The week initiating Might well also 5 and ending Might well also 11 witnessed undoubtedly one of the most ideal crashes in the history of cryptocurrency. While the shatter used to be devastating for retail traders, it appears to be like to be relish it used to be all however a possibility for the institutional traders who made the most of it.

Institutions Catch the Gravy

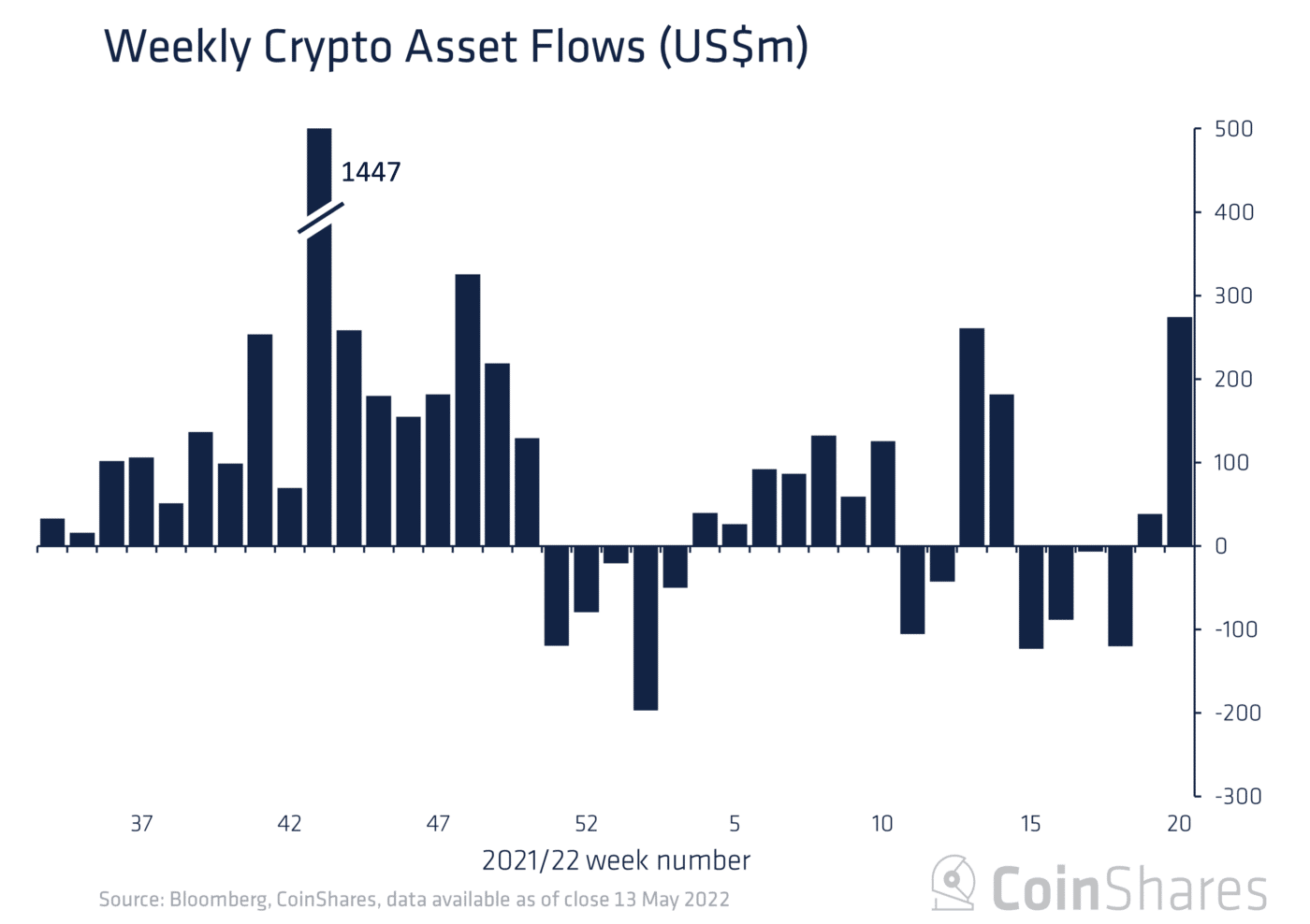

In response to the CoinShares fund creep with the jog document, digital investments, in the week ending Might well also 13, seen the ideal inflows from institutional traders in over 5 months.

