That is an thought editorial by Taimur Ahmad, a graduate pupil at Stanford College, specializing in vitality, environmental coverage and international politics.

Creator’s level to: That is the fundamental segment of a 3-segment publication.

Fragment 1 introduces the Bitcoin favorite and assesses Bitcoin as an inflation hedge, going deeper into the belief that of inflation.

Fragment 2 specializes in the present fiat plot, how cash is created, what the cash supply is and begins to observation on bitcoin as cash.

Fragment 3 delves into the historical past of cash, its relationship to enlighten and society, inflation in the Global South, the revolutionary case for/against Bitcoin as cash and replace use-cases.

Bitcoin As Money: Progressivism, Neoclassical Economics, And Picks Fragment I

Prologue

I once heard a story that enlighten me on my dash to set up out and designate cash. It goes one thing love:

Take into consideration a vacationer involves a itsy-bitsy, rural town and stays on the native inn. As with every respectable region, they’re required to pay 100 diamonds (that’s what the town makes use of as cash) as a break deposit. The next day, the inn proprietor realizes that the vacationer has all of sudden left town, leaving in the serve of the 100 diamonds. On condition that it’s a long way never going the vacationer will project serve, the proprietor is elated at this flip of occasions: a 100 diamond bonus! The proprietor heads to the native baker and pays off their debt with this extra cash; the baker then goes off and pays off their debt with the native mechanic; the mechanic then pays off the tailor; and the tailor then pays off their debt on the native inn!

This isn’t the entirely elated ending although. The next week, the identical vacationer comes serve to steal up some bags that had been left in the serve of. The inn proprietor, now feeling disagreeable for peaceful having the deposit and liberated from paying off their debt to the baker, decides to remind the vacationer of the 100 diamonds and hand them serve. The vacationer nonchalantly accepts them and remarks “oh these had been ultimate glass anyways,” sooner than crushing them underneath his feet.

A deceptively straightforward memoir, but frequently laborious to wrap my head around it. There are such a huge amount of questions that design up: if all people in the town was once in debt to every other, why couldn’t they ultimate rupture it out (coordination anxiousness)? Why had been the townsfolk paying for products and companies to every other in debt — IOUs — however the vacationer was once required to pay cash (belief anxiousness)? Why did nobody take a look at whether the diamonds had been accurate, and must peaceful they’ve even supposing they wished (standardization/quality anxiousness)? Does it topic that the diamonds weren’t accurate (what after all is cash then)?

Introduction

We are in the center of a poly-crisis, to borrow from Adam Tooze. As cliché because it sounds, favorite society is a foremost inflection level true by map of multiple, interconnected fronts. Whether or no longer it’s the international financial plot — the U.S. and China taking part in complementary roles as user and producer respectively — the geopolitical interpret — globalization in a unipolar world — and the ecological ecosystem — cheap fossil gas vitality fueling mass consumption — the foundations atop which the past few a long time had been constructed are permanently difficult.

The benefits of this largely stable plot, although unequal and at huge payment to many social teams, equivalent to low inflation, international supply chains, a semblance of belief, and so on., are fleet unraveling. That is the time to query gigantic, predominant questions, most of which we had been too jumpy or too distracted to query for a extremely very long time.

The premise of cash is on the center of this. Right here I don’t indicate wealth basically, which is the topic of many discussions in favorite society, but quite the belief that of cash. Our focal level is every so frequently on who has how worthy cash (wealth), how we can secure extra of it for ourselves, asking is the present distribution ultimate, and so on. Beneath this discourse is the assumption that cash is a largely inert thing, nearly a sacrilegious object, that will get moved around each day.

Within the past few years, nevertheless, as debt and inflation possess become extra pervasive topics in mainstream discourse, questions around cash as a view possess garnered increasing consideration:

- What is cash?

- Where does it design from?

- Who controls it?

- Why is one thing cash however the replace isn’t?

- Does/can it change?

Two solutions and theories which possess dominated this conversation, for higher or for worse, are Contemporary Monetary Theory (MMT) and replace currencies (mostly Bitcoin). On this piece, I will be essentially specializing in the latter and critically analyzing the arguments underpinning the Bitcoin favorite — the belief that we must peaceful replace fiat currency with Bitcoin — its doable pitfalls, and what replace roles Bitcoin will possess. This would possibly maybe maybe well also additionally be a critique of neoclassical economics which governs mainstream discourse open air the Bitcoin crew but additionally forms the muse for quite a lot of arguments on top of which the Bitcoin favorite rests.

