Institutional passion in cryptocurrency skilled exponential pronounce in 2021, and firms like FalconX, a cryptocurrency substitute totally centered on providing monetary services and products to establishments include entrance-row seats to the roam.

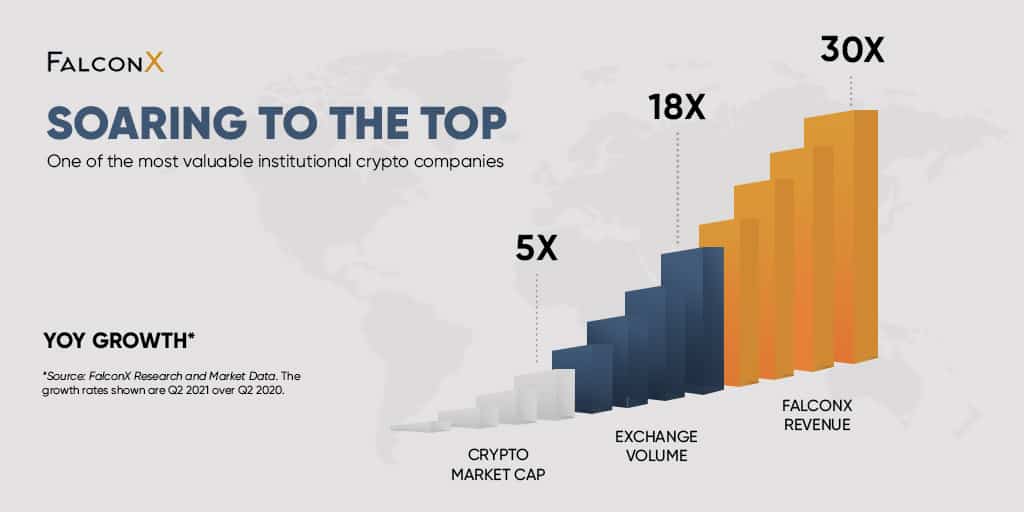

The corporate has viewed its obtain revenue grow 30x year-over-year, right this moment linked to the increased query for crypto from institutional traders. FalconX is opinion of as one in every of primarily the Most mighty institutional cryptocurrency firms, and its August 2021 $210M Series C build it at a $3.75 billion valuation.

The Series C used to be led by Altimeter Capital, B Capital Community, Sapphire Ventures and Tiger International with participation from Amex Ventures and Mirae Asset. This follows a $50 million Series B in March 2021, and an investment from Amex ventures in December 2020.

The pronounce of the FalconX platform, courtesy of the FalconX crew.

FalconX is uncommon in that it’s namely constructed for institutional traders, moderately than retail traders, a class centered by standard exchanges like Coinbase or Gemini (who moreover include institutional arms.)

“When FalconX began, the market used to be largely retail, our thesis used to be that if cryptocurrency went mainstream, the overwhelming majority of the quantity would be institutional,” says Aya Kantorovich, FalconX Head of Institutional Protection. “As you gaze in any varied aged asset class, up to now, that thesis has been true, as establishments include grown to express the broad majority of the quantity in the cryptocurrency market – we ask that construction to continue.”

Many institutional traders are with out discover sprinting into crypto making an try to secure outsized returns, portfolio diversification, and as an inflationary hedge.

By being the biggest institutional-simplest cryptocurrency monetary services and products company, Kantorovich believes, FalconX is positioned to refine the institutional client abilities with a high degree of granularity, exploring its product strains with both breadth and depth, and prioritize being the top for this reveal client persona.

FalconX makes utilize of machine discovering out to present establishments a single counterparty with entry to world cryptocurrency liquidity with 99.9%+ uptime. It affords a web interface, APIs, and 24/7/365 white-glove procuring and selling desk, and a credit ranking industrial to enable establishments to entry non everlasting financing for trades.

Aya Kantorovich, FalconX Head of Institutional Protection joins CoinCentral to chat about the institutional cryptocurrency investment panorama and FalconX’s plans for the long term.

What does the Head of Institutional Protection characteristic entail?

As the Head of Institutional Protection, my point of interest spans working with our potentialities on varied market systems, constructing the top abilities across product strains, and making particular now we include our pulse on our existing and future potentialities wants and wants.

At the present time, this expands across the globe with client personas starting from the sector’s biggest monetary establishments, hedge funds, asset managers, mission capital firms, fee services and investment purposes.

FalconX is plan-constructed for the sector’s leading institutional cryptocurrency market contributors. We’re dedicated to providing establishments with a single counterparty with entry to world cryptocurrency liquidity with 99.9%+ uptime through its web interface, APIs, and 24/7/365 white glove procuring and selling desk, and my work touches all functions of our product and potentialities on each day foundation.

Congratulations on the grand spherical! What are the next steps for FalconX?

FalconX will utilize this fresh investment to lengthen product strains, explore strategic acquisitions and hire distinctive abilities across the globe. We are angry to take care of constructing across our technical infrastructure and grow our teams of folks worldwide, taking half in an very famous and active characteristic to enable establishments in the industrial’s evolution.

FalconX plans to formally utter quite a lot of fresh product offerings in the coming months, every of that are currently live, rising immediate, and profitable.

How make you gaze institutional passion in cryptocurrency rising in the damage?

Passe establishments began to in fact earn all for cryptocurrency investments in late 2020. While in the origin starting with Bitcoin, now we include viewed these establishments continue to lengthen first to Ethereum and later to varied protocols such as Solana and Terra. What this manner is that whereas they’ll include joined per the inflation hedge myth, they’re expanding after seeing the staunch adoption and utilize cases of assorted blockchains to replace the model sources and value is exchanged and settled.

As the sector and markets continue to tokenize, the infrastructure produced from crypto can reimagine how establishments capture and ship monetary services and products.

FalconX is uniquely positioned to present establishments the potential to participate in this ecosystem. We’ve viewed query and fervour from a tall characteristic of establishments, including the sector’s biggest monetary establishments, hedge funds, asset managers, mission capital firms, and fee services. Staunch now in our client depraved, we’re seeing a roughly 50/50 cut up between crypto native and former monetary establishments.