Regardless of their statements, institutional traders are lengthy on crypto as they construct became all straight away around bullish or extremely bearish phases, right as they did sometime of the March-pause rally.

This week raking in $274 million payment of cryptocurrencies, this cohort of traders managed to flip the month-lengthy pattern from receding bearish to highly bullish.

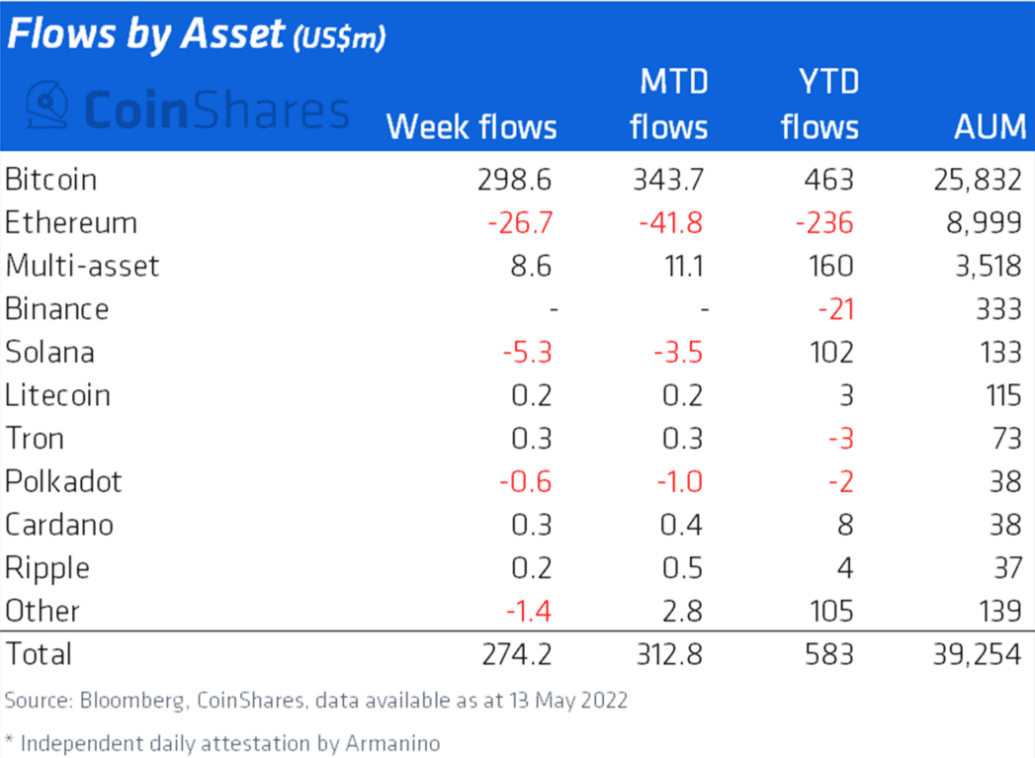

But even sometime of this replace, there used to be one repeated instance of a particular cryptocurrency noticing no hobby from these traders – Ethereum.

The king of altcoins used to be now not completely now not in their accumulation list, however institutions in truth ended up dumping over $26.7 million payment of ETH over the week.

This introduced the year-to-date flows of Ethereum to a staggering $236 million in outflows. Even the likes of Cardano and Litecoin are silent noting inflows after 5 months.

Nonetheless, this lack of hobby isn’t fresh, as Ethereum has been out of the institutions’ books for the reason that initiating of the year.

The disinterest has metastasized to about a degree where Ethereum’s outflows are payment better than all other sources’ combined get flows.

Now there is a possibility that this disinterest is potentially originating from the upcoming Merge. The transition to ETH 2.0 to order the blockchain right into a Proof-of-Stake consensus from the sizzling Proof-of-Work consensus has been an awaited moment in the crypto assign for over a year.

Alongside with it will most likely per chance per chance per chance reach something is legendary as a “mission bomb”, that can usually amplify the mining mission to about a degree where mining a block using proof-of-work will became now not capacity.

But whereas neither of the events’ dates has been launched, it is protecting traders, traders, and developers alike on their toes.

This will seemingly be what’s protecting the institutions’ cohort worried, as the hype could per chance pause up turning Ethereum into every other instance of Cardano accurate after the trim contract enhance.

The advent of DeFi on Cardano in September 2021 used to be hyped to the point where its anticipation placed ADA at a ticket of $3.16. But as DeFi style took time to engage off, traders misplaced hobby, and Cardano hasn’t stopped declining on the charts since.