Why Bitcoin? When I bought exposed to the crypto crew, the mantra I realized was once “crypto, no longer blockchain.” While there are deserves to that, for the categorical use-case of cash especially, the mantra to focal level on is “Bitcoin, no longer crypto.” That is a extremely important level on myth of commentators open air the crew too frequently conflate Bitcoin with other crypto resources as segment of their opinions. Bitcoin is largely the most easy after all decentralized cryptocurrency, with out a pre-mine, and with mounted rules. While there are rather a lot of speculative and questionable projects in the digital asset build, as with other asset courses, Bitcoin has neatly established itself to be a if truth be told revolutionary abilities. The proof-of-work mining mechanism, that regularly comes underneath attack for vitality use (I wrote against that and outlined how BTC mining helps ravishing vitality right here), is integral to Bitcoin standing other than other crypto resources.

To repeat for the sake of clarity, I will be purely specializing in Bitcoin simplest, particularly as a monetary asset, and mostly analyzing arguments coming from the “revolutionary” whisk of Bitcoiners. For most of this piece, I will be referring to the monetary plot in Western nations, specializing in the Global South on the tip.

Since this would possibly maybe maybe well also be a long, infrequently meandering, enlighten of essays, let me provide a hasty summary of my views. Bitcoin as cash does no longer work on myth of it’s a long way never an exogenous entity that would possibly maybe maybe well even be programmatically mounted. Equally, assigning moralistic virtues to cash (e.g. sound, ultimate, and so on.) represents a misunderstanding of cash. My argument is that cash is a social phenomenon, coming out of, and in some suggestions representing, socioeconomic family people, energy constructions, and so on. The topic cloth truth of the world creates the monetary plot, no longer vice versa. This has frequently been the case. Therefore, cash is a view frequently in flux, basically so, and must be elastic to absorb the complex movements in an financial system, and must be flexible to adjust to the idiosyncratic dynamics of every society. Lastly, cash cannot be separated from the political and acceptable institutions that fabricate property rights, the market, and so on. If we are looking to change the damaged monetary plot of as of late — and I agree it’s damaged — we must focal level on the ideological framework and institutions that form society so we can higher use present instruments for higher ends.

Disclaimer: I support bitcoin.

Critique Of The Contemporary Monetary System

Proponents of the Bitcoin favorite compose the next argument:

Authorities set watch over of the cash supply has ended in rampant inequality and devaluation of the currency. The Cantillon stay is with out doubt some of the fundamental drivers in the serve of this rising inequality and financial distortion. The Cantillon stay being an lengthen of cash supply by the enlighten favors of us who are shut to the centers of energy on myth of they secure secure entry to to it first.

This lack of accountability and transparency of the monetary plot has ripple effects during the socioeconomic plot, including reducing shopping energy and limiting the saving capabilities of the rather a lot. Therefore, a programmatic monetary asset that has mounted rules of issuance, low barriers to entry and no governing authority is required to counter the pervasive effects of this harmful monetary plot which has created a frail currency.

Old to I start up to evaluate these arguments, it’s foremost to situate this lunge in the increased socioeconomic and political constructing we stay in. For the past 50-odd years, there is after all in depth empirical evidence to uncover that accurate wages had been stagnant even when productivity has been rising, inequality has been surging increased, the financial system has been extra and extra financialized which has benefited the neatly off and asset homeowners, monetary entities had been focused on harmful and felony actions and many of the Global South has suffered from financial turmoil — excessive inflation, defaults, and so on., — underneath an exploitative international monetary plot. The neoliberal plot has been unequal, oppressive and duplicitous.

At some stage in the identical duration, political constructions had been faltering, with even democratic nations having fallen victim to enlighten accumulate by the elite, leaving itsy-bitsy build for political change and accountability. Therefore, while there are many neatly off proponents of Bitcoin, a foremost share of these arguing for this fresh favorite would possibly maybe maybe well even be viewed as of us who had been “left in the serve of” and/or acknowledge the grotesqueness of the present plot and are merely looking out how out.

It’s miles needed to comprehend this as an clarification to why there is an increasing replace of “progressives” — loosely outlined as of us arguing for some possess of equality and justice — who are turning into pro-Bitcoin favorite. For a long time, the inquire of of “what’s cash?” or the fairness of our monetary plot has been barely absent from mainstream discourse, buried underneath Econ-101 fallacies, and confined to mostly ideological echo chambers. Now, as the pendulum of historical past turns serve in the direction of populism, these questions possess become mainstream all but again, but there is a dearth of these in the knowledgeable class that can sufficiently be sympathetic in the direction of, and coherently acknowledge to, of us’s concerns.

