Right here’s an belief editorial by Kudzai Kutukwa, a passionate monetary inclusion imply who modified into as soon as identified by Rapidly Firm journal as in fact one of South Africa’s high-20 younger entrepreneurs beneath 30.

Privateness is an essential human appropriate that’s now being taken with no consideration. It’s now not about having something to shroud, but about exercising the ability to selectively show camouflage yourself to the field and thus securing autonomy over your have lifestyles. Doorways, locks, windows, safes and drapes are about a of the devices we expend in the bodily realm to guard our privateness. Sadly we now reside in a society in which privateness has been overcome by the compulsion for sharing and transparency. The records superhighway in its contemporary create is deficient in client privateness and modified into as soon as now not developed with sturdy privateness protections from the onset. Our personal files is the “new oil” and is ripe for exploitation by the recount, Tall Tech and hackers. Sharing has turn out to be the default thanks to the offer of digital instruments that allow one to fraction every thing from precious moments to steady places.

Whereas social media platforms salvage made verbal change over lengthy distances noteworthy more straightforward, the digital footprints being generated online, day-after-day by billions of folk compromise their privateness — and by extension their personal security — in a gigantic various of the way. Records hacks, online stalking, cyberbullying and phishing attacks are all but about a examples. Nonetheless, thanks to the aforementioned sharing custom, the want to recall care of privateness is frowned upon and deemed suspicious. In spite of every thing, why would you would possibly like privateness would maybe salvage to you have not got something else to shroud? With out privateness we proceed to reside beneath the counterfeit phantasm of freedom, whereas our risk-making is remotely controlled by those accumulating our files. Privateness is neither illegal nor is it a luxury. Privateness is an main prerequisite for freedom.

Till now not too lengthy ago monetary privateness modified into as soon as the default attributable to the intensive expend of commodity cash equivalent to gold and later on after that, cash. You would maybe freely transact without revealing any personal files to retailers or exposing any of your purchases to the monetary institution. In contemporary years, alternatively, the usage of cash has been gradually declining (and monetary privateness in conjunction with it) attributable to the upward push of various digital price channels and in some instances attributable to upright restrictions. The inspiration in the support of those restrictions being that they’re a tool for combating tax evasion, cash laundering and organized crime. Even even though digital price channels are much less non-public than cash, there are guidelines and barriers on who can access your monetary files, and there are upright processes that would maybe salvage to be adopted earlier than any disclosure of your monetary files to a third event by a monetary establishment. Whereas now not foolproof, they did issue classic monetary privateness protection. As a pseudonymous currency, Bitcoin transactions are public by default and would maybe additionally be considered by anyone and each person. In case your identity would maybe well be tied to a insist Bitcoin “pockets address” your monetary lifestyles (insofar as that bitcoin pockets is concerned) is now permanently in the public enviornment, with no upright processes required to access that files. Right here’s the predominant reason why functions and companies and products that offer protection to the privateness of cryptocurrency transactions are being centered by governments globally.

