Here’s an thought editorial by Peter Conley, a product advocate at Vercel.

BlackRock partnering with Coinbase to provide bitcoin services is now not upright upright for bitcoin, it’s big for bitcoin. Because bitcoin is for each person — and I point out each person; it’s now not upright for the plebs or the technologists or the “tech bros” or the cryptographers or the early adopters.

Bitcoin is for Vladimir Putin.

Bitcoin is for the Dalai Lama.

Bitcoin is for Kim Jong-un.

Bitcoin is for Eckhart Tolle.

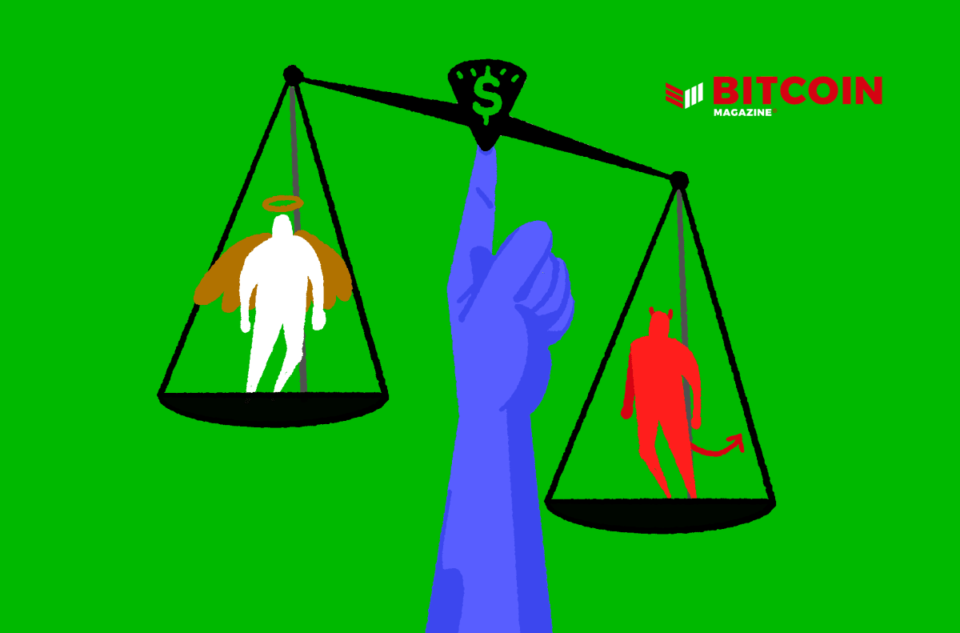

It’s for each and every saint and each and every sinner. For every and every Buddha and each and every bastard. For every and every miserable person and each and every billionaire. For every and every mother and each and every daughter. For every and every father and each and every son.

That’s now not restricted to the sizzling day; it would possess applied to the past as well. Bitcoin would had been for Mother Theresa and Adolf Hitler. It would had been for Ghengis Khan and Jesus.

Most wars, past and contemporary, are funded thru the hidden tax of inflation, now not enlighten taxation. It’s the commonest procedure for unpopular insurance policies (which would per chance be in total detrimental) to be compelled onto the populace.

With bitcoin, WWII would possess by no procedure lasted so long as it did. With bitcoin, the Iraq battle seemingly wouldn’t possess even began. With bitcoin, the armed forces-industrial complex would be 10 times smaller.

With bitcoin, “too immense to fail” businesses couldn’t exist. If we had undoubtedly laborious cash, these businesses that can’t continue to exist without cheap debt or which beget reckless dangers, would be washed out as a natural clearing feature.

With bitcoin, the bankers couldn’t had been bailed out throughout the World Monetary Crisis of 2008 and BlackRock wouldn’t be almost the dimension it is on the present time, nor would J.P. Morgan or any of these different lease-seeking institutions.

Within the long hurry, bitcoin takes away strength from the warmongers and of us who must inflate the cash provide in present to carry and invent never-ending weapons and habits never-ending wars.

It takes strength faraway from of us who beget pleasure in zero-sum change-basically based video games and businesses. It’ll beget away strength from the over-financialized map we currently possess, the one the place spinoff merchants are extra precious than high-tier doctors.

Bitcoin provides strength to of us contend with Jack Mallers over Jamie Dimon. It provides strength to these on Bitcoin Seaside in preference to the International Monetary Fund. It provides strength to the Ukrainian residents struggling with the Russian insurgency.

Jeff Sales location used to be once requested the demand, “What’s the worst ingredient about bitcoin?” His response used to be, “It be indispensable to accept that the of us you despise the most will commence up the usage of it and this can fracture the community stronger.”

We’re getting to the stage of bitcoin adoption the place it’s too immense to push apart. That you simply might per chance’t turn it off and it has change into “a vortex of determined incentives,” as Robert Breedlove likes to jabber.

That procedure we’ll commence up to jog searching all forms of countries, leaders, entities and of us piling in. Even of us that might maybe maybe possess benefited and accelerated the sizzling broken map — and that’s ok. It’s section of the formulation.

The hardest pill to swallow is that folks who benefited from the Cantillon Scheme, who bought us in the location we’re on the present time, are the ones that can high-tail bitcoin adoption the quickest.

Reduction in the early days of Facebook, they’d to grow person by person. No person might maybe maybe personally converse a billion users to the community, however you might maybe maybe now converse a billion greenbacks to the Bitcoin community, or ten billion, or a hundred billion.

Yes, the retail market is what bought bitcoin to the place it is now, however it acquired’t safe to the place it desires to jog. In present to safe the sector onto the Bitcoin Authentic, it’ll require of us who safe pleasure from and are addicted to the fiat usual.

The Saudi Sovereign Wealth Fund can jog the puck ahead with one allocation upright as like a flash as 3 million plebs. Norway’s Authorities Pension Fund can successfully double the price of bitcoin if they wanted. A family place of enterprise can beget extra cash off the market and into cold storage extra like a flash than the principle 100,000 users. BlackRock’s clientele can jog the price up sooner than any military of plebs.

These are upright things, now not inferior things. Here’s the embodiment of “ceaselessly, then .”

Yes, it stings sparkling that lease seekers and violent actors will seemingly discontinue up with extra sats than you however, in the long hurry, it doesn’t subject. I’m in this for the easier future on the different aspect, now not for the in miserable health positive aspects.

A better future procedure trendy adoption by as many souls as imaginable.

With bitcoin, the financial entities contend with BlackRock and a similar hedge funds, who invent nothing and are the benefactors of the Cantillon Scheme, will in any case be reduced to their upright dimension and scope.

So yeah, I’m concerned about BlackRock offering bitcoin services. Because bitcoin is the closing Computer virus and the usual legacy financial map is Troy.

I don’t study about you, however I’m cheering because BlackRock opened the gates.

Now all we possess got to realize is roll on in.

Here’s a customer put up by Peter Conley. Opinions expressed are entirely their very own and accomplish now not necessarily think these of BTC Inc. or Bitcoin Magazine.