with increased institutional adoption and regulatory developments.

Draw Ethereum ETF performance: a snapshot

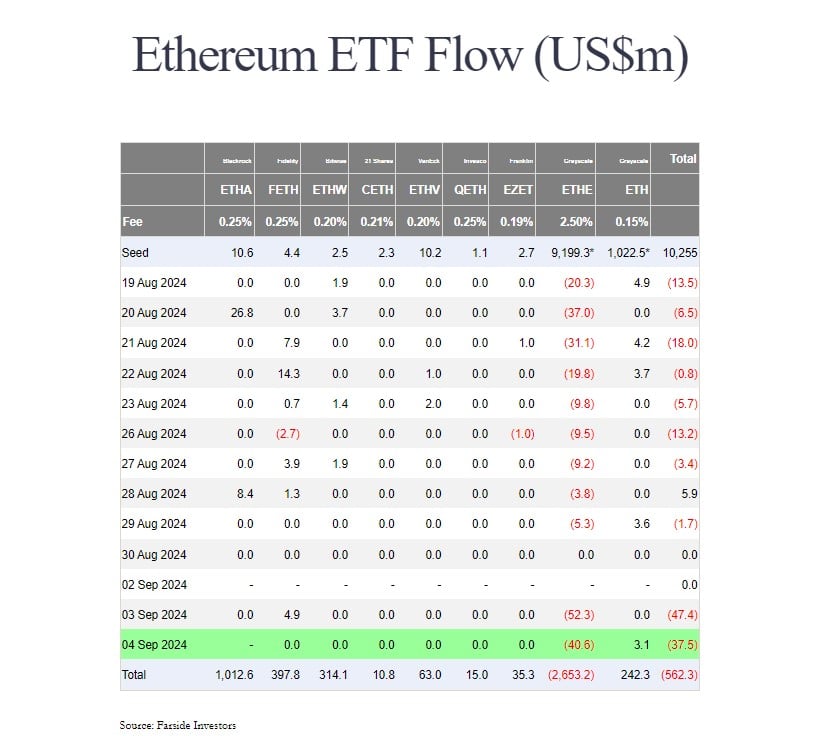

In step with knowledge from Farside Investors, Grayscale’s Ethereum fund, also identified as ETHE, has viewed over $2.6 billion in win outflows since it change into once converted into an ETF.

Grayscale has maintained a 2.5% price for its Ethereum ETF, which is ready ten cases dearer than other novices. Competitors love BlackRock and Fidelity cost around 0.25%, whereas others love VanEck and Franklin Templeton cost even much less.

Yet, the price building is now no longer the one factor that matters. Grayscale has provided a low-cost version of ETHE nonetheless it indubitably is soundless removed from competing with BlackRock’s Ethereum ETF.

BlackRock’s iShares Ethereum Belief (ETHA) has logged over $1 billion in win inflows since its commence. Alternatively, its performance has stagnated currently as it has experienced no flows for four straight days.

Three Ethereum ETFs trailing unhurried BlackRock’s ETHA are Ethereum’s FETH, Bitwise’s ETHW, and Grayscale’s BTC, with $397 million, $314 million, and $242 million in win inflows, respectively. With the exception of Grayscale’s ETHE, the remaining also reported minor gains over a month after their buying and selling debut.

Staking is regularly a giant deal that’s missing

Staking has became an integral piece of the Ethereum ecosystem after its landmark transition from the Proof-of-Work consensus mechanism to Proof-of-Stake. But the Securities and Commerce Commission’s (SEC) perceived stance on crypto staking has abominable ETF issuers from along side this scheme of their inform Ethereum ETF proposals.

Which means, all Ethereum merchandise went reside staking-free. The dearth of staking rewards would possibly well well more than seemingly diminish the nice looks of investing in Ethereum through ETFs for some, if now no longer many investors.

“An institutional investor taking a seek for at Ether knows that there are yields to be had,” said CoinShares’ McClurg. “It’s love a bond manager announcing I will aquire the bond, nonetheless I don’t prefer the coupon, which is counter to what you’re doing whenever you’re buying bonds.”

Equally, Chanchal Samadder, Head of Product at ETC Neighborhood, said holding an ETF without the staking yield is love proudly owning inventory without receiving a dividend.

Samadder believes that the lack of staking rewards would possibly well well more than seemingly deter some investors from Ethereum ETFs, as they essentially became love “a bond without a yield.”

No longer all consultants seek for the absence of staking in inform Ethereum ETFs as a vital problem.