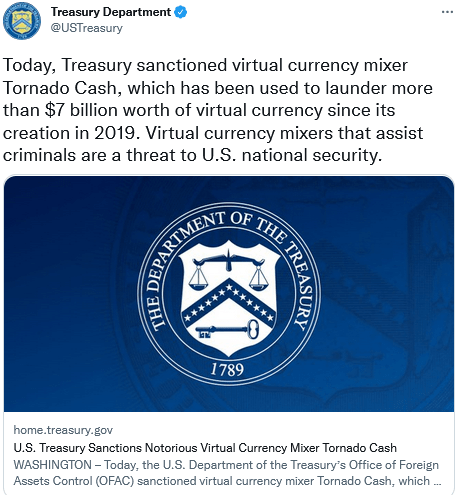

On 8 August 2022, the US Treasury’s Office For Sources Regulate (OFAC) sanctioned Twister Money (TC), an Ethereum tidy contract mixer, that lets in folk to offer protection to their monetary privateness online, and added it to the Namely Designated Nationals (SDN) Checklist. This effectively skill that American voters, residents and entities are banned from interacting with TC in any methodology. Privateness-enabling instruments admire TC allow folk to transact without exposing their total monetary exercise. In assorted phrases they’re worthwhile for the preservation of commercial privateness the effect transactions on-chain are concerned. Primarily basically based on OFAC, TC modified into as soon as allegedly mature to launder cryptocurrency rate $455 million that modified into as soon as hacked from Axie Infinity’s Ronin Bridge protocol by the North Korean authorities-backed hacker group the Lazarus neighborhood. OFAC had previously sanctioned the Lazarus neighborhood in 2019 and further system out that TC additionally obtained funds that were hacked from the Solidarity bridge in June moreover to the Nomad bridge.

Historically, folks or entities were the target of OFAC sanctions, alternatively what’s weird and wonderful about this insist scenario is that TC is neither a natural particular person or a juristic particular person, it’s starting up-offer code. Code is speech (Bernstein v. DOJ) and is thus safe by the First Amendment. In the identical methodology that a written musical safe is rate it for verbal change amongst musicians, code is additionally “an expressive skill for the change of files and suggestions,” amongst computer programmers (Junger v. Daley). Therefore, the advent and sharing of starting up-offer code is safe by the First Amendment, merely admire the advent and sharing of tune, books and flicks.

Delivery-offer code is free to be utilized by anyone and because no commercial intention accrues to its publishers, it’s therefore a public appropriate. The banking machine, files superhighway and roads are all public items which shall be mature by legislation-abiding voters and criminals alike, but wicked actors are the ones which shall be centered, now not the infrastructure. Even SWIFT acknowledges this fact per an announcement on their net situation’s FAQ fragment. Primarily basically based on the questions, “What’s the role of SWIFT in relation to monetary sanctions which shall be imposed by regulators?” and “Does SWIFT observe all sanctions guidelines?” they recount the following:

“SWIFT does now not observe or wait on an eye on the messages that users send by its machine. All choices on the legitimacy of commercial transactions beneath applicable regulations, equivalent to sanctions regulations, leisure with the monetary institutions going by them, and their competent global and national authorities. As far as monetary sanctions are concerned, the level of hobby of SWIFT is to support its users in assembly their responsibilities to conform with national and global regulations. SWIFT is finest a messaging provider provider and has no involvement in or wait on an eye on over the underlying monetary transactions which shall be talked about by its monetary institutional possibilities in their messages.”

In assorted phrases they’re suggesting that as a neutral communications network they build now not seem like topic on to the likes of OFAC and therefore the accountability for the enforcement of sanctions lies at as soon as with the monetary institutions processing them. As far as I will expose the identical reasoning would maybe well be applied to neutral, privateness bettering starting up-offer protocols admire TC that would maybe well be utilized by legislation abiding voters and criminals alike. It’s against this background that any rational particular person staring at the absurdity in all this is in a position to be forgiven for thinking that maybe the intent of this action is extra about sending a message to now not finest discourage the usage of mixers but to additionally curtail their construction. OFAC’s sanction by default implicitly pre-supposes guilt on the fragment of anyone searching for monetary privateness and by default compels full disclosure of a client’s files (i.e., their total on-chain monetary history). Right here’s now not merely a sanction on TC by myself but a slack skedaddle in the direction of outlawing all privateness bettering starting up-offer tool, or any tool deemed illegal by The Order.

Primarily basically based on a recent article in the Financial Times, a senior unnamed Treasury official commenting on the sanction of TC talked about:

“‘We attain imagine that this action will send a with no doubt crucial message to the personal sector about the hazards associated with mixers writ gigantic,’ adding that it modified into as soon as ‘designed to inhibit Twister Money or any style of reconstituted versions of it to proceed to operate. At present time’s action is the 2d action by Treasury against a mixer, but this could occasionally now not be our final.’”