Therefore, it’s serious to comprehend where this Bitcoin favorite story emerges from and to no longer outrightly push apart it, even supposing one disagrees with it; quite, we must acknowledge that a host of us skeptical of the present plot portion plenty better than we disagree upon, no longer lower than at a fundamental principles level, and that participating in debate past the surface level is largely the most easy formula to rob collective judgment of appropriate and unsuitable to a stage that makes change that that it’s seemingly you’ll well imagine.

Is A Bitcoin Fashioned The Resolution?

I will are attempting and address this inquire of at varied phases, starting from the extra operational ones equivalent to Bitcoin being an inflation hedge, to the extra conceptual ones equivalent to the separation of cash and The Mutter.

Bitcoin As An Inflation Hedge

That is an argument that’s widely outdated in the crew and covers a replace of aspects important to Bitcoiners (e.g., protection against lack of shopping energy, currency devaluation). Up till last twelve months, the favorite claim was once that as prices are frequently going up underneath our inflationary monetary plot, Bitcoin is a hedge against inflation as its stamp goes up (by orders of magnitude) better than the price of products and products and companies. This frequently appeared love an odd claim on myth of for the length of this era, many risk resources conducted remarkably neatly, and but they don’t appear to be deemed as inflation hedges in any formula. And additionally, developed economies had been working underneath a secular low inflation regime so this claim was once by no formula after all tested.

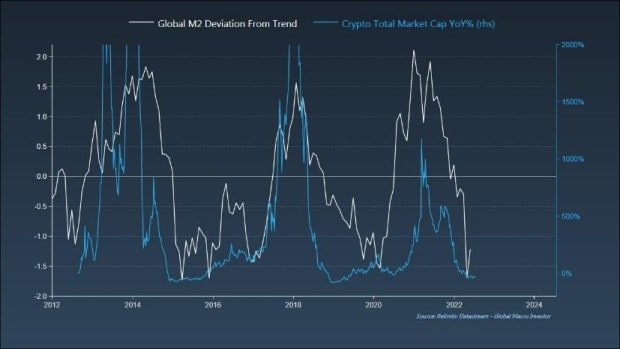

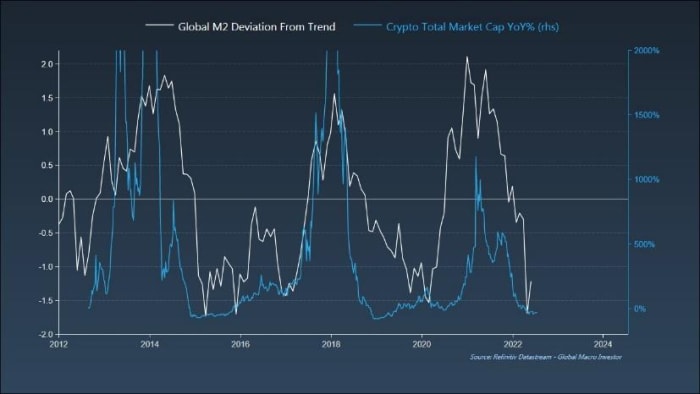

More importantly although, as prices surged increased over the last twelve months and Bitcoin’s stamp plummeted, the argument shifted to “Bitcoin is a hedge against monetary inflation,” meaning that it doesn’t hedge against a upward thrust in the price of products and products and companies per se, but against the “devaluation of currency by map of cash printing.” The chart underneath is outdated as evidence for this claim.

That is additionally a odd argument for multiple causes, every of which I will show in extra detail:

- All of it but again depends on the claim that Bitcoin is uniquely a “hedge” and no longer merely a risk-on asset, identical to other excessive-beta resources which possess conducted neatly over courses of increasing liquidity.

- It depends on the monetarist belief that lengthen in the cash supply straight and imminently ends in an lengthen in prices (if no longer, then why conclude we care concerning the cash supply to start up with).

- It represents a misunderstanding of M2, cash printing, and where cash comes from.

1. Is Bitcoin Merely A Threat-On Asset?

On the fundamental level, Steven Lubka on a fresh episode of the What Bitcoin Did podcast remarked that Bitcoin was once a hedge against inflation ended in by map of vulgar monetary growth and no longer when that inflation was once supply-aspect, which, as he rightly identified, is the present topic. In a fresh piece on the identical topic, he responds to the critique that other risk-on resources additionally stride up for the length of courses of monetary growth by writing that Bitcoin goes up better than other resources and that simplest Bitcoin must peaceful be regarded as as a hedge on myth of it’s “ultimate cash,” while other resources are no longer.

