With the worth of bitcoin hovering with regards to $50,000, momentum has returned to the market and stable arms enjoy gathered extra bitcoin than ever. A 2013-model double bubble is in the cards.

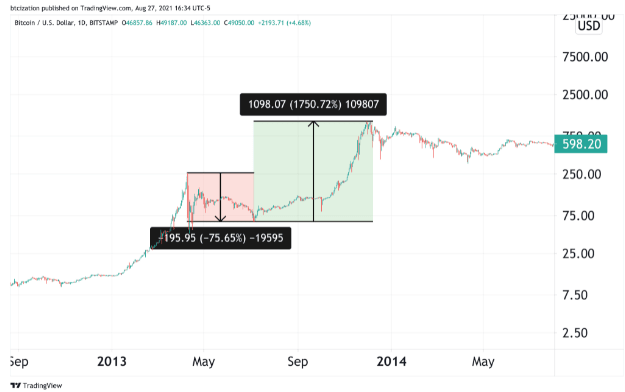

The 2013 cycle saw the worth of bitcoin intention down 75% from the highs sooner than rallying a staggering 1,750% in no longer up to 6 months. We are no longer suggesting that the rally will occur again with the identical performance, however rather an explosive “double bubble” all via the venerable four-year enhance-and-bust cycle.

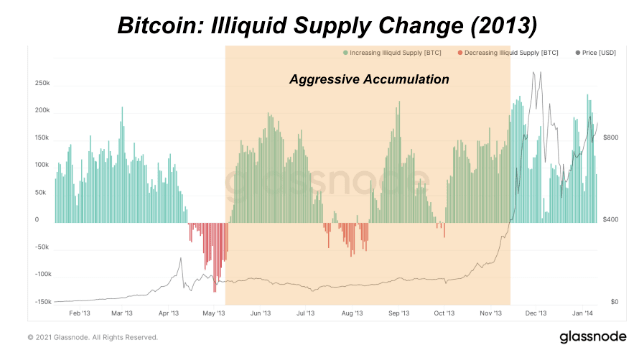

The market has long gone via moderately a the same cycle when put next with 2013 as neatly, with an initial parabolic flee up, a sparkling quantity of coins changing into liquid sooner than an aggressive reaccumulation and parabolic flee up.

If bitcoin continues to transfer to stable arms on the fresh stagger, a parabolic flee-up will commence that most on this planet can not fathom. Bitcoin, at nearly a $1 trillion asset this day, can elevate to a $5 trillion asset in 2022 with relative ease.

In any case, $1 of capital that flows into bitcoin adds some distance better than neutral correct $1 of market cap to the asset, and for the length of a bull market when most market individuals are retaining, the market cost to realized cost of bitcoin explodes upwards. If 1% of capital flows out of world debt funds into bitcoin as a safe haven, because the global economy experiences big offer chain disruptions causing rising costs across the board.