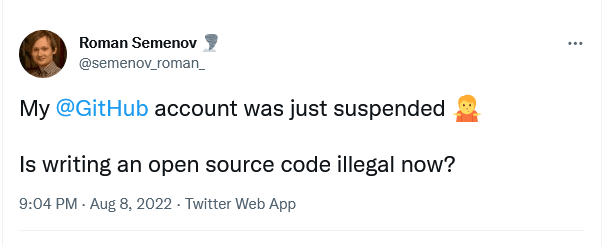

If that’s now not an starting up declaration of battle against monetary privateness then I don’t know what’s. This action by OFAC of sanctioning an starting up-offer protocol devices a precedent for in a roundabout intention criminalizing the act of searching for monetary privateness. Furthermore, it additionally creates uncertainty within the starting up-offer neighborhood, as developers would maybe well be held responsible for writing code which will likely be mature by criminals later on. Even even though starting up-offer code creators salvage zero wait on an eye on over how their code will likely be mature, in fact one of TC’s contributing developers, Alex Pertsev modified into as soon as arrested by Dutch authorities and he’s being accused of cash laundering. Aside from being a contributor to TC’s code no evidence has been disclosed that ties Alex to the laundered funds nor salvage any official charges against him been made and he’s quiet in police custody, as of time of writing this article. Right here’s the slippery slope that we safe ourselves in. Right here’s why censorship resistance and decentralization are essential.

Following the sanction of TC, “fragility contagion” ensued, which noticed Github deleting your total tool repository of TC. Ethereum’s two supreme node infrastructure services Infura and Alchemy restricted access to files on Twister Money tidy contracts, Defi Protocols’ admire Aave, DYDX and Uniswap blocking off access to TC and stablecoin issuers admire Circle straight away freezing assets associated to TC. All of those corporations went above and beyond the necessities of the sanctions legislation. They did now not merely obey an unjust screech, they went out of their methodology to inflict further wretchedness without even inserting up a fight — so noteworthy for being “on this collectively.” With out censorship resistance and decentralization as your first line of defense, you have not got something else. Anything else that’s “decentralized in title finest” (DINO) is the low inserting fruit that recount attacks will likely be directed in the muse, and as we’ve already viewed with the TC fallout, it doesn’t recall noteworthy to rattle the cage. Over time I request all these DINO projects to either be sanctioned out of existence admire TC or be co-opted into centralized finance.

The million dollar inquire of of the day is how does this have an effect on Bitcoin? On condition that Bitcoin is fully decentralized and censorship resistant, why would maybe salvage to Bitcoiners listen in on any of this? At the muse, Bitcoin isn’t non-public by default, and as such every transaction is recorded on the blockchain in perpetuity. Right here’s further compounded by the indisputable fact that heaps of the Bitcoin trading quantity is attributable to about a centralized exchanges admire Binance, FTX and Coinbase; in consequence, the majority of up-to-the-minute entrants pause up searching out for his or her bitcoin from these exchanges. The location with that’s that one has to provide personal files to those exchanges in screech to meet know your buyer (KYC) necessities. Thus, any Bitcoin purchased by these exchanges becomes tied to your exact identity. This creates three predominant concerns, particularly:

- Your personal files sitting on an change’s centralized database is at threat of hacks and records leakages. This files would maybe well be shared with the authorities on ask and create you a likely target for an “EO 6102 assault.”

- Exchanges can turn out to be a choke level for the enforcement of regulatory actions admire OFAC’s sanctions and additionally they’re obliged to conform.

- The loss of commercial privateness as your transactions would maybe well be tracked advert infinitum by the change, even in the event of a withdrawal of the bitcoin from the change.

These are about a of the hazards posed by utilizing centralized exchanges and additionally they’re going to now not hesitate to attain The Order’s bidding when called upon. The acceptable methodology to starting up to avoid these vulnerabilities is to starting up with getting your bitcoin off exchanges and self-custodying your bitcoin in a hardware pockets. Self-custody wants to be the norm as it’s likely that over time, third-event custodial companies and products will likely be any other regulatory choke level. The next circulation is to take bitcoin from non-KYC mediate about-to-mediate about exchanges admire Bisq and Hodl-Hodl. Moreover to this, approved CoinJoining for transactions is any other step that would maybe well be taken to make stronger privateness.