Nonetheless, the extent to which an asset’s stamp goes up shouldn’t topic as a hedge so long because it’s positively correlated to the price of products and products and companies; I’d even argue that stamp going up too worthy — admittedly subjective right here — pushes an asset from a hedge to speculative. And sure, his level that resources love shares possess idiosyncratic dangers love disagreeable administration choices and debt loads that compose them distinctly varied to Bitcoin is correct, but other components equivalent to “risk of obsolescence,” and “other accurate-world challenges,” to quote him straight, practice to Bitcoin as worthy as they practice to Apple stock.

There are a host of other charts that uncover Bitcoin has a solid correlation with tech shares in explicit, and the fairness market extra broadly. The truth is that the last using element in the serve of its stamp motion is the change in international liquidity, particularly U.S. liquidity, on myth of that is what decides how a long way true by map of the probability curve investors are attractive to push out. In times of crisis, equivalent to now, when safe haven resources love the USD are having a solid flee, Bitcoin is now not any longer taking part in a identical feature.

Therefore, there doesn’t seem like any analytical cause that Bitcoin trades another way to a risk-on asset using liquidity waves, and that it will peaceful be handled, merely from an investment level of learn about, as anything varied. Granted, this relationship would possibly maybe maybe well also change in due route but that’s for the market to steal.

2. How Fabricate We Give an explanation for Inflation And Is It A Monetary Phenomenon?

It’s serious to the Bitcoiner argument that increases in cash supply ends in currency devaluation, i.e., that it’s seemingly you’ll well buy less goods and products and companies as a result of increased prices. Nonetheless, this is laborious to even center as an argument on myth of the definition of inflation appears to be like to be in flux. For some, it’s merely an lengthen in the price of products and products and companies (CPI) — this appears to be like love an intuitive view on myth of that’s what of us as customers are most exposed to and care about. The opposite definition is that inflation is an lengthen in the cash supply — correct inflation as some call it — no topic the impression on the price of products and products and companies, even supposing this must peaceful result in stamp increases finally. That is summarized by Milton Friedman’s, now meme-ified in my learn about, quote:

“Inflation is frequently and by map of the region a monetary phenomenon in the sense that it’s and would possibly maybe maybe well even be produced simplest by a extra quick lengthen in the amount of cash than in output.”

Okay so let’s are attempting and comprehend this. Heed increases as a result of non-monetary causes, equivalent to supply chain points, are no longer inflation. Heed increases as a result of an growth of the cash supply are inflation. That is in the serve of Steve Lubka’s level, no longer lower than how I understood it, about Bitcoin being a hedge against correct inflation but no longer the present bout of supply-chain ended in excessive prices. (Sign: I am the use of his work particularly on myth of it was once neatly articulated but many others in the build compose a identical claim).

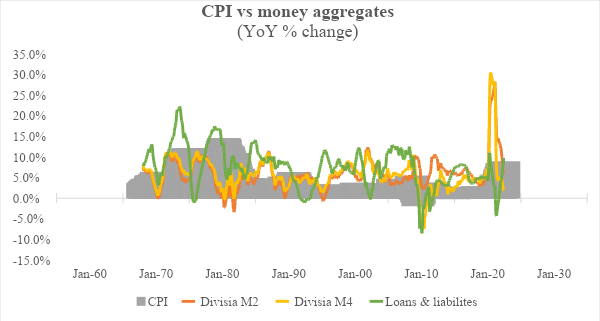

Since nobody is arguing the stay of supply chain and other bodily constraints on prices, let’s focal level on the 2nd insist. However why does change in the cash supply even topic except it’s tied to a transformation in prices, no topic when these stamp changes happen and how asymmetric they’re? Right here’s a chart displaying annual share change in varied measures of the cash supply and CPI.

Technical level to: M2 is a narrower measure of cash supply than M4 as the light does no longer encompass extremely liquid cash substitutes. Nonetheless, the Federal Reserve in the U.S. simplest provides M2 info as the broadest measure of cash supply as a result of the opaqueness of the monetary plot which limits moral estimation of the ample cash supply. Also, right here I use the Divisia M2 on myth of it affords a methodologically superior estimation (by applying weight to varied forms of cash) rather then the Federal Reserve’s formula which is a easy-sum common (regardless, the Fed’s M2 info is closely aligned with Divisia’s). Loans and leases is a measure of bank credit, and as banks fabricate cash after they lend rather then recycling financial savings, as I show later, this is famous to add as neatly.