If something identical occurs with Ethereum around the Merge, it will most likely per chance per chance well accumulate apart traders in lots of losses.

But the probabilities of that occuring are slim accurate now.

Ethereum Calm Has Some Time

Originally as per the on-chain records, the community is now not taking a blueprint at any significant losses accurate now. Though the events of Might well also 12 did engage a appreciable portion of Ethereum’s offer , most of it managed to accumulate better from the losses.

Even for the time being of all of Ethereum’s traders, completely 38% of them are in outright losses, whereas practically 60% of them are in profit. Though the 38% does bid over 30 million addresses, the focus is silent lower than many other altcoins.

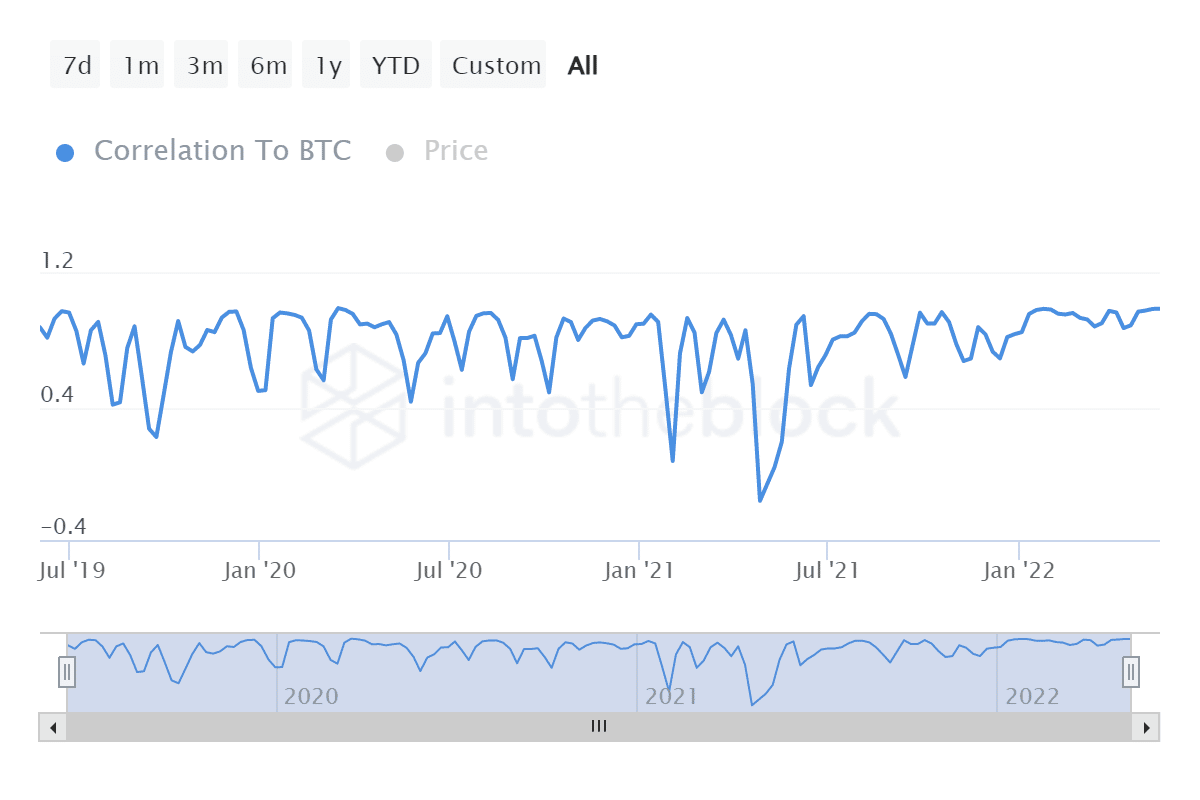

Secondly, strictly from an investment standpoint, Ethereum is dash to soar assist, given its correlation to Bitcoin. The safest route for Ethereum sometime of unstable classes is to have a examine the king coin’s lead, as that could per chance assist cease hastily recovery when Bitcoin rallies as properly.

Thirdly, Ethereum’s traders are now not giving up either. Regardless of all that has took place for the reason that initiating of the year, now not one ETH holder has exited the market, which affords Ethereum the accurate toughen wished to soar assist.

Thus as lengthy as Ethereum maintains its fresh space, it will most likely per chance per chance per chance successfully attain the Merge whereas silent protecting its traders from deserting the community.