A CoinJoin is when two or extra events batch their transactions into one transaction, with the design of obfuscating who owns which coin after the transaction. The CoinJoin is forward-trying privateness in that it severs the historical links associated to your bitcoin from any future transactions, thus fighting blockchain files watchers from tracing the origin of the bitcoin. It is rather suggested severely for bitcoin that modified into as soon as bought from centralized exchanges in screech to recall care of classic transactional privateness. Unlike mixers admire TC, CoinJoin coordinators never at any level recall custody of your bitcoin — they build now not seem like cash transmitters and are finest message transmitters admire SWIFT. It is crucial to showcase alternatively, that some centralized exchanges reject and flag deposits containing “mixed cash” thus representing any other choke level that would maybe well be mature to clamp down on Bitcoin privateness.

Running your have node coupled with CoinJoins and searching out for non-KYC bitcoin provides an additional layer of privateness to your Bitcoin transactions. As a gateway to the Bitcoin ecosystem your node is to blame for broadcasting transactions, verifying the legitimacy of the bitcoin you ranking and thus retaining your privateness. With out your have node it be a must to depend on a random public Bitcoin node to expose you your steadiness and to broadcast/ranking transactions to your behalf. The threat with here is that you just show camouflage files that would maybe well be mature to name you equivalent to your IP address, pockets steadiness moreover to all your contemporary and future addresses. Worse quiet, surveillance corporations additionally bustle a majority of those nodes, and the final ingredient you’d like to salvage is this files in their fingers. Running your have node ensures that you just are insulated against these network-stage privateness leaks. Mining is additionally an risk that would maybe well be utilized to access non-KYC bitcoin whereas additionally resulting in a a lot extra decentralized hash rate for the network. All things knowing to be, the suitable resolution would be incomes bitcoin in recount of trying to safe it and spending bitcoin in recount of marketing it. A bitcoin spherical economic system will get rid of the want altogether to make expend of fiat on/off ramps thus gradually obsoleting the role of centralized exchanges and over time dampening the volumes of bitcoin flowing by them.

Whereas Bitcoin is surely censorship resistant at the protocol stage, it quiet stays inclined at the particular particular person stage attributable to lack of sturdy privateness guarantees. The steps outlined above are measures that would maybe well be taken in the short-duration of time to give a enhance to monetary privateness and by extension insulate against coordinated recount attacks. Whereas these would maybe appear inconvenient and unhurried, the further effort is rate it all things knowing to be. In the lengthy-duration of time, extra client-friendly privateness instruments would maybe salvage to be constructed at the utility layer in screech to create the usage of bitcoin privately the rule, now not the exception. Financial freedom is largely one of basically the most essential pillars for securing particular particular person freedom. Outlawing monetary privateness, at as soon as or in a roundabout intention, severely undermines that freedom by erecting a digital panopticon that powers the surveillance recount. In a society the effect the fixed threat of monetary censorship is a ticket fact, it would maybe even be harmful to salvage a machine the effect every transaction you create is analyzed, monitored and controlled by The Order (mediate CBDC’s).

As the battle on monetary privateness heats up it’s wise to be awake the phrases of cypherpunk Phil Zimmermann in his essay, “Why I Wrote PGP”:

“If we attain nothing, new applied sciences will give the authorities new automated surveillance capabilities that Stalin would maybe never salvage dreamed of. The acceptable methodology to recall care of the line on privateness in the records age is sturdy cryptography.”

Bitcoin now not finest gave us a head starting up in declaring monetary privateness but in the eventual separation of cash and recount. It’s incumbent upon us to defend our monetary privateness, because without it we are in a position to doubtlessly be doomed to central banking imposed serfdom.

Right here’s a guest put up by Kudzai Kutukwa. Opinions expressed are fully their very have and attain now not necessarily specialize in those of BTC Inc. or Bitcoin Magazine.