We are able to glimpse from the chart that there is frail correlation between changes in cash supply and CPI. From the mid-1990s till the early 2000s, the price of change of cash supply is increasing while inflation is trending lower. The reverse is correct in the early 2000s when inflation was once picking up but cash supply was once coming down. Publish-2008 presumably stands out basically the most on myth of it was once the starting up up of the quantitative easing regime when central bank steadiness sheets grew at unprecedented rates and but developed economies frequently did now not meet their possess inflation targets.

One doable counterargument to this is that inflation would possibly maybe maybe well even be uncover in accurate property and shares, which had been surging increased by map of most of this era. While there is an positively solid correlation between these asset prices and M2, I don’t judge stock market appreciation is inflation on myth of it does no longer impression the shopping energy of clients and as a result of this truth, does no longer require a hedge. Are there distributional points that result in inequality? Fully. However for now I are looking to focal level on the inflation narratively exclusively. With regards to housing prices, it’s sophisticated to depend that as inflation on myth of accurate property is a foremost investment automotive (which is a deep structural anxiousness in and of itself).

Therefore, empirically there is never a foremost evidence that an lengthen in M2 basically ends in an lengthen in CPI (it’s price reminding right here that I am specializing in developed economies essentially and must peaceful address the topic of inflation in the Global South later). If there was once, Japan wouldn’t be caught in a low inflationary financial system, neatly underneath its inflation scheme, no topic the growth of the Bank of Japan steadiness sheet over the last few a long time. The present inflationary bout is as a result of vitality prices and provide chain disruptions, which is why nations in Europe — with their excessive dependence on Russian gas and poorly thought-out vitality coverage — for instance, are facing increased inflation than other developed nations.

Sidenote: it was once attention-grabbing to search Peter McCormack’s response when Jeff Snider made a identical case (referring to M2 and inflation) on the What Bitcoin Did podcast. Peter remarked how this made sense but felt so counter to the existing story.

Although we steal the monetarist belief as correct, let’s secure into some specifics. The main equation is MV = PQ.

M: cash supply.

V: flee of cash.

P: prices.

Q: quantity of products and products and companies.

What these M2 based fully charts and analyses leave out is how the flee of cash changes. Purchase 2020 for instance. The M2 cash supply surged increased as a result of the fiscal and monetary response of the authorities, leading many to predict hyperinflation true by map of the nook. However while M2 increased in 2020 by ~25%, the flee of cash diminished by ~18%. So even taking the monetarist belief at face price, the dynamics are extra sophisticated than merely drawing a causal link between cash supply lengthen and inflation.

As for folk who will bring up the Webster dictionary definition of inflation from the early 20th century as an lengthen in cash supply, I’d scream that regulate in cash supply underneath the gold favorite meant one thing entirely varied to what it’s as of late (addressed subsequent). Also, Friedman’s claim, which is a core segment of the Bitcoiner argument, is mostly a truism. Yes, by definition increased prices, when no longer as a result of bodily constraints, is when extra cash is chasing the identical goods. However that does no longer in and of itself translate to the truth that lengthen in the cash supply necessitates an lengthen in prices on myth of that extra liquidity can liberate spare skill, result in productivity beneficial properties, expand the usage of deflationary applied sciences, and so on. That is a central argument for (trigger warning right here) MMT, which argues that focused use of fiscal spending can expand skill, particularly by map of targeting the “reserve army of the unemployed,” as Marx called it, and the use of them rather then treating them as sacrificial lambs on the neoclassical altar.

To bring this present a shut then, it’s laborious to comprehend how inflation is, for all intents and applications, anything varied to an lengthen in CPI. And if the monetary growth ends in inflation mantra does no longer support, then what’s the merit in the serve of Bitcoin being a “hedge” against that growth? What precisely is the hedge against?

I will admit there are a plethora of points with how CPI is measured, nevertheless it’s gross that changes in prices happen as a result of a myriad of causes true by map of the ask-aspect and provide-aspect spectrum. This truth has additionally been famed by Powell, Yellen, Greenspan, and other central bankers (finally), while varied heterodox economists had been arguing this for a few years. Inflation is a remarkably sophisticated view that can now not be merely reduced to monetary growth. Therefore, this calls into inquire of whether Bitcoin is a hedge against inflation if it’s a long way never defending price when CPI is surging, and that this belief of hedging against monetary growth is ultimate chicanery.

In Fragment 2, I show the present fiat plot, how cash will get created (it’s no longer the total authorities’s doing), and what Bitcoin as cash would possibly maybe maybe well lack.

That is a guest put up by Taimur Ahmad. Opinions expressed are entirely their possess and prevent no longer basically mirror these of BTC, Inc. or Bitcoin Magazine.