There would possibly be a belief that total quiz for Ethereum will soundless lengthen as a result of introduction of these ETFs, even without staking rewards. The advent of inform Ethereum ETFs is anticipated to device a tall fluctuate of investors, along side these who would possibly well well more than seemingly no longer have previously engaged with crypto straight.

Nate Geraci, president of the ETF Retailer, believes staking in Ethereum ETFs is a subject of “when, now no longer if” because the regulatory ambiance evolves.

Lawful product, now no longer easy time?

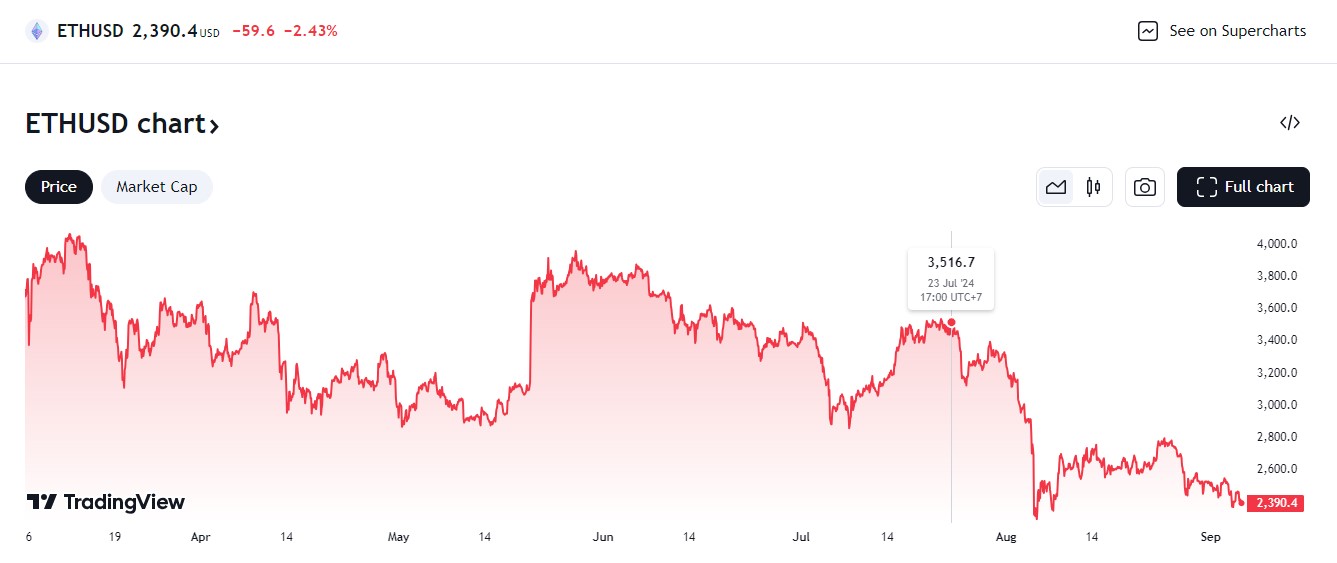

US inform Ethereum ETFs procedure at a now no longer easy time when the crypto market has entered a pointy correction.

In step with knowledge from TradingView, Ether has plunged around 30% since the commence of inform Ethereum ETFs, from around $3,500 on their debut date to $2,400 at press time.

The contemporary crypto market downturn and Wall Facet street inventory promote-offs have created additional be troubled all the device in which through crypto sources, and thus significantly impacted Bitcoin and Ethereum ETFs.

As of September 4, US inform Bitcoin ETFs hit a 6-day dropping lope, reporting over $800 million withdrawn all the device in which during the interval, Farside’s knowledge presentations.

Attainable for future growth

On the lope aspect, Ethereum ETF outflows are now no longer entirely unexpected. Certainly, Bloomberg ETF analyst Eric Balchunas estimated previously that Ethereum ETF inflows would possibly well well more than seemingly be lower than Bitcoin’s, in accordance to their assorted traits and market dynamics.

Analysis companies Wintermute and Kaiko also forecasted that Ethereum ETFs would possibly well well more than seemingly experience lower quiz than anticipated, expecting only $4 billion in inflows over the next three hundred and sixty five days. Since starting buying and selling, the crew of US inform Ethereum merchandise, other than Grayscale’s ETHE, has captured over $2 billion in inflows.

Whereas the preliminary performance of these funds has been mixed, their success would possibly well well very wisely be realized in some unspecified time in the future, especially because the crypto market recovers and investors became more delighted with this asset class.

As lengthy as Ethereum maintains its space as a number one blockchain platform, lengthy-timeframe Wall Facet street adoption would possibly well well more than seemingly force growth in Ethereum ETFs.

Half this article